Last update on: Thu Mar 6, 2025 12:05 AM

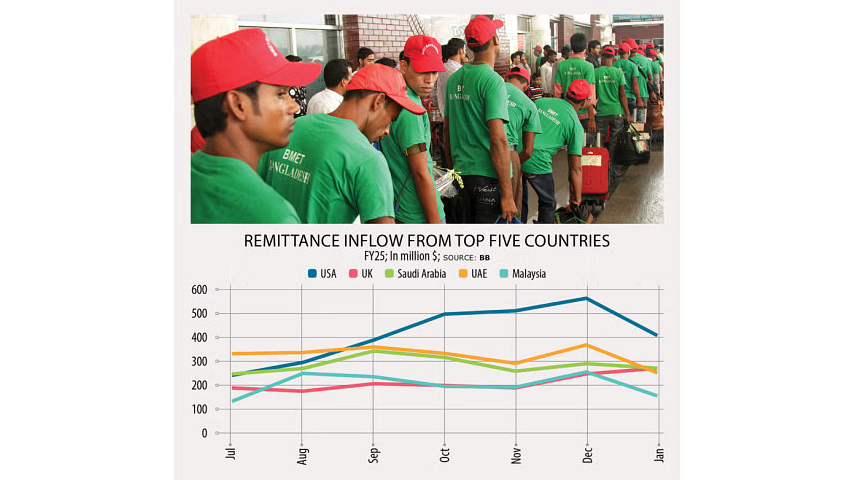

The United States, the United Kingdom, and Saudi Arabia were the top sources of remittance inflows to Bangladesh in the first seven months of the 2024-25 fiscal year.

According to Bangladesh Bank, total remittance inflows from the top 30 countries stood at $15.96 billion during the period.

Remittance inflows peaked in December before declining in January, likely due to post-festival slowdowns and economic adjustments.

The United States led with $2.9 billion in remittances from July 2024 to January 2025. Monthly inflows from the US peaked at $565.04 million in December before falling to $407.52 million in January.

The United Kingdom ranked second, with inflows totaling $1.47 billion. Migrant Bangladeshis in the UK sent home $248.48 million in December, which rose to $273.4 million in January.

Saudi Arabia followed closely, contributing $1.99 billion during this period. Inflows from the kingdom increased until December, reaching $290 million, but fell by 30 percent in January.

The United Arab Emirates ranked fourth, with total remittances at $2.27 billion. December inflows stood at $370.85 million before dropping to $249.56 million in January.

Among the top 10 contributors, Malaysia sent $876.14 million, while Kuwait followed with $867.14 million. Italy, Oman, Qatar, and Singapore also played significant roles.

Remittance from Italy surged in January to $131 million, the highest in seven months.

South Africa, Canada, and Australia contributed smaller amounts, with inflows totaling $175.16 million, $99.82 million, and $93.82 million, respectively.

Saudi Arabia has historically been the largest remittance-sending country for Bangladesh. However, in recent years, the UAE and the USA have emerged as the top sources, possibly due to the role of aggregators, said Professor Mustafizur Rahman, distinguished fellow of the Centre for Policy Dialogue.

When commercial banks offered to buy foreign currencies at premium exchange rates due to a shortage of supply, these aggregators saw an opportunity to purchase foreign currency from remitters and sell the bulk currency to banks at a premium rate, he said.

Dubai, in particular, has emerged as a key hub for aggregator activities, Rahman added.

“Suddenly, remittance flows from Saudi Arabia dropped sharply, while those from the UAE surged. This shift in remittance sources needs to be closely examined by the relevant authorities.”

Mohammad Ali, managing director and CEO of Pubali Bank, told The Daily Star that the US, the UK, and Saudi Arabia remain the top remittance sources as they host the highest number of Bangladeshi migrants.

Remittance inflows typically rise before festivals and winter as migrants send money home for Eid, Durga Puja, and winter weddings, he said.

Remittance Trends

Bangladesh’s economy remains heavily reliant on remittances, with traditional markets playing a key role in inflows.

Remittance inflows have undergone dynamic shifts from FY2016-17 to FY2024-25, influenced by global economic trends, migration policies, and labor market conditions.

The UAE, Saudi Arabia, and the US have consistently remained top contributors, with inflows rising over the years.

In FY2016-17, remittances from the UAE stood at $2.09 billion, increasing to $3.01 billion by FY2022-23. Saudi Arabia’s inflows rose from $2.26 billion in FY2016-17 to $3.75 billion in FY2022-23. The US saw a steady increase, reaching $2.96 billion in FY2022-23.

While some corridors have shown consistent growth, others have fluctuated.

Kuwait’s remittances grew modestly from $1.03 billion in FY2016-17 to $1.55 billion in FY2022-23. Malaysia recorded little variation, maintaining inflows around $1.25 billion during the same period.

European countries such as the UK and Italy have remained strong sources. The UK’s inflows increased from $808.2 million in FY2016-17 to $2.08 billion in FY2022-23.

Italy’s contribution more than doubled, rising from $510.8 million to $1.18 billion during the same period.

Emerging and Declining Sources

South Korea, Japan, and Australia have emerged as growing remittance sources. South Korea, which recorded $80.7 million in FY2016-17, surged to $116.4 million in FY2023-24.

Japan also saw a rise in inflows, while Australia followed an upward trend.

Conversely, some Middle Eastern nations have experienced fluctuations. Qatar saw a decline after an initial rise. Oman, which recorded $897.2 million in FY2016-17, fluctuated, standing at $766.3 million in FY2024-25.

The number of aggregators has increased since the onset of the Covid-19 pandemic, as global foreign currency markets became more volatile, the Pubali Bank managing director said.

Money changers in Qatar or Oman may have used channels of US-based aggregators to send foreign currencies to Bangladesh, leading to a drop in remittance inflows from Qatar and Oman while increasing inflows from the USA, he said.