A big chunk of foreign funds was provided as budgetary support from the World Bank and the Asian Development Bank (ADB) in December released $1.1 billion, leading to a rise in foreign aid disbursement and providing some relief to the government.

In the last month, the government received around $2 billion while the average for the previous five months was only around $309 million.

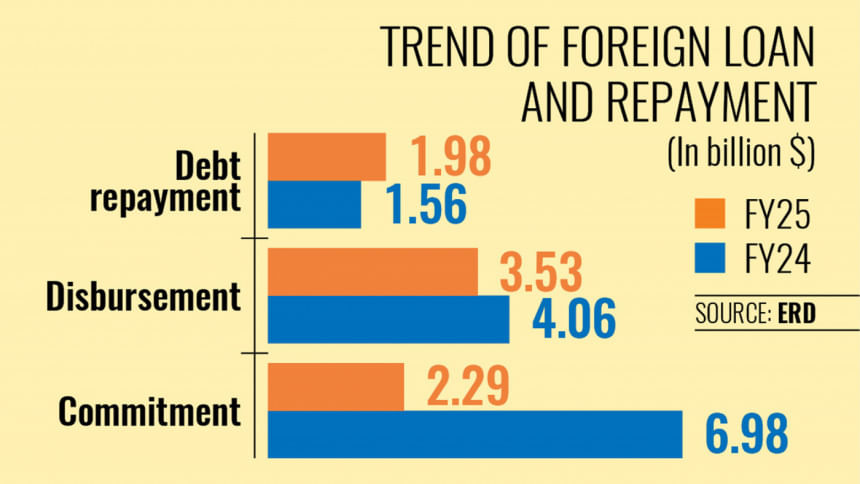

In the six months from July to December, total foreign loan disbursement amounted to $3.53 billion whereas it stood at $1.54 billion at the end of November.

The highest amount of loans during the six-month period came from the ADB, amounting to $1.05 billion, of which $600 million came as budget support in December. The World Bank also provided $800 million, of which $500 million came as budget support in December.

Besides, Russia disbursed $532 million, mainly for the Rooppur Power Plant project, while Japan disbursed $441 million, China $268 million, and India $72 million during the six months.

However, despite such a big chunk being disbursed in December, it was not enough to stave off a year-on-year drop of 13 percent in foreign loan disbursement from $4.06 billion.

However, the rise was somewhat offset by the fact that Bangladesh’s foreign debt servicing rose 27 percent year-on-year in the first six months of FY25.

From July to December of FY25, the country paid $1.98 billion in principal and interest, up from $1.57 billion in the same period of FY24 due to an expanded foreign loan portfolio and higher global interest rates.

In local currency, the payments increased to Tk 23,675 crore from Tk 17,240 crore, intensifying pressure on public finances.

According to the breakdown, the value of principal payments climbed 33 percent to $1.23 billion while interest payments rose 16 percent to $747 million.

Adding to the fiscal pressures, foreign assistance commitments have fallen precipitously.

In the first six months of FY25, total commitments for grants and loans fell sharply, plunging 67 percent to $2.29 billion compared to $6.98 billion in the previous year.

Loan commitments fell from $6.58 billion to $2 billion while grant commitments reduced to $289 million from $410 million.

With the obligations mounting and foreign commitments diminishing, economists called to renegotiate repayment periods and interest rates as well as prioritise foreign-funded projects.

This combination of rising debt obligations and declining foreign commitments is presenting a huge challenge for Bangladesh’s fiscal management amid the lower domestic revenue collection.

“The debt-servicing cost was expected as we are approaching the loan repayment since the grace period is ending,” said Mustafuzur Rahman, a distinguished fellow at the Centre for Policy Dialogue, a local think-tank.

“This will definitely create pressure on the foreign currency reserves,” he said.

“Although it will be challenging, we should try to renegotiate in terms of both interest rates and repayment periods. The government is also trying to address the issue now,” he said, mentioning recent negotiations with China.

However, Rahman added that a more sustainable route was to attract foreign direct investment alongside strengthening the negotiating capacity.

However, Ashikur Rahman, principal economist at the Policy Research Institute of Bangladesh, does not believe the burden of debt servicing will pose any risk for the country.

“The debt servicing scenario still does not pose any serious risk as exports and remittances offer a safe cushion that can help the treasury meet its immediate international debt obligations,” he said.

As things now stand, payments for the first six months only account for 5.6 percent of foreign exchange earnings from exports and remittances in the corresponding period, which should not be a cause for concern for the interim government, he said.

In the current fiscal year, foreign exchange earnings from exports and remittances are likely to cross $75 billion, which means even if debt servicing obligations reach $4-5 billion, it poses no significant debt default risk for Bangladesh, he said.

Nonetheless, given that the exchange rate is likely to depreciate against the US greenback, the domestic fiscal burden of additional international debt servicing is going to increase, which necessitates that the Ministry of Finance keeps streamlining domestic resource mobilisation initiatives that can offer the government more fiscal space to manage this additional pressure.

However, domestic revenue mobilisation does not offer much hope.

During the July-December period of FY25, revenue collection logged nearly a 0.98 percent negative growth year-on-year, according to sources at the National Board of Revenue.

daily star