Bring in foreign currency, call it remittance, and skip taxes. Simple? Not quite. But one Bangladeshi businessman managed to pull it off – evading Tk180 crore in taxes in the process.

The amount is staggering. That sum alone could fund the government’s old-age allowances for 30 lakh elderly citizens for an entire month.

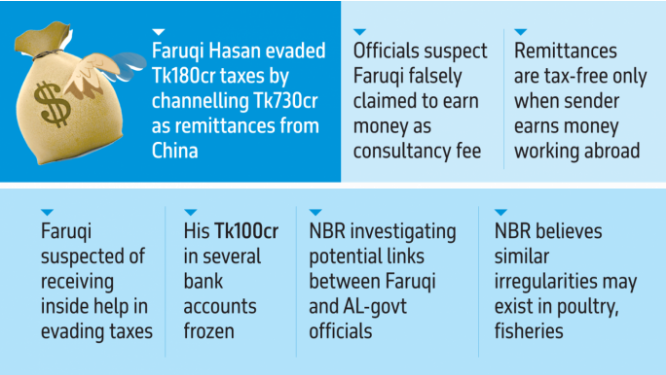

This revelation did not come from a leaked investigation but directly from the National Board of Revenue (NBR) chairman. At a programme on Monday, he disclosed how a businessman channelled Tk730 crore (actually Tk721 crore) into the country, passing it off as personal remittances from China.

The trick? Positioning it as foreign earnings to claim tax exemptions.

But there’s a catch. While remittances are tax-free, they only qualify if the sender earns the money abroad.

The businessman in question was residing in Bangladesh but claimed he earned the funds as consultancy fees from abroad. NBR’s tax intelligence division found he was operating a business locally while millions were transferred under his name.

“This wasn’t possible without inside help,” an NBR official familiar with the probe told The Business Standard, hinting at collusion within tax offices. “It’s a classic case of policy abuse.”

Who is this businessman?

At the centre of the storm is SM Faruqi Hasan, chairman of Protik Group, a conglomerate with interests in ceramics, real estate, food, and energy.

Well-connected and politically active, Faruqi was once vice president of the Awami League’s Dhanmondi Thana unit. The party ruled Bangladesh for over a decade and a half before being ousted on 5 August last year following a student-led uprising.

Faruqi has reportedly fled the country since the fall of Sheikh Hasina, and his phone remains switched off.

According to NBR intelligence officials, the 67-year-old received funds from companies like Norinco International Corporation and China Shipbuilding and Offshore International Company.

Officials said they had never encountered such a tax evasion method before.

Faruqi failed to provide evidence of foreign earnings, violating tax exemption conditions – making him liable for taxes.

Tax experts clarified that consultancy fees are not tax-exempt if brought into the country. Banks typically deduct an initial 10% tax, with additional taxes of up to 25% applicable.

An NBR tax intelligence official, requesting anonymity, told TBS, “We’ve already instructed him to pay 25% tax and his accounts at Southeast Bank, Eastern Bank, and several other banks have been frozen.”

He added, “These frozen accounts hold over Tk100 crore.”

He suspects the money could either be embezzled funds during the previous government’s tenure or proceeds from illegal transactions linked to deals with China.

“There are also suspicions that high-ranking figures from the former government benefited from these funds, with the name of a former prime minister’s adviser surfacing,” he added.

How did officials let this happen?

Over nine years, Faruqi brought Tk721 crore into the country – money that should have attracted Tk180 crore in taxes, none of which was paid.

According to NBR data, in FY22 alone, he brought in Tk269 crore. In the following two years, he transferred Tk77 crore and Tk81 crore, benefiting from remittance exemptions. Over the previous four years, nearly Tk300 crore was transferred.

NBR records show that suspicions arose over his tax filings for FY22 and the previous four years, prompting a review. However, three officials in charge at the time ruled no taxes were applicable.

Faruqi was registered under Dhaka’s Tax Zone-5, where the commissioner at the time was Abu Sayeed Md Mustaque, now an NBR member.

Despite multiple calls and messages, he did not respond.

A former deputy tax commissioner admitted to TBS that nearly Tk300 crore in remittances over four years was granted tax-free status.

“Since the bank didn’t charge tax on foreign remittances, we didn’t either,” he said. “According to the law, if income is earned abroad, it is considered remittance and tax-free—even if the individual resides in Bangladesh.”

He added, “This wasn’t my decision alone; senior officials approved it.”

Former NBR tax policy member Syed Md Aminul Karim told TBS, “This money should have been taxed. Why it wasn’t is unclear.”

A tax official, requesting anonymity, told TBS, “Officials were likely pressured by influential political figures. Those responsible may now face consequences.”

Tax expert Snehasish Barua noted, “Consultancy fees earned abroad while residing in Bangladesh are taxable, except for IT sector earnings.”

What about the banks?

Syed Mahbubur Rahman, managing director of Mutual Trust Bank and former president of Association of Bankers Bangladesh, emphasised the role of banks and officers in approving such transactions.

“Suspicious Transaction Reports (STRs) should have been raised, and Bangladesh Bank should have been informed. How was this money cleared otherwise?” he questioned.

He suspects it was not just a banking oversight but likely an intentional act.

Zahid Hussain, former lead economist at the World Bank’s Dhaka office, speculated that political influence from the ruling party at the time could have played a role.

“A thorough investigation could reveal much more. Those responsible must face legal action,” he said.

Are there more such cases?

The government provides tax exemptions across multiple sectors, including remittances, poultry, fisheries, IT, and exports.

In FY21 alone, over Tk11,000 crore was waived for remittances, while poultry and fisheries received nearly Tk3,000 crore in exemptions.

During a pre-budget discussion in Agargaon on Tuesday, the NBR chairman said, “The government offered reduced tax rates to support the fisheries and poultry sectors, but these benefits have been widely misused.”

Media reports have also surfaced about fraudulent claims where businesses collected export incentives without actually exporting.

Additionally, many political figures reportedly declared fisheries income to exploit tax breaks – funds suspected to be black money.

On Wednesday, in response to media queries, the NBR chairman reiterated, “Tax benefits in poultry and fisheries have been heavily misused,” hinting at a possible reduction in exemptions.

However, Zahid Hussain cautioned,”Considering the reality, withdrawing tax benefits from genuine remitters would be unfair.”