Bad loans, the worst type of defaulted loans, in the country’s banking sector increased by 20.60 per cent to Tk 52,445.65 crore in last year as the scheduled banks failed to recover their classified loans, said officials of Bangladesh Bank.

They said a rise in financial scams in banks aggravated the situation.

According to the latest BB data, the amount of bad loans was Tk 43,485.71 crore as of December 31, 2015.

As of December 31, 2016, the bad loans accounted for 84.35 per cent of the total classified loans — Tk 62,172.32 crore — in the banking sector.

The non-performing loans in the banking sector increased by Tk 10,801 crore in 2016 as the central bank unearthed a number of loan scams in different banks that fuelled the overall banking sector defaulted loans.

The BB conducted detailed inspections in recent years at different banks and unearthed significant amount of defaulted loans at the state-owned and private commercial banks, a BB official told New Age on Thursday.

The banks disbursed huge amount of loans in recent years on political consideration, violating rules and regulations, he said.

The banks frequently failed to recover the loans which were distributed on political ground that ultimately fuelled the defaulted loans, he said.

The BB data showed that the overall defaulted loans increased to Tk 62,172 crore as of December 31, 2016 from Tk 51,371.22 crore as of December 31, 2015.

The huge amount of bad loans usually puts an adverse impact on the banks’ loan disbursement capacity as they (banks) have to keep 100 per cent provision against the loans, the BB official said.

The businesspeople are now frequently failing to repay instalments against their loans amid dull business situation that also increased the defaulted loans, he said.

There are three types of classified loans — sub-standard, doubtful and bad.

As per the BB regulations, if a client fails to pay instalment for any loan for three months, the loan will be considered as a sub-standard one.

Banks have to keep 20 per cent provision against such loans up to next three months.

A loan will be a doubtful one if a client fails to pay instalment six to nine months and banks have to keep 50 per cent provision against such loans.

If any defaulter fails to pay instalment for nine or more months, the loan will be classified as bad loan. Banks have to keep 100 per cent provision against bad loans.

The BB official said that some banks faced provision shortfall in last year as they held huge defaulted loans.

He said that the crisis in the banking industry would deepen in the months to come as the clients were now failing to repay their bank loans due to dull business situation in the country.

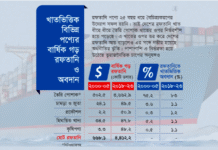

The six state-owned banks — Sonali Bank, Janata Bank, Agrani Bank, Rupali Bank, Bangladesh Development Bank and BASIC Bank — held the largest amount of bad loans in the banking sector at the end of 2016.

In the banks, the bad loans stood at Tk 26,070.22 crore or 49.70 per cent of such loans in the banking industry.

The bad loans in the private commercial banks stood at Tk 19,823.04 crore, that in the foreign commercial banks at Tk 2,162.37 crore and that in the state-run specialised banks at Tk 4,390.03 crore as of December 31, 2016.

They said a rise in financial scams in banks aggravated the situation.

According to the latest BB data, the amount of bad loans was Tk 43,485.71 crore as of December 31, 2015.

As of December 31, 2016, the bad loans accounted for 84.35 per cent of the total classified loans — Tk 62,172.32 crore — in the banking sector.

The non-performing loans in the banking sector increased by Tk 10,801 crore in 2016 as the central bank unearthed a number of loan scams in different banks that fuelled the overall banking sector defaulted loans.

The BB conducted detailed inspections in recent years at different banks and unearthed significant amount of defaulted loans at the state-owned and private commercial banks, a BB official told New Age on Thursday.

The banks disbursed huge amount of loans in recent years on political consideration, violating rules and regulations, he said.

The banks frequently failed to recover the loans which were distributed on political ground that ultimately fuelled the defaulted loans, he said.

The BB data showed that the overall defaulted loans increased to Tk 62,172 crore as of December 31, 2016 from Tk 51,371.22 crore as of December 31, 2015.

The huge amount of bad loans usually puts an adverse impact on the banks’ loan disbursement capacity as they (banks) have to keep 100 per cent provision against the loans, the BB official said.

The businesspeople are now frequently failing to repay instalments against their loans amid dull business situation that also increased the defaulted loans, he said.

There are three types of classified loans — sub-standard, doubtful and bad.

As per the BB regulations, if a client fails to pay instalment for any loan for three months, the loan will be considered as a sub-standard one.

Banks have to keep 20 per cent provision against such loans up to next three months.

A loan will be a doubtful one if a client fails to pay instalment six to nine months and banks have to keep 50 per cent provision against such loans.

If any defaulter fails to pay instalment for nine or more months, the loan will be classified as bad loan. Banks have to keep 100 per cent provision against bad loans.

The BB official said that some banks faced provision shortfall in last year as they held huge defaulted loans.

He said that the crisis in the banking industry would deepen in the months to come as the clients were now failing to repay their bank loans due to dull business situation in the country.

The six state-owned banks — Sonali Bank, Janata Bank, Agrani Bank, Rupali Bank, Bangladesh Development Bank and BASIC Bank — held the largest amount of bad loans in the banking sector at the end of 2016.

In the banks, the bad loans stood at Tk 26,070.22 crore or 49.70 per cent of such loans in the banking industry.

The bad loans in the private commercial banks stood at Tk 19,823.04 crore, that in the foreign commercial banks at Tk 2,162.37 crore and that in the state-run specialised banks at Tk 4,390.03 crore as of December 31, 2016.

Source: New Age