The International Monetary Fund asked Dhaka to withdraw the interest rate cap on lending, report net foreign currency reserves and introduce market-based exchange rate to secure a $4.5 billion loan from it as budget support.

The issues were discussed at a day-long meeting between a visiting IMF team and Bangladesh Bank officials in the capital’s Motijheel yesterday.

“We had a fruitful meeting and are hopeful of getting a decision on the $4.5 billion loan in the next two weeks,” BB spokesperson Abul Kalam Azad told The Daily Star.

Seeking anonymity, another high official of the central bank said the team members explained why the reforms recommended by the IMF were important for the country’s banking and financial sectors.

The team also said the removal of the interest cap would help contain non-food inflation and curb imports.

The BB officials, however, did not agree on the removal of the interest cap, saying it could be removed for some sectors in the future only if the government wished to do so.

The IMF officials then said the BB should calculate and regularly publish the net foreign currency reserves, which is the global practice.

The BB currently shows gross foreign currency reserves which include the export development fund, green transformation fund, and a loan given to Biman by Sonali Bank, said the BB official, adding that the IMF asked the BB not to count these as reserve assets.

As of October 19, the reserves stood at $35.98 billion. If the IMF instructions are followed, the net reserve would be $27.98 billion.

The BB officials then said they would publish both the gross and net reserves in the future.

The IMF team also opposed to different exchange rates for export, import and remittance.

In response, the BB officials said they might consider a single rate in the future.

The team then sought updates on BB’s pilot programme to reduce the non-performing loans at 10 commercial banks.

The BB informed the team that the programme had already started.

Besides, the BB informed the IMF that it had decided to amend five laws to crack down on the willful defaulters.

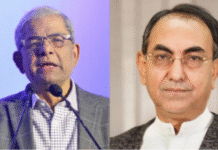

The visiting IMF team, led by its Mission Chief to Bangladesh Rahul Anand, will hold more meetings with the BB before the wrap-up meeting with BB Governor Abdur Rouf Talukder on November 8, said the official.

The discussion started on Wednesday.

In a statement on October 21, the IMF said the visiting team’s objective would be to achieve progress towards a staff-level agreement on a prospective Extended Credit Facility/Extended Fund Facility programme and access under the newly created Resilience and Sustainability Facility in the coming months.

As major reform priorities, the IMF suggested Bangladesh strengthen corporate governance, ensure strict supervision and enforcement of the current framework, and reform the legal system to support a stronger enforcement of creditor rights and debtor incentive for repayment.

Earlier in July, Dhaka sought the loan from the IMF in the form of budgetary support to shore up its depleting foreign currency reserves.