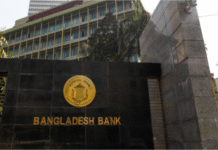

The Bangladesh Bank on Thursday dissolved the National Bank Limited’s board due to financial irregularities by the directors who approved loans in breach of rules and regulations, according to a BB order.

The central bank issued the order in this regard on the day.The reasons for this action also included the directors’ undue intervention in bank management, centralisation of shares within a family, complexities in electing or re-electing directors, the board’s weakness in policy making leading to the bank’s financial deterioration, the board’s involvement in activities against the interests of depositors and the bank’s governance and discipline, according to the order.

The order mentioned that the Bangladesh Securities and Exchange Commission had recommended action due to the irregularities.

The move aims to safeguard the interests of depositors and the public.

The decision came after Parveen Haque Sikder, a director of the bank, sent a letter to the BSEC expressing concerns about possible manipulation in the forthcoming board election.

Syed Ferhat Anwar, a former professor at the Institute of Business Administration of the University of Dhaka, has been appointed as new chairman to the bank’s board.

Md Sirajul Islam, a former executive director of the Bangladesh Bank, and M Kamal Hossain, a former managing director of Southeast Bank, have been appointed as independent directors.

The restructured board has retained NBL directors Parveen Haque Sikder, Khalilur Rahman and Md Shafiqur Rahman, and its sponsor shareholder Moazzem Hossain.

Directors Zakaria Taher, Monowara Sikder, Rick Haque Sikder, Ron Haque Sikder, Md Naimuzzaman Bhuiyan Mukta and Murshid Kuli Khan were removed from the board.

National Bank reported a net loss of Tk 357 crore in January-September this year, compared with a net profit of Tk 134 crore in the same period of the past year and a net profit of Tk 348 crore in 2020.

The bank’s defaulted loans reached Tk 11,335 crore at the end of September, up from Tk 4,588 crore a year earlier, with a 27.46-per cent of the bank’s loans now defaulted.

New Age