Bangladesh Bank has recommended the government taking actions against chairman and board of directors of BASIC Bank for their alleged involvement with the bank’s Tk4,500 crore loan scams.

The central bank sent a letter to the finance ministry yesterday saying that the chairman and board of directors cannot avoid their responsibility in one of the country’s biggest credit forgeries.

In the afternoon yesterday at the Secretariat, Finance Minister AMA Muhith told the Dhaka Tribune that he had received the letter but was yet to read it.

He, however, said the board would be “reformed in a short time.”

Muhith said: “We cannot dissolve a board instantly. We have to wait until formation of another board of directors.” But Bank Division Secretary Dr M Aslam Alam declined to make any comment on the matter.

Although Bangladesh Bank had sent such letters earlier recommending actions against the present board of BASIC Bank, the finance ministry didn’t initiate any move.

Under the Bank Company Act, the central bank cannot take actions against bank officials appointed by the government. It can only report about the government-appointed chairman and directors to the government about their irregularities with recommendation to consider actions against the misdeeds.

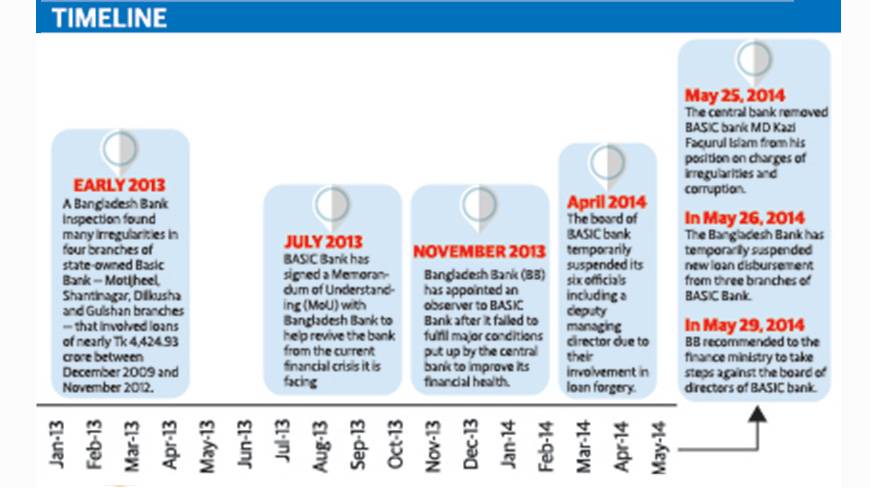

Under a recent amendment to the law, Bangladesh Bank has already removed BASIC Bank Managing Director Kazi Faqurul Islam for the loan scams with a directive to halt lending in the bank’s Gulshan, Dilkusha and Shantinagar branches in Dhaka.

In a recent letter, finance ministry asked the central bank to stop loan activities in Gulshan branch of BASIC Bank and provide a review of all steps taken against the bank in last one year, said a senior executive of the central bank.

Following the instruction, Bangladesh Bank decided to suspend loan disbursement of the three branches, he said.

The central bank also sent a review of steps taken against the BASIC Bank over the last one year.

Sheikh Abdul Hye Bacchu is the Chairman of BASIC Bank’s board of directors while the members are Shubhashish Bose, Fakhrul Islam, Shyam Sunder Sikder, Neelufar Ahmed, Quamrun Naher Ahmed, Md Anwarul Islam and Anis Ahamad.

Investigations by Bangladesh Bank last year revealed that the Basic Bank had approved loans of Tk4,500 crore, mostly without proper documentation or scrutiny.

Most of the irregularities took place in four branches – Motijheel, Shantinagar, Dilkusha and Gulshan – that granted loans of Tk4,424.93 crore between December 2009 and November 2012 on poor documents and inflated mortgages.

The bank gave loans to nonexistent companies and promptly approved loans to clients after they had opened accounts. In September last year, a memorandum of understanding was signed between Bangladesh Bank and BASIC Bank to rein in the financial irregularities rampant in the state-run scheduled bank for the past few years.

But the central bank’s latest investigations still found irregularities continued at BASIC Bank, even as recently as January, which prompted Bangladesh Bank to slap a notice to the bank’s MD Kazi Faqurul asking why he should not be removed from his position.

Source: Dhaka Tribune