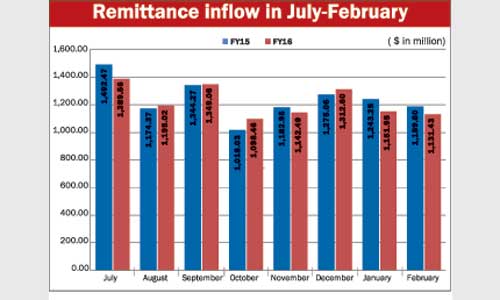

Remittance inflow decreased by 1.15 per cent to $9.76 billion in eight months of the financial year of 2015-16 compared with that in the same period of FY15, according to the Bangladesh Bank data released on Wednesday.

The remittance inflow figure was $9.92 billion in the July-February period of FY15.

Experts said the fall might put an adverse impact on the country’s gross domestic product.

Former interim administration adviser Mirza Azizul Islam told New Age on Wednesday that it was a matter of concern that the country’s inward remittance was on the decline for the last few months.

He said, ‘The economies of Arabian countries, which are our main manpower export destinations, are now facing crisis that has put an adverse impact on the country’s inward remittance.’

Besides, an anti immigration sentiment is building up in whole Europe, forcing Bangladeshi nationals to leave the countries of the continent, he said.

Mirza Aziz said that the country earned around $15 billion from remittance in a year which was 10 per cent of the GDP.

The inward remittance played a major role in increasing the consumption power of the people, he said.

‘The consumption capacity of the people will decrease if the remittance inflow maintains a downward trend which will ultimately hit the GDP growth,’ he said.

The BB data showed that the inward remittance decreased to $1.13 billion in February against $1.18 billion in the same month of last year.

A BB official said that one of the major causes of decreasing the inward remittance was the lower price of petroleum products on the global market.

The majority of the Bangladeshi expatriate workers are now working in Middle East countries and the economies of the region mainly depend on the income from the petroleum products, he said.

The lower cost of petroleum products has hit business of the Middle East, resulting in squeezing of their spending.

Besides, the government has also failed to export human resources to new markets like Malaysia, said the banker.

The government should take prompt action to expand the new markets to export its human resources in a bid to boost the inward remittance, he said.

According to the BB data, the private commercial banks received $767.03 million in inward remittance in February while the state-run commercial banks received $342.13 million, foreign commercial banks $11.25 million, and specialised development banks got $11.03 million.

In February, Islami Bank Bangladesh received the highest amount of remittance — $275.28 million — among the private commercial banks, while Agrani Bank got the highest amount of remittance — $128.24 million — among the state-run banks.

The inward remittance increased by 7.59 per cent year-on-year crossing $15.30 billion in FY15. The remittance inflow had gone down to $14.22 billion in FY14 from $14.46 billion in FY13.

Source: New Age