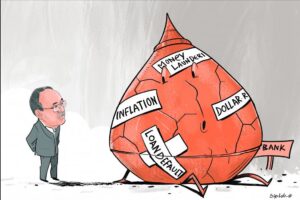

Faiz Ahmad Taiyeb : Food inflation in the country rose to 12.54 percent in August, the highest in 12 years, according to the Bangladesh Bureau of Statistics. Bangladesh Bank (BB) has implemented a series of measures, some to appease the International Monetary Fund (IMF), to manage inflation. These measures include adjustments to the repo and reverse repo rates, marginal increases in banking interest rates, and higher treasury bill interest rates. However, the question arises: are these policies sufficient to effectively address the complex issue of inflation control?

Faiz Ahmad Taiyeb : Food inflation in the country rose to 12.54 percent in August, the highest in 12 years, according to the Bangladesh Bureau of Statistics. Bangladesh Bank (BB) has implemented a series of measures, some to appease the International Monetary Fund (IMF), to manage inflation. These measures include adjustments to the repo and reverse repo rates, marginal increases in banking interest rates, and higher treasury bill interest rates. However, the question arises: are these policies sufficient to effectively address the complex issue of inflation control?

Bangladesh is categorised as a free market economy. But, in practice, the country’s markets do not always respond naturally to supply and demand forces. They exhibit limited responsiveness to international market dynamics and supply-side factors. After the pandemic, the prices of many products in the world market saw a decline, but the same has not happened in Bangladesh. Despite BB’s effort to combat the economic impact of the Covid-19 pandemic by lowering interest rates, the credit flow in the private sector saw minimal improvement. Banks preferred to lend to established clients, particularly larger entities, contributing to a concentration of credit. This approach has had unintended consequences, including the risk of capital flight as larger borrowers transfer funds abroad.

One key factor hampering the effectiveness of BB’s policies is the delay in decision-making and significant transmission lags. The time between BB’s policy decisions and their impact on inflation can span several months, or even years, since the start of the problem. During this time, various macroeconomic variables undergo significant changes. For instance, the devaluation of the taka against the US dollar does not occur in a timely manner, creating opportunities for alternative channels such as hundi markets to emerge. These channels accommodate the demand for foreign currency and even integrate mobile banking and digital e-commerce platforms illegally, thus diminishing the formal inflow of remittance.

A more continuous and incremental approach to policy evaluation would be advisable, which would allow the market to adjust to changes gradually and prevent sharp shocks due to sudden policy implementation.

BB’s inability to effectively manage letters of credit (LCs) and the imposition of onerous LC-related restrictions have led to the circumvention of formal banking channels. There is also the foreign currency reserve drain. The fluctuation in the dollar-to-taka exchange rate between the opening and closing stages of LCs has driven up prices. Importers have exploited this inconsistency and delayed releasing commodities into the market, capitalising on inflationary trends to increase profits. This situation has contributed to a self-reinforcing cycle of inflation, where the expectation of rising prices on the supply side actively contributes to increasing overall inflation.

To control inflation, the government initially delayed taking action. It remained unsuccessful in selling government bonds and withdrawing money from the market, due to its reluctance to raise interest rates. Instead, a disputed approach of filling budget deficiency via excessive money printing (known as devolvement), has been adopted. This fueled inflation further. Even now, new money is coming into being in the cyclic flows of this powerful reserve. Repo and reverse repo rates have recently been introduced after much ado, but their impact may be limited, given that private credit flow had already decreased before these measures were finally put in place.

The key challenge for our central bank lies in addressing wilful defaulters and the issues within the banking sector, particularly regarding non-performing loans. The reported data on defaulted loans is likely too low to be representative of the actual extent of the problem, and the lack of stringent actions against defaulters exacerbates the issue. These defaulters control the allocation of private investment. SMEs receive minimal private investment due to banks’ preference for lending to established clients.

There are still more reasons behind Bangladesh’s inflation. Opening of LCs for imports fell by 18 percent in the first quarter of the ongoing fiscal year, compared to the same period last year. Sector-wise credit openings fell by even more: by 39 percent for consumer goods, by 28 percent for industrial raw materials, by 22 percent for energy and petroleum products, among others. And because there is no proper initiative for LC quality control, smuggling is still prevalent under the cover of imports. Without a massive reduction in money laundering, the dollar reserve crisis will not improve and the taka will continue to lose value.

The issue of high inflation in Bangladesh originated from a significant increase in fuel prices over only nine months. To make things worse, fertiliser prices also rose.

To effectively address high inflation, lowering the price of essential fuel as a strategic economic commodity is crucial. The average international crude oil price remained relatively low over the last year, but the government’s taxation policies, which involve multiple levels of duties, have resulted in uncompetitive fuel prices. Maintaining these anti-people policies significantly boost government revenue. However, the existence of a large and unproductive bureaucracy increases the cost of government operations. This, in turn, limits public spending and the incentives that are crucial for addressing the impact of inflation.

Regulatory policies can only work when the market functions properly, which is not the case in Bangladesh. Here, there are multiple layers of syndicates, including the government itself, that do not allow the market to function well. The range of structural, operational, and external factors contributing to high inflation must be confronted with timely standard practices, institutional rule, and transparent political will.

Faiz Ahmad Taiyeb is a Bangladeshi columnist and writer living in the Netherlands.

Daily Star