Last update on: Fri Feb 28, 2025 01:46 AM

Depositors continued to move their funds out of full-fledged Islamic banks in the October-December period last year, a sign that many savers have yet to regain confidence in the Shariah-compliant banks due to alleged irregularities.

In contrast, conventional banks with Islamic banking branches and windows recorded an increase in the flow of funds during the period, according to Bangladesh Bank’s (BB) quarterly report on Islamic banking in Bangladesh.

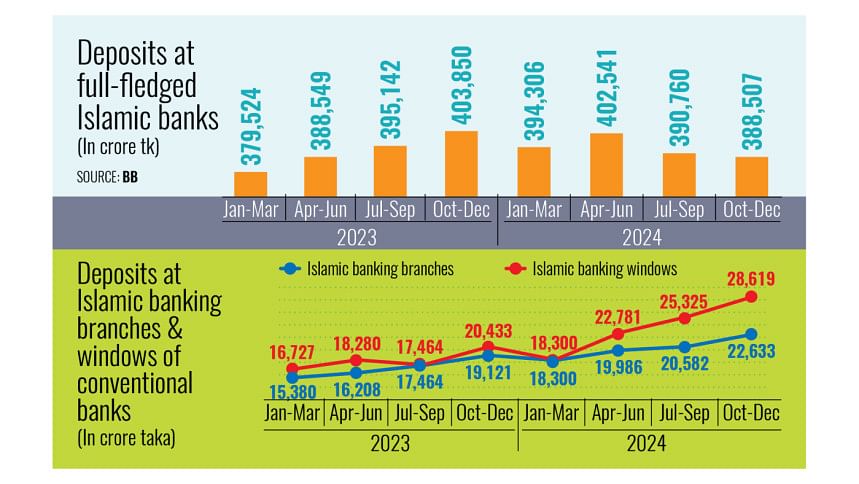

The report, released yesterday, showed that deposits at the 10 full-fledged Islamic banks declined to Tk 388,507 crore, the lowest since the April-June 2023 period.

This marked the second consecutive quarter that fully Shariah-compliant banks experienced fund withdrawals. As a result, overall deposits at these banks dropped by 4 percent year-on-year from Tk 403,850 crore in the October-December 2023 period.

Although deposits declined quarterly, overall deposits in Islamic banking grew marginally to Tk 439,580 crore compared to the previous quarter.

However, total savings at Islamic banks decreased by nearly 1 percent compared to the same quarter a year ago.

“The reason for the decline in deposits is that customers have lost confidence in full-fledged Islamic banks due to their poor health, which became evident after the ouster of the previous regime in August last year,” said Fahmida Khatun, executive director of the Centre for Policy Dialogue.

“Savers would rather not keep their money in troubled banks.”

The data follows a series of changes to the boards of several full-fledged Islamic banks, especially those associated with the controversial conglomerate S Alam Group, after the political changeover in August 2024.

The Bangladesh Bank restructured the boards of 11 banks, including Shariah-compliant ones, to bring discipline to the banking sector, which has been marred by loan scams, poor governance and rising defaulted loans.

Fahmida said that those who still wish to remain in Islamic banking have kept their deposits in healthier banks that either have Islamic banking branches or offer Islamic banking windows.

Among the 17 conventional banks with Islamic banking branches and 12 conventional banks with Islamic banking windows, some are considered healthy.

“Customers have likely kept their deposits in those banks,” she said.

BB data showed that deposits at Islamic banking branches and windows of conventional banks stood at Tk 51,252 crore at the end of 2024, the highest in two years.

This amount was 30 percent higher than the Tk 39,554 crore recorded the year prior, and 12 percent higher than the previous quarter.

“Full-fledged Islamic banks are going through many uncomfortable events. As a result, many depositors are shifting their funds,” said Shah Md Ahsan Habib, professor at the Bangladesh Institute of Bank Management.

The deposits are being moved to two destinations: conventional banks with Islamic banking branches and windows, and fully commercial banks.

He added that the central bank has taken several measures to assist crisis-hit banks and restore depositor confidence.

“But we have not yet seen any indication of renewed confidence among depositors, signalling that they can trust these banks with their funds,” he said. “Our words and deeds have not been enough to provide confidence.”

At the end of 2024, excess liquidity at Islamic banks increased by Tk 9,272 crore to reach Tk 9,435 crore.

The rise was due mainly to Tk 24,000 crore in liquidity support provided by the Bangladesh Bank to six Islamic banks as overdraft and demand loan facilities during the quarter.

The excess liquidity was up from Tk 163 crore in September 2024, but still lower by Tk 1,672 crore, or 15.05 percent, compared to the same period last year.

Ahsan said that while the intentions of the authorities are good, time may not be sufficient to restore confidence.

“Trust can be lost in an instant. But regaining it is time-consuming,” he said.