Last update on: Sat Aug 17, 2024 10:22 AM

Directors of eight private banks borrowed heavily from each other’s banks in reciprocal lending practices fraught with serious risks. Some banks went one step further and lent thousands of crores to relatives of these banks’ chairmen or directors.

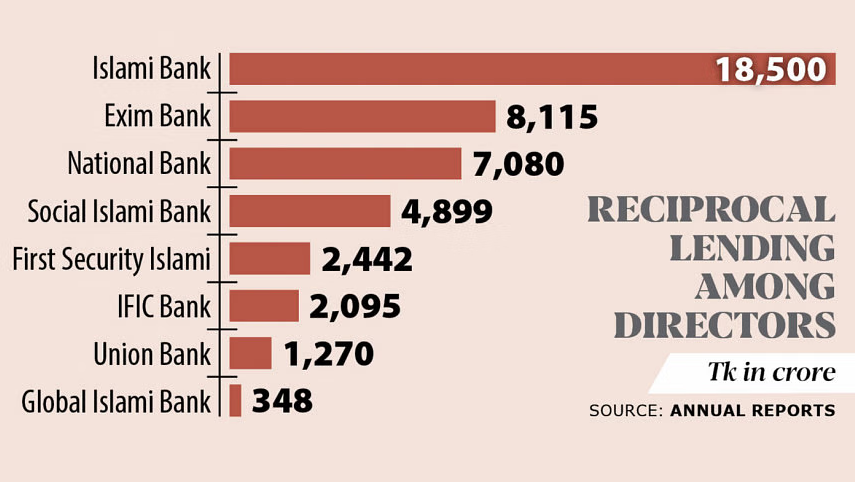

The loans going in and out of these eight banks for directors amounted to Tk 25,000 crore at the end of 2023, according to their financial reports analysed by The Daily Star. Apart from this, four of these lenders provided around Tk 20,000 crore to the relatives of the bank directors. That means the total reciprocal loans sanctioned for these directors and their relatives amounted to Tk 45,000 crore. Most of these loans changed hands in the last five years.

Over the last three months, The Daily Star analysed the financial reports of the 51 scheduled banks currently operating in Bangladesh and found that no other banks except these eight were engaged in such lending practices.

The banks are Exim Bank, Islami Bank, Social Islami Bank, National Bank, IFIC Bank, First Security Islami Bank, Union Bank and Global Islami Bank.

These banks are known for their questionable banking practices and were allegedly linked with the just-ousted Awami League government. During Sheikh Hasina’s 15-year rule, powerful business groups with banking assets, including S Alam, Beximco, Nassa and Sikder Group, thrived on murky politics and bent rules, exposing the entire financial sector to serious risks.

The combined contribution of the eight bank directors in question to the lenders’ paid-up capital is TK 2,400 crore, or about 5 percent of the Tk 45,000 crore loans they have taken from each other.

Most of these groups were not capable of getting loans if their business practices and financial health were taken into account, and so they lent reciprocally.

As the central bank rules prohibit the lending of a bank to its own directors, the directors deployed this cunning method. This trend is not new, but it spread in the banking sector in the last seven to eight years, officials said.

“As most of the bank owners are also successful in their own businesses, the central bank cannot prevent banks from lending to the owners of other banks,” a banking analyst said.

According to a 2014 central bank circular, commercial banks can lend to their directors’ firms up to 50 percent of their contribution to the paid-up capital.

Four of these banks declined to comment for this story, and two others said the loans were sanctioned under relevant laws. The Daily Star could not reach the two other banks.

Bankers say such reciprocal lending is risky for the relevant banks and the banking sector as a whole.

This type of borrowing indicates that these directors helped each other out with depositors’ money as they would find it difficult to secure loans from other banks, they add.

Most of the loans were approved following the orders of the directors, and bank officials had nothing to do, according to three mid-level bankers at Islami Bank, Social Islami Bank and Exim Bank.

Requesting anonymity, they said several banks lent some companies large sums, in many cases multiple times their annual sales.

“So how will they repay the loans?” said one of the three bankers. His view was echoed by the two others.

‘UNDUE BENEFITS’

Data show Islami Bank and Social Islami Bank started engaging in reciprocal lending in 2016 when these two banks were taken over by S Alam Group.

Exim Bank, National Bank, and IFIC Bank have already been involved in such lending practices for years, but on a limited scale. The size of such loans multiplied over the last 10 years.

When banks lend to relatives of their directors, they put the banks at risk since the financial strength of the borrowers is not seriously considered while sanctioning these loans, experts say.

These borrowers usually get undue benefits in taking loans, and repayment. Several banks are already facing risks because of such lending.

The financial statements of the companies in question should be analysed to see whether their assets and liabilities support the lending, Bangladesh Bank spokesman Mezbaul Haque told The Daily Star.

“If it is over-lending, the central bank will take action,” he said.

EXIM BANK

Exim Bank provided Tk 8,115 crore, the highest amount of reciprocal loans, to several firms owned by directors of other banks. Of the amount, Tk 3,982 crore went to three companies owned by S Alam Group, whose chairman is Mohammed Saiful Alam, also chairman of First Security Islami Bank.

