Bangladesh ranks among the countries with the highest income disparities globally, but there is another problem way worse than that: wealth inequality, which means a minuscule portion of the population owns a disproportionate amount of wealth compared to the majority.

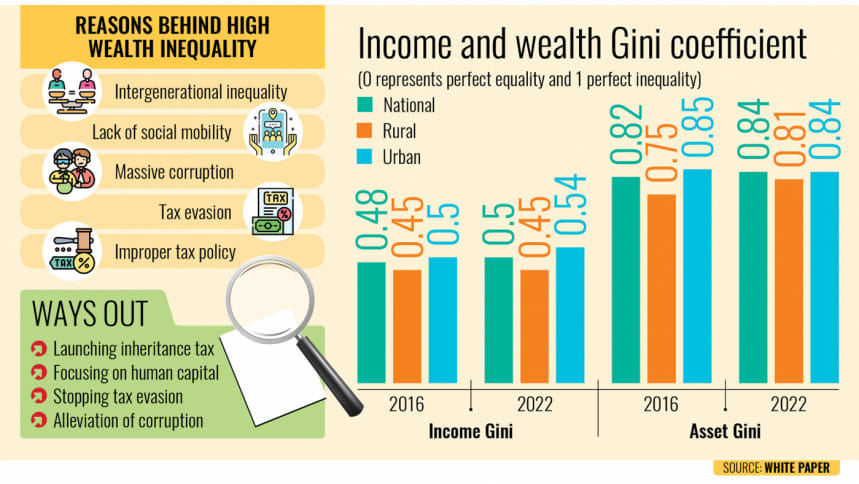

The Gini coefficient, a way of measuring inequality in a population, increased from 0.48 in 2016 to 0.50 in 2022 for income inequality, according to the white paper.

Meanwhile, wealth inequality rose from 0.82 to 0.84 over the same period, said the “White Paper on the State of the Bangladesh Economy”.

These figures were calculated using data from the Household Income and Expenditure Survey (HIES).

A Gini index ranges from 0 to 1, with 0 representing perfect equality and 1 representing perfect inequality. This provides a numerical representation of inequality. A score approaching 0.50, as in Bangladesh’s case, indicates a severe level of inequality.

Citing World Bank data, the white paper said among the 72 countries with Gini coefficient data, only Colombia, Brazil and Panama reported values over 0.50 in 2021.

Prepared by a panel of economists and submitted to Chief Adviser Muhammad Yunus on Sunday, the report said, “Although there are issues with the comparability of the estimates across countries, Bangladesh’s current income inequality is worryingly high.”

The paper mentioned that even the high Gini figures likely underestimate the true extent of wealth inequality due to incomplete data, especially for wealthy households.

For example, the wealthiest 10 percent of income earners, according to the HIES 2022 data, reported owning assets worth only Tk 7.36 lakh.

But Wealth-X, a global financial intelligence and data company, reported in 2018 that Bangladesh has had the highest rise in ultra-wealthy population, surpassing any other country in the world.

The growth rate calculated by Wealth-X stood at a solid 17.3 percent that year.

However, the company didn’t reveal how many ultra-rich — those who own at least $30 million or Tk 25 billion — the country had.

Referring to the HIES wealth data, the white paper said, “These figures may seem implausible when compared to casual observations of wealth ownership.”

Zahid Hussain, a former lead economist of the World Bank’s Dhaka office and also a member of the white paper panel, said the asset Gini coefficient reveals a highly unequal distribution of assets in the country.

“This inequality is perpetuated by intergenerational inheritance, where wealth accumulates among the upper-income class and is subsequently passed down to their children.”

This pattern, according to Hussain, also extends to education and human capital, as these advantages are often concentrated within families.

Persistent income inequality is also a cause of asset inequality. This, in turn, reinforces income inequality. “As a result, social mobility is limited and poorer individuals struggle to accumulate assets,” Hussain added.

He pointed to the absence of inheritance tax in Bangladesh. This is unlike those in Scandinavian countries and the US, where such taxes play a key role in mitigating asset inequality.

While Bangladesh imposes a surcharge on wealth, its effectiveness is limited. The surcharge ranges from 0 percent for assets up to Tk 4 crore to 10-35 percent for higher asset brackets.

Mohammad Abdur Razzaque, chairman of Research and Policy Integration for Development (RAPID), criticised the current surcharge on wealth.

“What kind of system is it?”

He said the absence of effective policies, rampant tax evasion and corruption contribute to the concentration of wealth among the affluent.

For instance, the real price of land or flats and their registered values often differ significantly. Moreover, tax policies inadvertently encourage wealth accumulation among the affluent, Razzaque said.

Meanwhile, Hussain said massive corruption is another factor contributing to high wealth inequality.

To minimise this disparity, Hussain recommended defining income tax more precisely and enforcing tax compliance. Besides, he called for curbing illegal money generation.

According to the World Inequality Database, the bottom 50 percent of the Bangladeshi population owns only 5 percent of the country’s assets.

The white paper said, “Despite underreporting, land accounts for half of the reported wealth and is heavily concentrated among the rich.”

A breakdown of asset distribution by consumption decile reveals that land and real estate constitute over half of the total wealth accumulated across consumption deciles.

Real estate wealth inequality can stem from concentrated land ownership or appreciation of land and property values. Households in the highest income decile own the most significant portion of real estate.

They also show a higher propensity to invest in return-generating assets like stocks, bonds, and jewelry in both 2016 and 2022.

While the differences in the average land ownership among rich and poor households are relatively small, with the richest quintile owning only 0.03 acres more on average, the real disparity lies in land value.

Land values for the upper quintile were significantly higher in 2016 and increased dramatically by 2022, unlike those for lower quintiles.

The primary factors driving this stark inequality in land value are location, access to infrastructure, and utilities.

The disparity in land value appreciation across quintiles suggests that government infrastructure investments have disproportionately benefited the wealthy while neglecting the poor.

Daily Star