More than 40 percent listed textile mills’ profits declined in the second half of 2018 thanks to the slide in prices of garment items and stockpiling of yarn for invasion of cheaper alternatives from India and China.

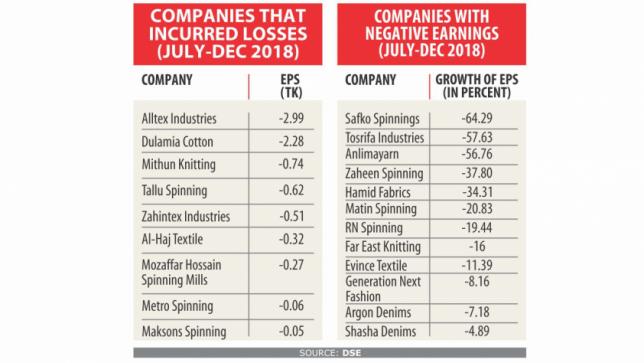

Of the total 53 listed textile, spinning and garment factories on the Dhaka Stock Exchange (DSE), nine companies logged in losses and 12 registered lower profits than a year earlier.

Those who saw their profits rise between the months of July and December last year logged in marginal increases.

Investors on the stock market have long been complaining that the textile, spinning mills and garment companies were not paying handsome dividend using the excuse of lower profits or losses — although the size of those companies is bigger than in other sectors.

Take the case of Hossain Chisty Shiplu, who bought some textile and spinning companies’ stocks expecting high dividends.

“I had thought that the textile, spinning and garment companies would make hefty profit since garment exports are increasing. But I am disappointed,” he added.

Some of the companies though are making good profit thanks to expansion of production capacity, installation of modern machinery, improvement in product quality and product diversification, industry insiders said.

Envoy Textiles is one such company. The company got listed in December 2012 and began paying cash dividend from 2015, when it gave its shareholders 17 percent cash dividend and 5 percent stock dividend.

In 2018 it gave 10 percent cash dividend and 2 percent stock dividend. The previous year, it handed out 7 percent cash dividend and 5 percent stock dividend.

“We have taken so many initiatives from product diversification and investment to recruiting new designers for keeping up with the latest market trends,” said Kutubuddin Ahmed, chairman of Envoy Textiles.

The company has taken a lot of initiatives to reduce the cost of operations like reducing water consumption, energy and wastage. It is the world’s first platinum rated LEED certified company for its green operations.

“We have recruited Chinese, Italian and Turkish designers so that we can manufacture different varieties of yarn and denim fabrics,” Ahmed added.

A spinning mills owner whose company failed to make any profit between July and December last year said the yarn price has been on the slide in the last few months due to availability of cheap yarn from China and India.

The widely consumed 30-carded cotton yarn is now selling for $2.90 to $2.95 a kg, down from $3.05 to $3.10 a kg before November last year.

“Besides, the demand for cotton-made yarn is also falling as the demand for man-made fibres is rising worldwide,” the miller said.

In Bangladesh, the majority of the spinning mills produce cotton yarn, he added.

Jahangir Alamin, former president of the Bangladesh Textile Mills Association, the platform of spinning, weaving and dyeing mills owners, echoed the same. “Various problems are afflicting the primary textile sector,” he added.

The exact amount of profits made by a company is not reflected due to faulty audit reports, said the managing director of a spinning mill listed on the DSE upon condition of anonymity to speak candidly on the matter.

by Ahsan Habib and Refayet Ullah Mirdha