Bangladesh Bank purchased US dollars worth $264 million in the first 23 days of this month with $48 million on Thursday as most of the scheduled banks are now holding good amount of greenbacks amid a stagnant business situation in the country due to the ongoing political crisis.

A BB official told New Age on Thursday that the central bank had been compelled to purchase a record amount of dollars in recent years due to lower import growth and increased inflow of inward remittance and the situation remained the same in April.

The country has been facing political unrest and uncertainty for a long period that foiled the business momentum resulting that banks were forced to hold huge amount of greenbacks, he said.

The official said the BB had mainly taken the move with a view to preventing depreciation of the dollar against the local currency taka.

Bangladesh received inward remittance worth $778.18 million between April 1 and April 17 of this year from Bangladeshi workers abroad, according to the central bank’s latest statistics.

The country’s inward remittance increased by 7.21 per cent to $11.25 billion in nine months of the FY 2014-15 from $10.49 billion in the same period of the FY14.

Besides, a lower import payment amid the political unrest also played a significant role in holding available foreign exchanges by banks this month.

The BB resumed purchasing greenbacks from banks on January 12, 2015 after around two and a half months because of a lower demand for the dollar in the market.

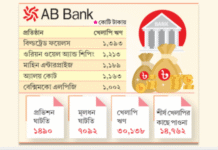

After starting the purchase of the US dollar, the central bank bought $224 million from banks in January. It was $304 million in February and $640 million in March of this year.

The BB has so far purchased greenbacks worth $2.77 billion between July 1 and April 23 of this financial year, the BB data showed.

The central bank will have to continue to purchase the greenback if the existing political unrest persists in the months to come, the BB official said.

The businesspeople has adopted a ‘go-slow’ policy to expansion of their business due to the existing political crisis that has ultimately compelled the central bank to purchase greenbacks from banks to keep the exchange rate of the taka against the dollar stable, he said.

Due to the central bank’s initiative, the dollar became stable at around Tk 77.80 in the last few months, the BB data showed.

The BB purchased a record amount of dollar — worth $5.15 billion — from banks in the FY14 while it purchased $4.53 billion in the FY13.

Due to the dollar purchasing spree of the BB, the country’s foreign exchange reserve increased significantly in the last two years.

The reserves crossed $15-billion mark on May 7, 2013, $16-billion mark on August 13, $17-billion mark on October 22, $18-billion mark on December 19, $19-billion mark on February 19, 2014, $20-billion mark on April 10, $21-billion mark on June 16, $22-billion mark on August 7 and $23-billion mark on February 26 of this year.

Source: New Age