Private sector credit growth came back to slower pace again in recent months due to lack of credit demand.

The authorities concerned claimed that investment barriers including lack of electricity and gas supply still exist, resulting in slow credit inflow.

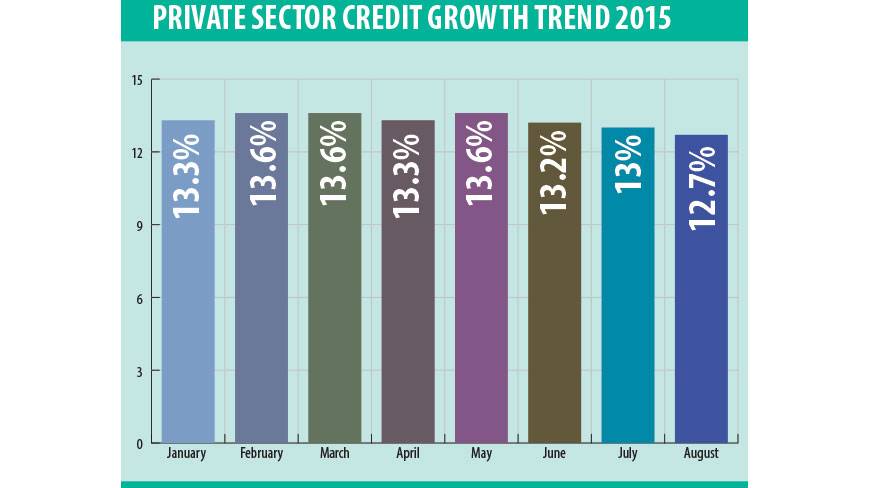

The credit growth dropped to 12.7% in August compared to 13% in July this year, according to the Bangladesh Bank statement.

Banking sector experienced momentum in growth from December last year with the rising rate at 13%. The rate hovered between 13.5% and 13.6% till May this year. Later the credit growth started to decline and came to below 13% in August again.

“Businessmen are reluctant to expand their business as the barriers they have been facing are still prevailing,” said Allah Malik Kazemi, change management adviser to Bangladesh Bank.

He said businesses are still suffering for gas and electricity supply which are major barriers to investment.

Drop in demand for export in the international market amid global recession also accounted for slower credit growth, he claimed.

Lower export and import growth due to price fall in commodities in the international market accounted for slower credit growth, said Mohammed Nurul Amin, managing director of Meghna bank.

Though the country came out of political unrest, uncertainty still refrains businessmen from further investment, he observed.

Meanwhile, Bangladesh Bank continued to mop up excess liquidity from the banks every day to retain the call money rate at higher than the bank rate of 5%.

The central bank is mopping up over Tk13,000 crore per day from the market through reverse repo at the rate of 5.25%, according to the recent data.

The amount of excess liquidity withdrawn from the markets was between Tk6,000 crore to Tk7,000 crore per day during Eid ul-Azha as there was credit demand to celebrate the festival.

But the amount of excess liquidity went up in the market just after the festival and the central bank started to seize more money, paying close to Tk700 crore as interest per day to the banks.

The call money rate would come to 1% if central bank would not mop up money from the market, said Kazemi.

He said the government is unhappy with the central bank due to lower profit, but there is nothing but to mop up money from the banks, paying interest.

Inflation which is the major concern of the central bank to maintain within the targeted limit of 6.2% will be affected by excess liquidity, he explained.

Banks will suffer a huge loss due to sluggish credit demand, said Nurul Amin, Meghna Bank managing director.

“Banks could get returns up to 15% from credit, but instead of that they are investing money to the government bond at 5.25% due to lack of credit demand,” he said.

The lending rate is continuously falling over the last two years and stood at 11.51% in August against which the deposit rate was 6.74%.

The spread gap between lending and deposit rate remained at the expected level of below 5% since March due to fall in lending rate.

Source: Dhaka Tribune