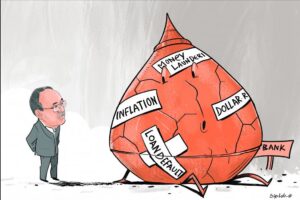

Most of the macroeconomic indicators of Bangladesh have been in bad shape for the last several months owing to external and internal factors, intensifying people’s suffering as consumer prices surged to record levels.

Most of the macroeconomic indicators of Bangladesh have been in bad shape for the last several months owing to external and internal factors, intensifying people’s suffering as consumer prices surged to record levels.

The foreign exchange reserves have halved in a span of two years and the decline has continued every month. The taka has lost its value sharply against the US dollar, making imports expensive.

Remittance and export receipts have been weaker-than-expected. The inflation rate is lingering at a record level and investment is stuck at a lower level.

The shocks stemming from the Covid-19 pandemic and the war between Russia and Ukraine as well as inadequate policy measures have been behind the weaker economic data.

Now, as the political uncertainty aggravates, the economy would face added challenges, shattering people’s hopes of overcoming the struggle by fixing domestic challenges.

“The political situation always dominates economic issues, so the present economic situation of Bangladesh will not improve if the political crisis is not resolved,” said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

His comments came as the country descended into fresh chaos after supporters of the Bangladesh Nationalist Party (BNP) clashed with police on the streets of the capital yesterday and Bangladesh sees a return of hartal to be enforced by a major political party.

The problem of Bangladesh’s economy is depleting reserves as import cost continues to be higher than export receipts and remittance inflow coming through formal channels.

Remittance earnings slipped 13 percent year-on-year in September when migrant workers sent home $1.34 billion. The receipts were the lowest in 41 months.

Exports, the other major source of foreign currencies, brought home $4.3 billion, up 10.4 percent year-on-year but the lowest amount in three months.

On October 25, the foreign currency reserves stood at $20.89 billion, enough to meet around four months’ import bills. It was about $40.7 billion in August 2021.

By the end of 2023, the reserves will come down to three months’ import cover, according to an estimate of American credit ratings agency Fitch.

Mansur said the country’s politicians don’t want to compromise, a tendency that ultimately undermines the democratic process.

“So, the country is unfortunately heading towards more political unrest. Under such a scenario, development and economic activities stall.”

For instance, the former economist of the International Monetary Fund (IMF) said, investors will not invest and banks will not be interested in lending if uncertainty persists.

“These are crucial issues for an economy.”

Already, the World Bank has slashed the economic growth forecast for Bangladesh by 0.6 percentage points to 6.1 percent for the current fiscal year that ended on June 30.

Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, said running political activities is a democratic right.

He warns that the economic situation will deteriorate further owing to the exacerbating political uncertainty. “Then, it will be difficult for any government to tackle the situation whoever comes to power.”

Anwar-ul Alam Chowdhury Parvez, a former president of the Bangladesh Chamber of Industries, said businesses always want a congenial environment, including political stability, policy continuation, and safety and security, to run their operations.

“And this is possible if there is a democratic process.”

Muinul Islam, a former professor of economics at Chittagong University, thinks the political crisis is yet to affect the economy.

“But the economic problem will deepen if there are hartals and instability in the political arena.”

He said money transfers through hundi or informal channels have increased. As a result, the economic situation has become volatile.

Fazlul Hoque, a former president of the Bangladesh Knitwear Manufacturers and Exporters Association, said the macroeconomic situation is in a tough situation.

“If the political situation deteriorates, it will aggravate the economic situation. So, we are concerned. A peaceful solution is necessary now.”

Mostaque Ahmed Sadeque, a former president of the DSE Brokers Association, said stock market stakeholders are already in major pain as the market has become dry.

Turnover on the Dhaka Stock Exchange declined by around 40 percent to Tk 793 crore in 2022-23. It was Tk 1,328 crore in the previous year, DSE figures showed.

PRI’s Mansur says confidence will return if a fair and transparent election takes place. “The ruling government should compromise and bring back the confidence.”

Parvez thinks holding dialogues will bring about positive results.

CPD’s Rahman said it is the duty of all political parties to act responsibly.

“All political parties should play their role responsibly so that their actions don’t affect the economy.”

Daily Star