The Single Point Mooring (SMP) project at Maheshkhali, Cox’s Bazar, was completed in March this year, nine years after being initiated by the state-owned Bangladesh Petroleum Corporation’s Eastern Refinery Limited. Multiple reviews extended the project’s timeline, while factors such as additional components, taxes, and exchange rate fluctuations increased its cost to Tk8,222 crore, up from the initial estimate of Tk4,936 crore.

Construction began in 2019, funded by a $550 million Chinese preferential loan, repayable over 20 years with a five-year grace period. The project underwent a trial run in July last year, but a significant technical issue delayed its commissioning until March this year.

The sea-to-shore floating terminal was designed to seamlessly transfer imported fuel oils from mother vessels to storage tanks and refineries to cut transportation time and freight costs. The China-funded project is expected to save around Tk800 crore annually by cutting time from 11 days to two days to transfer 1 lakh tonnes of fuel oils by chartered lighterage vessels that cost Tk66 crore per month.

Under the project, six storage tanks have been built in Maheshkhali adding a capacity of 2,00,000 tonnes to Eastern Refinery, enabling it to stockpile oil for two and a half months’ need – providing a buffer for supply disruptions.

It is now eight months since it was commissioned in March 2024. But the desired benefits so far cannot be reaped as the ready-to-use terminal, fitted with 110 km double pipelines, does not have an operator yet. The immediate past government, armed with the Quick Enhancement of Electricity and Energy Supply (Special Provision) Act 2010, was in the process of engaging China Petroleum Pipeline Engineering Company Ltd, which constructed the SPM, as its operator.

Given that local operators were not equipped to handle a project of such complexity and scale, the Awami League government planned to appoint a global operator to manage the SPM efficiently after its commissioning, officials from the state-owned agency BPC told The Business Standard in October. Initially, the plan was to hire a foreign operator for 18 months, until local expertise could be trained to take over the SPM’s operations.

Since the Chinese builder itself offered to operate it for three years, the then government was in favour of giving it the job under the 2010 Special Energy Security Provision Act that allowed the signing of such unsolicited contracts in the energy sector.

But the process got stuck after the abrupt 5 August fall of Sheikh Hasina’s regime through a student-led mass uprising.

Soon after taking office, the interim government suspended special energy security provisions amid criticism and controversies around unsolicited energy and electricity projects.

Tough on renewable, soft on dirty fuel

In September, the energy ministry decided to scrap 31 unsolicited renewable energy projects awarded by the previous government under the same act. Entrepreneurs said the decision put investment proposals worth about $5 billion in clean fuel electricity projects at stake. They claimed $200 million was already invested in land acquisition and other project-related steps.

If implemented, the renewable power plants in these projects would have generated 2,678MW of clean electricity and saved nearly $820 million (Tk9,700 crore) annually in energy bills, according to a study by the Bangladesh Sustainable and Renewable Energy Association (BSREA).

Meanwhile, the interim government has formed a national committee to review all unsolicited energy deals signed under the Special Provision Act.

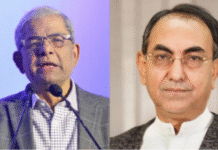

Energy Adviser Muhammad Fouzul Kabir Khan told TBS in early September that fresh tenders would be called and selected ones would be given a go-ahead.

Starting the tender process afresh could take at least a year, leading to investors’ frustration and discouragement, warned renewable energy entrepreneurs who had shared their concerns with the energy adviser and requested to help them continue the projects.

On 30 November, the energy adviser at an event in Dhaka said a new policy was being developed for the renewable energy sector as he found the previous policy was not properly implemented. On the same day, the interim government repealed the Special Provision Act but declared all existing contracts made under the Act would remain valid.

Before that, on 20 November, the Advisory Council Committee on Economic Affairs, chaired by Finance Adviser Dr Salehuddin Ahmed, chose China Petroleum Pipeline Engineering Co (CPPEC), the same Chinese state-owned firm that built the BPC’s single point mooring project to operate and maintain it.

It approved in principle the proposal, submitted by the Energy and Mineral Resources Division, under the direct purchase method.

Officials said the detailed proposal will be reviewed in the upcoming meeting of the Advisory Council Committee on Government Purchase.

What do procurement laws say?

Industry insiders say the BPC’s attempt to award SPM’s operation and management services directly to an unqualified contractor goes against the interim government’s declared stance against unsolicited energy projects as reflected in the cancellation of the special act. Contracting out a ready project to a sole source contractor also does not comply with the existing Public Procurement Regulations (PPR) and public-private partnership (PPP) rules, they view.

