tbsnews.net

Economists for maintaining a minimum of $6 billion per month in imports to function normally

Opening of letter of credit (LC) for imports has plummeted by around 25% in the first seven months of FY23, according to central bank data, amid the government’s belt-tightening to save dollars and the Bangladesh Bank’s scaled-up monitoring of import prices.

LC opening in the July-January period of the current fiscal year was $39.46 billion, down 24.79% or $13 billion from the same period of FY22, according to the Bangladesh Bank data.

However, LC settlement – known as import payments too – in July-January stood at $46.82 billion, up 2.86% compared to FY22, due to global commodity price hikes.

The country’s forex reserve stood at around $44 billion in April 2022. At the end of January 2023, the reserve fell to $32.22 billion.

But in the face of a fast-depleting forex reserve, the government reined in imports in April last year, restricting dollar spending except for the daily essentials.

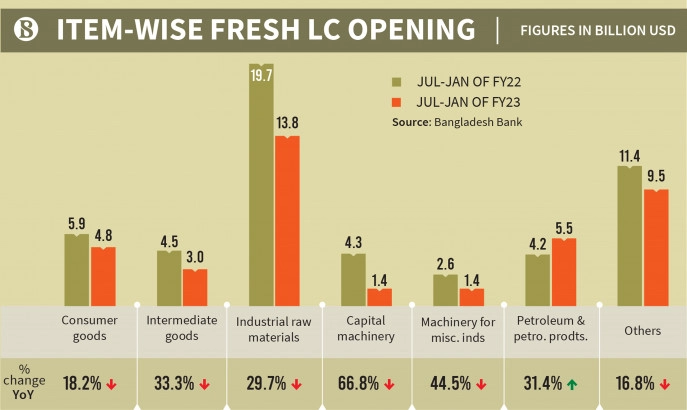

The latest Bangladesh Bank data shows imports of capital machinery, consumer goods, intermediate goods and industrial raw materials except petroleum have fallen substantially in July-January.

LC opening for capital machinery was $1.41 billion in the first seven months of the current fiscal year, down from $4.25 billion during the corresponding period last year.

Besides, imports of consumer and intermediate goods decreased by 18.22% and 33.30% respectively in the seven months of FY23. Imports in these two sectors during the period were $4.7 billion and $3 billion.

By issuing notices at regular frequencies, the central bank started tightening its grip on imports in April last year.

On April 17 last year, the cash margin for LCs was initially widened to 25%, which was expanded in phases to 100% for 27 items. Besides, the central bank asked the banks to notify in advance for LCs worth more than $3 million.

“There are no import curbs for daily essentials. Rather we are providing dollars to facilitate such imports,” a senior central bank official told The Business Standard Tuesday.

He said the Bangladesh Bank has ramped up import monitoring so that dollars are spent for important purposes. “We are verifying the import rates in light of the international market. Besides, applications to import luxury goods are being reviewed strictly.”

According to treasury officials of some public and private banks, the fall in imports is due mostly to the dollar crisis. They also said many businessmen have reduced imports due to the volatile global market.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said there is no alternative to reducing imports to narrow the trade deficit.

“But it [imports] should not be reduced at all. Our country needs to maintain a minimum average of $6 billion in imports per month to function normally.”