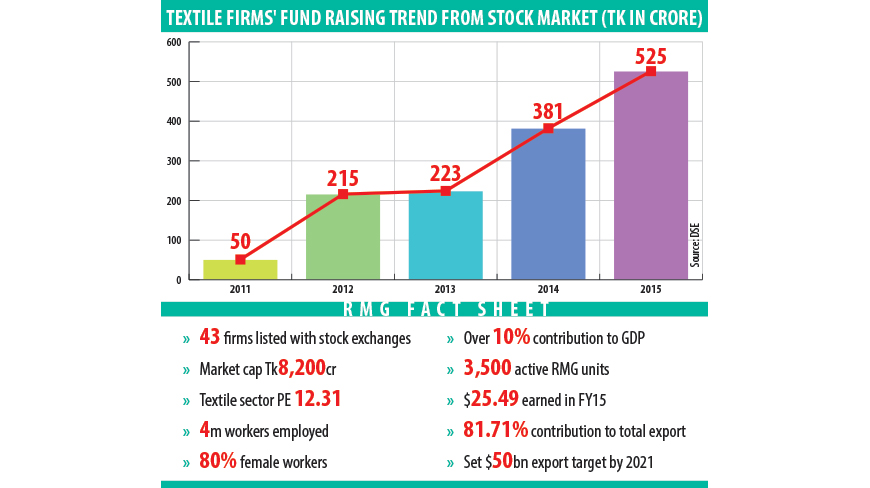

The year 2015 saw a rush of textile companies to the country’s stock market as they opted for raising fund at lower cost than that of bank loans.

A total of 12 companies and mutual funds raised Tk830 crore from stock market in the year, of which, textile companies constitute more than 63%, according to the Dhaka Stock Exchange

Eight textile companies raised Tk525 crore, up 37.7% from a year earlier while six companies received Tk381 crore.

According to the initial public offering prospectus, funds raised from public have been used for repayment of bank loans, capital investment, working capital, construction of new establishments, acquisition of machinery and expansion of existing business.

“It is a good sign for the capital market as well as for the industry as the fund is being collected from the stock market for textile firms’ business expansion,” Abdus Salam Murshedy, managing director of Envoy Textile, a listed company, told the Dhaka Tribune.

He said the businesspeople preferred raising funds from the stock market to bank borrowing as the option was less costlier than taking bank loans.

Md Shakil Rizvi, a DSE director, said if the companies were sound and well-performing in terms of financial statement and growth, it was better for the capital market.

He said as the growth prospect of the textile industry looked bright, the stock investors were keeping their money on the sector.

Shakil, however, urged Bangladesh Securities and Exchange Commission to be cautious over allowing companies to raise funds considering the investors’ interest and their fundamentals.

Ex-BGMEA President Anwar-ul-Alam Chowdhury Parvez said the RMG industry needed investment for growth, “but it is very tough to make profits with the higher interest rate of bank loans.”

He said: “That is why the textile entrepreneurs turned up in the stock market rather than going to banks.”

Anwar-ul-Alam, also managing director of Argon Denim, added: “As everyday fashion has taken a new look in the clothing industry, adopting the change needs investment, for example, to bring latest technology to the sector.”

Professor of Economics at Dhaka University Abu Ahmed said the listing of low technology textile firms would help to increase the number of stocks in the market, “but the market needs quality stocks for its stability.”

Source: Dhaka Tribune