Freight rates for the Bangladesh-China route have more than doubled over the past six months due to container delays at major ports like Shanghai, Ningbo, Singapore and Colombo amid supply chain disruptions caused by the Houthi attacks in the Red Sea.

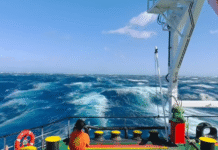

At Singapore port, a major transshipment route for Bangladesh, it takes about 7 days for a ship to get berthing in place of one-and-half days at normal time, according to data from container shipping analysis firm Linerlytica.

Charges have increased by 50% at Singapore and 15% at Colombo port.

A senior official at the Bangladesh office of a global shipping company told TBS that congestion at ports in China and Singapore causes supply disruption for most of Bangladesh’s imported goods, especially industrial raw materials, electronic products, and machinery, that come from China to Bangladesh via transshipment ports.

Goods are transported from Chattogram port to ports in China, as well as to European and American ports, via transshipment ports such as Singapore, Port Klang, Colombo, and Tanjung Pelepas.

Bangladesh Shipping Agents’ Association Senior Vice Chairman Syed Iqbal Ali Shimul told TBS that freight charges are now sky-high for two reasons. “Firstly, the detour in transporting goods due to Houthi militant attacks in the Red Sea. Secondly, congestion at ports in various countries, including Singapore and China.”

With ships and containers stuck at ports, the number of vessels and containers available for sea routes has decreased and shipping companies are increasing their charges, he added.

Shipping companies have reported that due to Houthi militant attacks in the Red Sea, commercial ships travelling between Bangladesh and Western countries have to take a detour around Africa to reach their destinations. This is causing an additional delay of at least 15 days for transporting goods from Asia, particularly China, to Europe.

Moreover, shipping company Maersk Line, based in Denmark, will be implementing a peak season surcharge ranging from $700 to $1,400 on routes from South China, including Hong Kong, to Bangladesh beginning on 15 June.

Freight charges surge

Currently the freight for a 20-foot container (TEU) from Chattogram to China is between $2100 and $2500, which was $800–-$1000 just six months ago.

According to information from shipping companies, the current freight for containers from Chattogram to Singapore port is $300, which is $230 for Colombo, marking 50% and 15% increase respectively.

Moinul Hoq Chowdhury, managing director of Global Link Associates, told TBS, “Containers are waiting for berthing at Singapore port day after day. This has impacted freight charges.”

Shipping agents said container freights even exceeded pre-Covid rates for both American and European destinations.

Shahed Sarwar, a former CEO of Bangladesh Shipping Agents Association and deputy managing director of Crown Navigation, told TBS container freight to America soared to $12,000–$14,000 levels during the pandemic from previous $3500.

But the rate dropped below $3000 when the conflict between Russia and Ukraine started. “Recently, due to the instability caused by attacks in the Red Sea and Iran-Israel tensions, container freight to America has risen to $4500 to $5000,” said Sarwar.

Similarly, during the pandemic, freight charges to Europe increased from $2000 to as much as $10,000, he said. “It somewhat stabilised around $1500, but currently, this charge has risen to $3000 to $3500.”

Mohammad Abu Taher, chief operating officer (commercial) of Meghna Ocean-Going Fleet, told TBS that currently freight charges for bulk carriers have surged too. “Before the start of the Russia-Ukraine conflict, the daily charter rate for bulk carrier vessels in the Asian region was between $20,000 and $25,000. In the Europe-America region, the rate was $40,000 to $45,000. With the onset of the Russia-Ukraine conflict, global trade has declined. In mid-2023, the charter rates for Ultramax-sized vessels were around $10,000 in the Asian region and $20,000 in the Europe-America region.”

Businesses suffer

Garment owners say it now takes about a month to import fabrics. Goods from Vietnam and Cambodia arrive within seven days. However, sending goods via Europe and America now takes more than 15 days, delaying delivery. Therefore, buyers from Europe and America are turning to countries where they can deliver goods in less time, such as Vietnam and Cambodia.

Not only has the cost of transporting goods in containers increased, but the cost of transporting goods via bulk carriers has also risen by more than 30%, they say. In such a situation, a negative impact on Bangladesh’s imports and exports has begun to emerge, say the garment owners.

BGMEA Vice President Rakibul Alam Chowdhury told TBS that the country’s garment sector is facing time-bound challenges. “Due to increased freight charges and longer lead times, foreign buyers are opting for alternative countries instead of Bangladesh. Foreign buyers have reduced orders to meet their time frames.”

Internal transportation costs are also gradually increasing on domestic routes. The covered van rental fee for transporting goods from Dhaka to various depots in Chattogram was previously Tk15,000, according to RMG exporters. Now, the charge has increased to between Tk22,000 and Tk25,000, they said.

Bangladesh Knitwear Manufacturers and Exporters Association Director Mohammed Shamsul Azam told TBS, “A few months ago, the average cost of container transportation for delivering goods from Chattogram port to Dhaka was Tk15,000. However, recently it has increased to Tk25,000 to Tk30,000. Due to the gradual increase in fares, the production cost of clothing items has also increased.”

TBS