The tax authority has yet to get a good response from the holders of undisclosed money despite offering amnesty that none will question the sources of income this fiscal year, said its chief yesterday.

“As far as I know, we are not getting that much response,” said Abu Hena Md Rahmatul Muneem, chairman of the National Board of Revenue (NBR), at the launch of the Electronic Fiscal Device (EFD).

The revelation comes nearly two months past the start of fiscal 2020-21 in July.

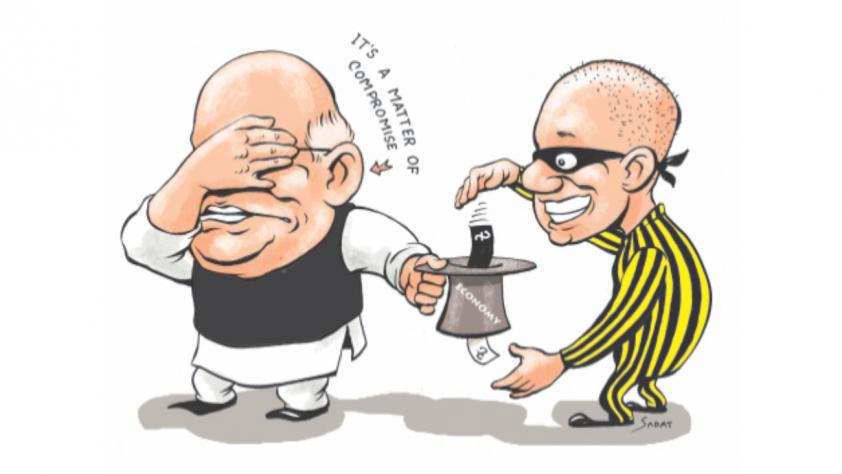

With its avenues for revenue collection squeezed for the drop in economic activities for the pandemic, the government has turned to tax cheats for boosting its coffer this fiscal year.

Until last fiscal year, black money-holders had been able to whiten their assets by investing in residential buildings by paying a tax of 10 per cent on the amount invested, which for regular taxpayers is between 10 and 30 per cent.

In fiscal 2020-21, the amnesty has been widened.

Now, individual taxpayers will be allowed to disclose any type of undisclosed house properties, including land, building, flat and apartment by paying tax at a particular rate on per square metre.

Individual taxpayers will also be able to make any disclosure of undisclosed cash, bank deposits, savings certificates, shares, bonds or any other securities on paying taxes at a rate of 10 per cent.

They can also invest in the capital market and show it in their tax returns. They have to maintain a lock-in period for a year.

No authority, including the NBR and Anti-Corruption Commission, would be able to raise any question on such declarations, said taxmen.

Muneem said the impact of the indemnity might be visible in the recent buoyancy in the stock market.

And the reflection will be seen in the submissions of returns this year.

“As there are still a couple of months left for submission of tax returns, we may see the impact later,” he said at the event held at the NBR headquarters.

The NBR chief said many feel shy about declaring undisclosed wealth in tax returns fearing that the other state entities might question the income.

Holders of undeclared income would be able to challenge any government agency questioning the source of their money.

“We have talked to those organisations that can raise questions. We have explained the spirit of the law in detail. They are convinced that it will not be the right thing to question. They will respect the spirit of the law.”

The indemnity would be applicable for legally earned income, not for illegally earned money, Muneem added.

Over the past couple of decades, successive governments offered the scope to holders of undisclosed income as a tool to increase tax collection and bring the money into the formal channel for the benefit of the economy.

Yet, the responses had not been that high.

The highest amount of money that was legalised was during the regime of the army-backed caretaker government.

Holders of undisclosed money legalised Tk 9,680 crore of undisclosed income in fiscals 2007-08 and 2008-09, NBR data showed.

In the previous two periods of the Awami League-led government, people legalised Tk 1,805 crore and Tk 4,856 crore respectively.

Asked whether the provisions of the finance act can supersede the law of the ACC, Muneem said: “It could — since the law was passed in the parliament.”

Meanwhile, the NBR is focusing on expanding the tax net to increase the revenue collection.

The shortfall in revenue collection due to the pandemic would be made up for through the release of arrear revenue and some innovative steps.

The tax collector will also try to realise arrear tax from state agencies, Muneem added.