TBS

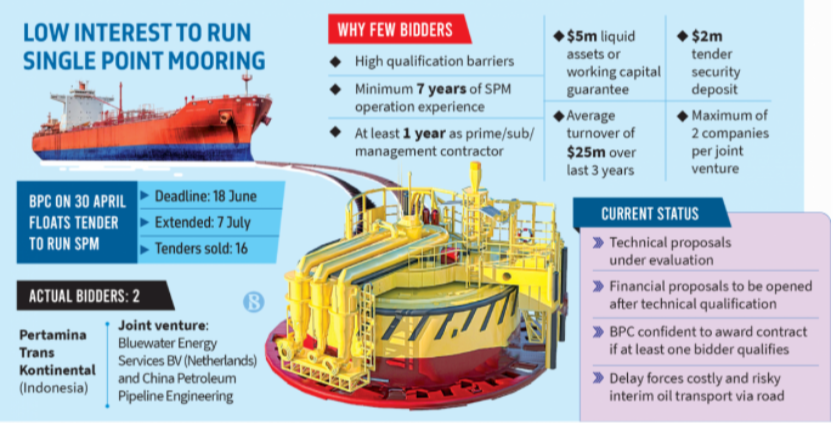

The bid to appoint a contractor for operating and maintaining Bangladesh’s lone Single Point Mooring (SPM) terminal has failed to attract expected interest, with only two companies submitting proposals despite a 19-day extension to the submission deadline.

Officials from the Bangladesh Petroleum Corporation (BPC) said many firms that initially showed interest later withdrew after realising they could not meet the tender’s eligibility requirements – particularly the need for extensive prior experience and high financial thresholds.

The BPC floated the international tender on 30 April, setting 18 June as the original deadline before extending it to 7 July in hopes of attracting more bidders.

However, only Pertamina Trans Kontinental of Indonesia and a joint venture between Bluewater Energy Services BV of the Netherlands and China Petroleum Pipeline Engineering ultimately submitted proposals.

The technical proposals are now being evaluated by ILF Consulting Engineers of Abu Dhabi, the firm that also helped prepare the tender documents. The financial proposals will be opened only after the technical evaluation concludes.

“To attract more bidders, we extended the submission deadline, but still received only two bids,” said Raihan Ahmad, managing director of the Petroleum Transmission Company, which operates the SPM under BPC.

“ILF is now reviewing the technical proposals. If they qualify, we’ll move on to the financial evaluation,” he added.

The SPM system – built on 90 acres in Maheshkhali, Cox’s Bazar – became commercially operational in March 2024. It connects to storage tanks at Kalamarchhara, Matarbari, via a 36-inch pipeline. From there, crude oil is piped 220km to Eastern Refinery in Chattogram through an 18-inch line.

The system is designed to drastically reduce fuel offloading time from 11–12 days to just two days. However, the delay in appointing a long-term operations contractor has forced BPC to continue transporting crude oil using tankers and lorries.

High hopes, low submissions

In total, BPC sold 16 sets of tender documents during the 68-day window between the opening of sales and the submission deadline.

Interest was initially strong, with many international and local companies attending the pre-bid meetings and even touring the offshore buoy and site facilities. But most buyers ultimately refrained from submitting bids.

According to Md Amir Masud, general manager (Planning and Development) at BPC, many of these firms backed out after realising they could not meet the stringent qualification requirements.

“Many companies purchased bid documents but later saw they lacked the necessary experience,” he told The Business Standard. “They knew partial submissions wouldn’t pass technical evaluation, so they chose not to proceed.”

He noted that BPC provided substantial support and information to prospective bidders, including site visits to the SPM terminal and the offshore buoy system, to help them fully understand the scope of work.

“We will proceed if at least one qualifies,” said Masud. “The rules allow us to work with a single eligible bidder, and we believe this process will ensure the system’s smooth operation going forward.”

Who showed interest

The list of companies that purchased bid documents includes global players such as Svitzer Asia (Singapore), JIFMAR Offshore Services (France), AMANIAGA Resources (Malaysia), Omega Marine Solutions FZE (UAE), and JST Group (Thailand).

Multiple Chinese companies also bought the tender, including China Petroleum and Petrochemical Construction and CenerTech Offshore Production Services Company.

Four Bangladeshi companies – Northern Gold Holding Company, Prime Ocean Trade, PEAL Engineering and Construction, and Sterling Multi-Technologies – also acquired the bid papers.

Nigerian firm Ereme Jackson Global Services and India’s Coastal Marine Construction and Engineering were among the others who showed initial interest.

Why the hesitation

BPC’s Masud said the low final participation is due to the tender’s high bar for eligibility. Bidders must demonstrate a minimum of seven years of experience in SPM operations, with at least one year as a prime contractor, subcontractor, or management contractor.

Additional requirements include $5 million in liquid assets or working capital guaranteed by a reputable bank, and a three-year average annual turnover of $25 million. Bidders also needed to provide a $2 million tender security, and joint ventures were limited to a maximum of two companies.

“We used a one-stage, two-envelope system, where both technical and financial proposals had to be submitted together,” Masud added. “There is no bar to awarding the contract to a single bidder under the Public Procurement Rules, as long as they meet all qualifications and their bid is within budget.”

Originally approved in 2015 with a project cost of Tk4,936 crore, the SPM terminal’s final expenditure rose to Tk8,341 crore. The increased cost reflects delays, price escalations, and expanded project scope.

China financed the project through two loans totalling $550.34 million, repayable over 20 years with a 2% annual interest rate and a five-year grace period.