For its part, First Security Islami Bank lent Nassa Group, whose outstanding loan at the bank was Tk 734 crore at the end of 2023.

Nazrul Islam Mazumder, chairman of Exim Bank, himself took loans from most of these banks in the name of Nassa Group, which he owns. Nassa Group also secured loans from Islami Bank, where S Alam’s son Ahsanul Alam is the chairman.

Exim Bank lent Tk 801 crore to Unitex Spinning and its associates, whose managing director Belal Ahmed is the chairman of Social Islami Bank (SIBL).

Nassa Group’s outstanding loan to SIBL stands at Tk 651 crore.

Beximco and its various concerns’ loan outstanding at Exim Bank was Tk 661 crore at the end of 2023. Beximco’s Vice-chairman Salman F Rahman is also chairman of IFIC Bank. To IFIC Bank, Nassa Group’s outstanding loan is Tk 637 crore.

Exim Bank lent Tk 2,671 crore to PowerPac Mutiara Keraniganj Power Plant, a sister concern of Sikder Group, controlled by Rick Haque Sikder and his brother Ron Haque Sikder. They had also directorships at the National Bank before they were forced out by the regulator.

Nassa Group’s loan outstanding to National Bank was Tk 1,632 crore at the end of 2023.

Exim Bank’s financial reports show Mazumder and his family contributed around Tk 250 crore to the paid-up capital of Exim Bank by holding 25 crore shares.

Under central bank rules, he is eligible to secure only Tk 125 crore (50 percent of the share value) of loans from the bank.

“This is a concentration of lending and this type of lending creates risks for a bank though this loan has not become defaulted yet,” said Muhammad A (Rumee) Ali, a veteran banker.

“If any big borrower defaults, it would make the bank vulnerable. A good bank usually does not allow this type of lending due to such concerns,” he said.

To avoid the loan concentration, the central bank rolled out a rule of a single exposure limit. But these banks have systematically dodged the rule by taking loans in the name of several firms.

“From the banking side, it is not difficult to find out who is the ultimate beneficiary of the loans, so they should be careful,” said Ali, a former deputy governor of Bangladesh Bank.

SOCIAL ISLAMI BANK

Social Islami Bank (SIBL) provided loans of Tk 1,700 crore to directors of other banks, and its Chairman Belal Ahmed took loans from their banks. For instance, it lent Tk 1,049 crore to several firms of Infinia Group whose chairman is Ahsanul Alam, also chairman of Islami Bank.

In return, Islami Bank lent Tk 2,221 crore to two firms of Unitex Group whose managing director is Belal Ahmed.

Apart from these reciprocal lending, SIBL lent Tk 3,199 crore to several firms and sister concerns of S Alam Group. SIBL Chairman Belal Ahmed and S Alam Group’s Saiful Alam are relatives.

Unitex Group holds around 4.5 crore shares in SIBL. This means the company’s contribution to the paid-up capital of the bank is less than Tk 50 crore. Several relatives of S Alam also hold shares at the bank and their combined contribution to the bank’s paid-up capital is around Tk 230 crore.

ISLAMI BANK

Islami Bank reciprocally lent Tk 4,333 crore to directors of other banks.

Apart from this, the bank’s lending to S Alam Group’s several firms alone stood at Tk 14,167 crore.

In Islami Bank, Ahsanul Alam, who is the bank chairman, and his relatives hold shares equivalent to Tk 350 crore of the bank’s paid-up capital.

Since S Alam Group did not invest in Islami Bank in its own name, the bank has no legal binding in lending to the Group’s companies.

OTHER BANKS

Similar practices were widespread at National Bank, IFIC Bank, First Security Islami Bank, Global Islami Bank and Union Bank.

National Bank for example lent Tk 7,080 crore to several companies whose owners are also directors of other banks. These loans were provided to Beximco Group, Nassa Group, and S Alam Group.

Sikder Group, in return, received loans from IFIC Bank, Exim Bank, and First Security Islami Bank.

Similarly, IFIC Bank lent TK 1,075 crore to Nassa Group and Sikder Group. In return, Beximco Group got loans from Exim Bank and National Bank.

IFIC Bank provided loans of Tk 1,020 crore to Sreepur Township Ltd, where Beximco is a joint venture partner.

Salman F Rahman and his son Ahmed Shayan Rahman hold 4.11 percent or 7.51 crore shares of the bank worth Tk 75 crore.

First Security Islami Bank provided those types of loans amounting Tk 2,442 crore.

Global Islami Bank and Union Group’s reciprocal lending to each other was Tk 1,618 crore.

Several relatives of S Alam hold 30 crore shares at Global Islami Bank, meaning their investment is around Tk 300 crore in the bank. In Union Bank, S Alam Group holds shares worth Tk 570 crore.

The Daily Star first contacted most of these banks on June 15 and followed up with them on August 12-13. Representatives from National Bank, First Security Islami Bank, IFIC Bank, and Exim Bank did not respond or declined to comment.

Zafar Alam, chief operating officer at SIBL, said they sanctioned all loans in line with banking rules, and that the borrowers, including S Alam Group, are eligible for big loans.

Islami Bank CEO Mohammed Monirul Moula said they have been investing in Nassa Group and S Alam Group since the 1990s, and that the two groups’ performance was excellent.