“Although procurement under the Special Provision Act is supposed to have been shunned, it appears the Ministry of Energy is attempting to exercise the same de facto power and award the Operations & Maintenance (O&M) contract, without tender, for the Single Point Mooring to a Chinese company in the guise of a concocted G2G scheme,” one of them told TBS, wishing not to be named.

The Chinese company CPPEC, chosen for the work, was favoured by the previous state minister of energy and the then Awami League government earlier this year floated a tender for the O&M with a document that was designed in fact for CPPEC only, the insider familiar with the process said.

“Regrettably, however, instead of issuing an open tender, BPC proceeded to craft a scheme to award the contract to CPPEC on a sole source basis, ironically just as conceived by the previous government,” he said, questioning the energy ministry’s justification that BPC and CPPEC, both being state-owned enterprises, can go for a direct G2G award, bypassing open tender process.

In their recommendation, the energy ministry and the BPC claimed that such G2G direct procurement is permitted under Public Procurement Rules Clause 75.0 and 76.2 and the Public Private Partnership Act.

“We reviewed Article 75.0 and 76.2 of the PPR and associated sub-articles, which list various circumstances under which direct contract may be made, but curiously G2G is not mentioned or referenced in any shape or form in the referenced clauses of the PPR,” the insider said. The G2G concept was indeed included in PPP supplementary gazette issued in 2017 and the energy ministry misrepresented the facts to the advisory council’s committee by “conflating the PPR & PPP and obfuscating the illicit nature of the award”, he said in a written text sent to TBS.

Explaining G2G criteria under PPP Rules and PPP, he said the G2G Partnership gazette states that GoB may directly engage with other governments and seek their support to implement projects on a PPP basis.

The Bangladesh government did not engage with the Chinese government regarding the O&M project and did not request China for any financial support or investment. The project is purely financed by the Bangladesh government. CPPEC is not making any investment, as required under PPP. Thus, this project does not meet the requirement to be classified as PPP, he pointed out, revealing that no G2G framework agreement or memorandum of understanding was also signed between the two governments required under the G2G Partnership Policy for PPP projects.

He noted that the energy ministry is setting a dangerous precedent where any state-owned entity can contract with any Bangladesh government agency and claim that the contract can be awarded without tender under the guise of G2G. In China, there are more than 350,000 state-owned entities and in Bangladesh 30-50 such Chinese entities do business, he pointed out.

“We have also discovered that CPPEC has no experience whatsoever in undertaking O&M of SPM – not even a single project,” he said, challenging BPC’s claim that CPPEC has “commissioning” experience of offshore pipelines in Angola and Abu Dhabi.

“Our investigative research leads us to conclude that CPPEC is indeed NOT doing the O&M for the Weizhou terminal as claimed,” the industry insider stated.

The O&M of SPM is highly complex and poses many risks, and the risk of handing over custody of such a critical infrastructure of national interest to an “inexperienced and novice contractor” can be very grave, he warned.

“Instead of investigating the repeated price increase of the EPC contract under the previous regime, it appears that the current government wants to further reward the same transgressing actors,” said the insider, who thoroughly examined the contract process, referring to cost escalation of the SPM project.

Government procurement officials, however, said even though the Special Provision Act has been repealed, existing rules also allow the government to go for direct contracts on certain conditions.

“Yes, PPR 2008 stipulates that the direct procurement method is allowed for the operation of a project by the builder/contractor. If you build a port as a contractor, you may get the operation contract through DPM, provided that CCEA approves it,” said a former senior executive of the PPP Authority.

Still, there is no G2G deal with China in PPP, the official told TBS.

Mohammed Shoheler Rahman Chowdhury, former director general of the Central Procurement Technical Units, now the Bangladesh Public Procurement Authority, shared a similar perspective.

He said the government procurement law provides such opportunities, but it is crucial to assess to whom the contract is being awarded. It is difficult to determine the reasons behind selecting a particular company without reviewing the relevant documents. Sometimes the decision is justified, while at other times it may not be.

The relevant authorities are best positioned to explain why a company is selected without an open tender. In such cases, it’s important to understand their rationale, and if it aligns with the rules and regulations, it can be accepted. Otherwise, appointing a company without a tender would not be appropriate, Rahman added.

TBS