Currently, the country’s export earnings are highly dependent on RMG products, which account for over 82% of the earnings

Bangladesh is likely to miss the export target of $37 billion for the outgoing fiscal year as it has to earn $5.20 billion more by this month that is soon coming to an end next Friday.

Export Promotion Bureau (EPB) data reveals that the average per month export earning was around $3 billion. So, in order to hit the target, the country’s export earnings in this month have to be $5.20 billion, which seems to be quite ambitious.

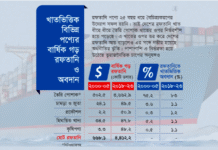

Of the $37 billion target for the FY2016-17, $31.79 billion was earned during the July-May period.

Reasons for target mismatch

Labour unrests at the end of last year and ongoing structural reforms in the apparel industry have been blamed for this discrepancy in export earnings.

According to some trade analysts, the target mismatch might have occurred due to sluggish demands, especially for RMG products, and economic slowdown in export destinations.

Moreover, the Brexit issue is no less responsible for the slothful demand. It has cast a shadow over the export of Bangladeshi products to Europe as foreign buyers are in a dilemma over the consequences of their trade deals with Bangladesh if Britain leaves the EU.

According to EPB data, In July-May of the current fiscal year, Bangladesh Export to United Kingdom has seen a 5.61% decline to $3.25 billion, which was $3.44 billion in the same period a year ago.

“…Bangladesh will likely miss the export target. This is only because of sluggish demands and lower production capacity that were caused by structural reforms in the RMG sector, Exporters Association of Bangladesh President Abdus Salam Murshedy told the Dhaka Tribune.

Hopefully, Bangladesh will be able to enhance its market share in the global market after the completion of safety remediation, he added.

Among the major and potential sectors, only plastic and plastic products were able to reach their target, earning the country $110 million in 11 months, which is about $17 million higher than the target of $93 million.

The RMG industry, which is considered to be the lifeline of the country’s export earnings, will have to earn $4.75 billion within this month to reach the $30.37 billion export earnings target.

Salam, however, hoped that the RMG production capacity would increase as remediation would come to an end by 2018. Besides, a good number of new compliant factories are in the offing that will contribute to increasing the production capacity.

According to data released by World Trade Organization, Bangladesh’s global market share in clothing rose to 5.9% in 2015 from 5.1% in the previous year. China’s share was on the top of the list, increasing to 39.3% in 2015 from 38.6% in the previous year.

If the government wants to hit the target set for the upcoming fiscal year, it will have to provide policy support in the next budget and cut taxes at source for this sector, said Salam, also the former president of Bangladesh Garment Manufacturers and Exporters Association (BGMEA).

“On the basis of the current growth trend, it will not be possible to meet the target,” Centre for Policy Dialogue (CPD) Research Director Khondaker Golam Moazzem said.

The devaluation of euro against the US dollar, slow demands from European buyers, and compliance issues all are coming in the way of the export earnings target, he said, adding that Bangladesh would have to concentrate on product and market diversifications to achieve the target.

Currently, the country’s export earnings are highly dependent on RMG products, which account for over 82% of the earnings.

“Possible Brexit effects, fluctuating exchange rates as well as downturns in export destinations are among the reasons for this lacklustre export growth,” said ABM Mirza Azizul Islam, former adviser to a caretaker government.

The government and factory insiders will have to explore new markets and put emphasis on central Asian markets, he stressed. Focus should also be on product diversification in order to reduce dependency on the apparel sector, the eminent economist suggested.

Price cuts by foreign buyers are also a glaring reason for the downturn in export earnings Taking advantage of compliance issues, retailers have decreased prices of RMG products, factory insiders claimed.

“Price cuts in RMG product casts a shadow over the total export earnings as the sector contributes over 82% to the country’s export earnings,” BGMEA Vice President Mohammed Nasir said.

Moreover, appreciation of Bangladeshi currency against the US dollar added salt to the wounds, eroding the country’s competition in the global market.

In order to help the sector come out from this gloomy circumstance, the insiders urged the government to introduce special exchange rates for export-oriented businesses.

“As an export promoting authority, EPB has taken a lot of initiatives including diversifying products and markets to enlarge the export basket,” Bijoy Bhattacharjee of EPB informed.

But, manufacturers will have to add extra value and quality to their products so they can attract new buyers, he stressed.

Bijoy said: “In addition to exploring new markets, we are organising exhibitions and fairs abroad with manufacturers.

“Apart from that, commercial councillors are doing their due jobs to promote Bangladeshi products.”

$41.5bn target for FY2017-18

Amid apprehension over the target mismatch for the FY 2016-17, the government plans to set a target of $41.50 billion with a 7.27% growth for the next fiscal, mainly riding on the apparel sector.

Of the amount, $38 billion is expected to come from manufacturing sectors, including the RMG sector, and $3.50 billion from service sectors.

In May, the EPB in a meeting with stakeholders set the target, which will be finalised in consultation with the Commerce Ministry.

As per the proposed target placed earlier this month, the government wants to earn $30.56 billion from the apparel industry, $1.37 billion from the leather industry, $900 million from home textiles, and $1.15 million from jute and jute products.

Source: Dhaka Tribune