The country’s biggest initial public offering is going to hit the stock market soon as Robi Axiata Ltd yesterday received the nod from the stock market regulator to go public.

The Bangladesh Securities and Exchange Commission (BSEC) approved the IPO plan of the country’s second-largest operator at a meeting presided over by Prof Shibli Rubayat Ul Islam, chairman of the watchdog.

“We would like to thank the BSEC for kindly approving our IPO application,” said Shahed Alam, chief corporate and regulatory officer of Robi Axiata, in a statement.

“This is indeed a historic moment for Robi. We are immensely proud to be coming to the stock markets with the largest-ever stock listing. The approval to enlist in the country’s stock markets paves the way for the people of the country to become shareholders of the company.”

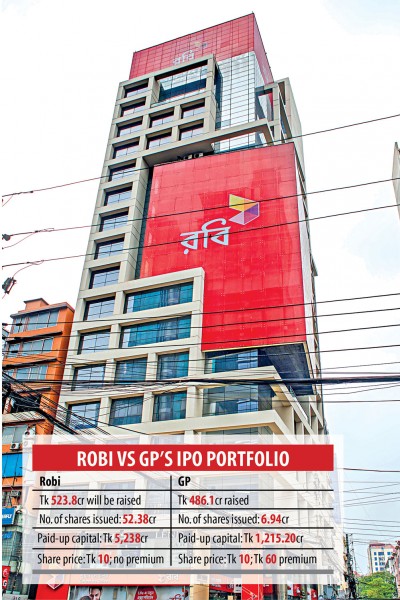

Robi would raise Tk 523.7 crore from the market by issuing 52.3 crore shares. This would be the biggest IPO in Bangladesh and would overtake Grameenphone’s flotation of Tk 486 crore in 2009.

The face value of the shares will be Tk 10 and there will be no premium.

The operator submitted the proposal on March 2 to float 10 per cent of the shares under the fixed-price method. Of the shares, 38.77 crore will be issued through the IPO and the rest 13.6 crore would be issued to employees.

The operator has already raised around Tk 136 crore as share money deposit by issuing securities to employees. It has not distributed the shares among the employees yet.

Companies in Bangladesh cannot issue shares to employees after they go public. So, the mobile operator had sought an exemption from the BSEC to issue the shares to its employees and the regulator gave its consent.

The operator would use the IPO proceeds to expand the network.

Robi attached two conditions to get listed: reducing the turnover tax to 0.75 per cent from 2 per cent and slashing the corporate tax to 35 per cent for 10 years.

“We hope that the government will positively consider certain conditions we had placed for the enlistment in the interest of the prospective investors,” Alam added.

Once listed, the operator’s corporate tax will be slashed to 40 per cent from 45 per cent applicable for non-listed mobile phone operators.

The per-share net asset value of Robi Axiata was Tk 12.64 as on December 31 of 2019 and the earnings per share were Tk 0.04 for the year.

The carrier started its journey in 1997 under the brand name of Aktel.

In 2009, the name of the company was changed to Axiata (Bangladesh) and in 2010, the company assumed its present name, Robi Axiata. It has 4.91 crore subscribers as of July, up 2.85 per cent year-on-year, data from the Bangladesh Telecommunication Regulatory Commission showed.

IDLC Investments was the issue manager. The merchant bank also worked as the corporate adviser in the Robi and Airtel’s merger in 2016, which was one of the largest mergers in Bangladesh.

“This approval reiterates IDLC’s commitment to bringing well-governed companies to the market and testifies its continued leadership in the investment banking landscape of the country,” said Arif Khan, chief executive officer of IDLC Finance.

OTHER BSEC DECISIONS

The BSEC also approved the IPO proposal of Crystal Insurance, which would issue 1.6 crore shares to raise Tk 16 crore. The insurer will invest the IPO proceeds into the stock market and deposit in banks.

The per-share net asset value of the company was Tk 24.42 on December 31 last year and the earnings per share were Tk 2.92 for the last year.

The BSEC also decided to issue a notification as per a request from the Insurance Development and Regulatory Authority so that insurance companies can raise funds less than Tk 30 crore.

As per listing regulations, companies have to raise at least Tk 30 crore under the fixed-price method. But 26 insurers will be allowed to raise capital less than the required amount.

They will, however, have to raise more than Tk 15 crore.

The commission approved a Tk 500 crore bond for Dutch-Bangla Bank. The tenure of the non-convertible, fully redeemable, floating rate and subordinated bond would be seven years. The lender would use the proceeds to strengthen the capital base.

The BSEC also gave its consent to the fully redeemable, non-convertible zero-coupon bond for Aamra Networks. Its coupon rate would be 8.68 per cent to 9.73 per cent.