The Bangladesh Bank has ended its virtual meeting with the International Monetary Fund (IMF) without reaching an agreement over exchange rate flexibility, sources familiar with the matter told The Business Standard.

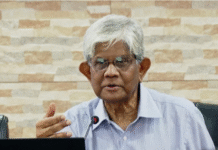

Bangladesh Bank Governor Ahsan H Mansur and two deputy governors, Md Habibur Rahman and Md Kabir Ahmed, participated in the meeting from the Bangladesh side.

Bangladesh Bank will hold another meeting with the IMF after discussion with the government, sources said.

“The governor is still trying to convince the IMF to delay the implementation of greater exchange rate flexibility, considering the current high inflation rate,” an official familiar with the matter said on condition of anonymity.

“However, Bangladesh Bank sees positive development in today’s meeting,” the official added.

Prior to the meeting, a senior BB official told The Business Standard that the “release of the next instalments will depend on today’s meeting,” as Bangladesh Bank could not reach an agreement during discussions in the Spring meeting in Washington.

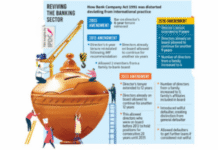

The issue remains a sticking point in the ongoing IMF negotiations, delaying the release of the next $1.3 billion tranche from the lender’s $4.7 billion loan package.

Even during the recent IMF-World Bank Spring Meetings in Washington, BB Governor Ahsan H Mansur resisted calls to adopt a free float regime immediately.

Bangladesh’s gross reserves currently exceed $21 billion, enough to cover nearly four months of imports. However, the IMF monitors NIR, which excludes certain liabilities, as a key benchmark.

During the IMF’s recent Dhaka review mission, BB proposed scrapping the NIR floor to allow the fund’s creation. While the IMF hasn’t responded yet, the central bank hopes to reach an agreement by June.

Previously, a BB official warned that a sudden free float could trigger disruptions, with aggregators hoarding dollars to drive up prices.

“With inflation already high, we need to avoid added volatility,” he said. “The fund would allow us to inject dollars and counter manipulation.”

Citing India’s model, he noted that the Reserve Bank of India frequently intervenes in the forex market to steady the rupee amid capital outflows and trade uncertainties.

He also shared a recent incident: when the Bangladesh Bank directly paid Qatar for energy imports, bypassing the open market, dollar hoarders were forced to sell at lower rates, causing the exchange rate to fall by Tk0.50 to Tk0.60.

Chief Adviser’s Special Assistant Anisuzzaman Chowdhury on Saturday said Bangladesh would pull out of the loan programme if the IMF imposes additional conditions for the release of upcoming tranches.