Padma Bank, which is on the list of weak banks, has sent a letter to the Bangladesh Bank, seeking Tk1,300 crore liquidity support.

Confirming the receipt of the letter, Bangladesh Bank’s Executive Director and Spokesperson Husne Ara Shikha today (19 December) said no decision has yet been made by the central bank regarding the matter.

An official from the central bank said Padma Bank has requested assistance from the central bank to return deposits of customers and institutions. Before this, senior officials of Padma Bank had met with central bank officials.

Currently, the bank does not have enough funds to return deposits, and therefore, it is seeking liquidity support from the central bank.

Efforts to contact Padma Bank’s Chief Executive Officer Kazi Md Talha for a comment were unsuccessful.

A senior official from Padma Bank, speaking on condition of anonymity, said the bank is facing a liquidity crisis and is unable to return customers’ deposits. The bank currently holds over Tk6,000 crore in deposits. To ensure some return of these deposits to customers, the bank has requested liquidity assistance from the central bank.

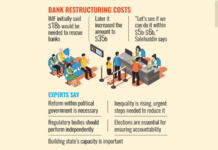

In November, the Bangladesh Bank provided Tk22,500 crore in liquidity support to six struggling banks: National Bank, Exim Bank, Social Islami Bank, First Security Islami Bank, Global Islami Bank, and Union Bank.

However, it has said while money is being printed, it will also withdraw that money from the market, ensuring that it does not fall behind in efforts to maintain inflation control, according to the central bank’s governor.

Due to financial irregularities, Padma Bank has been unable to return depositors’ money for several years. Previously known as Farmers Bank, it changed ownership and management in 2017 when it faced closure due to irregularities and loan scandals. With the initiative of the government and the cooperation of Bangladesh Bank, state-owned banks Sonali Bank, Agrani Bank, Janata Bank, Rupali Bank, and the Investment Corporation of Bangladesh bought the majority of Padma Bank’s ownership. This required an infusion of Tk715 crore in capital, but even then, the bank could not recover.

Padma Bank was also listed among the ten weak banks of Bangladesh Bank. As part of financial sector reforms, a merger process was initiated nearly seven months ago to rescue weak banks. The audit work for the merger of Padma Bank and Exim Bank has been completed and submitted to the central bank. However, the process stalled due to various reasons.

tbs