The government’s debt servicing costs are set to balloon after sales of high interest-bearing savings instruments rocketed in the first eight months of the fiscal year.

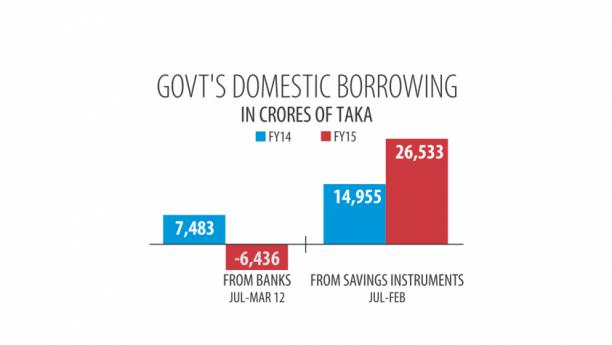

Between July last year and February this year, sales of savings instruments soared 77.41 percent year-on-year to Tk 26,533 crore, according to statistics from the National Savings Directorate.

Sales of ‘Paribar Sanchay Patra’ from which the savers get the highest interest rate of 13.45 percent stood at Tk 9,480 crore in the same period.

The development is a massive setback for the government, which aimed to keep the net borrowing through savings instrument within Tk 9,056 crore this fiscal year.

The rise in savings instrument sales means the government’s borrowing from the banking system was less.

The rate of interest on savings instrument is between 12 percent and 14 percent, but in case of borrowing from banks it is 7-8 percent.

Subsequently, the government aimed to borrow Tk 31,221 crore from banks in fiscal 2014-15.

But so far this fiscal year, the government did not borrow from the banking system; rather, it repaid its debts.

Between July last year and March 12 this year, the government paid back Tk 6,436 crore to banks, according to central bank statistics.

During the same period last fiscal year, the government borrowed Tk 7,483 crore from the banking system.

Zahid Hussain, lead economist of the World Bank’s Dhaka office, said the government’s expenditure on interest payment will increase next fiscal year with the rising savings instrument sales.

The low petroleum price in the international market and the resultant drop in subsidy costs have presented the opportunity to create fiscal space for priority expenditure.

“But it looks like it will shrink due to an increase in costs over debt service payment.”

The government’s expenditure on interest payment for savings instrument increased 23.68 percent to Tk 6,108 crore in the first eight months of the fiscal year, according to data from the Savings Directorate.

Last fiscal year, domestic borrowing shot up; so much that the government had to increase the allocation for interest payment in the revised budget.

“This year too that scenario is likely to be repeated,” a finance ministry official said.

The reason for the popularity of savings instruments, Hussain says, is the higher interest rate than bank deposits.

“The situation is such that the government is taking loans with higher interest to pay lower interest credits, which are bank borrowings.”

In the last two and a half years, the rate of interest on bank deposits has been on a slide.

In January, the weighted average interest rate on deposits was 7.26 percent, down from 8.34 percent a year ago.

The rates of interest on most of the savings deposit scheme are 4-5 percent and on some fixed deposits 7-8 percent, said an official of Bangladesh Bank.

To address the situation, Hussain said the government can lower the rates of interest on savings instruments and impose small taxes on them, which currently enjoy tax waivers. However, the finance ministry official said the government has been refraining itself from the interest rate for savings instrument considering the small savers.

Source: The Daily Star