MediGreen, a newly registered company, secured Tk900 crore in loan from Islami Bank in October, just a month after getting registered with the Registrar of Joint Stock Companies for setting up a trading business.

A 24-year-old man, Abdullah Al Rakibe, who holds a higher secondary certificate (HSC), is the chairman of the company with a 50% stake in it, according to the approved loan documents, a copy of which has been obtained by The Business Standard.

The company address mentioned in the loan documents and in the RJSC registration papers was found to be fake as TBS did not find any office of the company there.

What is more, the owner of the company could not be traced as the relevant branch could not provide his national ID or any contact number, which conveys a sense that the identity of the owner is false.

A trust receipt is an arrangement where a lender gives a loan to a borrower on trust and on the promise that the loan amount will be repaid upon the sale of the goods.

Interestingly, MediGreen’s is not the only case where Islami Bank has appeared very generous in approving a loan.

Each of the three companies which have secured Tk2,700 crore in loans from Islami Bank has used fake office addresses, which clearly demonstrates that these are shell companies and the real beneficiaries of these loans are anonymous, and the loans were given for the same purposes.

This is how Islami Bank, the largest private commercial bank in the country that saw transfer of ownership in 2017 through some lesser-known companies, has been approving loans against dubious borrowers, putting depositors’ money at risk.

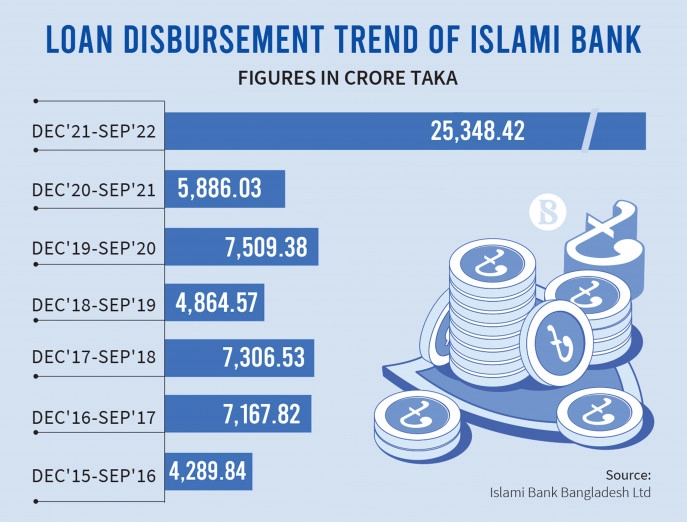

The bank posted a historic high loan growth of 21.36% in the first nine months of the current year when the industry’s average private sector credit growth was 9%.

The bank disbursed Tk25,348 crore in loans in the January-September period this year, which is 53% of its total loans disbursed in the past five years until 2021, according to the financial statement of the bank.

The size of the total loan book stood at Tk1.43 lakh crore in September this year, which was Tk71,000 in 2017 when the bank was taken over by another group.

The bank had a huge deposit base of Tk1.75 lakh crore at the end of September this year.

The cases of MediGreen

MediGreen got registered with the RJSC on 11 September this year and 14 days later it applied to the Nawabpur Road Branch of Islami Bank for a loan of Tk1,000 crore.

The bank approved Tk900 crore in loan on 24 October without even taking a collateral.

The condition of the loan was that the security of the loan will be built up in the subsequent six months through a deposit of Tk180 crore with the respective branch. Moreover, the bank gave the loan without taking a Document Verification Code (DVC) and credit rating report.

The Document Verification Code is a numerical unique number/ code auto-generated by the document verification system (DVS) of Chartered Accountants of Bangladesh (ICAB), which is used to verify the data and originality of a company.

The bank gave the borrower time until December to provide the verification code and the credit rating report.

According to banking rules, a bank must provide a loan on the basis of a credit rating report.

Even though the company secured a big loan, it has no website to trace its existence.

According to the RJSC and loan documents, the company address is House:9, Road:23, B-Block, Banani, Dhaka. The TBS visited the place but did not find any existence of a MediGreen office. Moreover, the building is completely residential. A signboard states that no office space is in the building.

Nur Alam, the security guard of the building, told TBS that there is no company named MediGreen there and that he did not know anybody named Abdullah Al Rakibe.

SS Straight Line

Another company, S.S Straight Line, obtained registration on 3 August from RJSC and applied to the VIP Road branch of Islami Bank for a loan on 23 August.

The bank approved a loan of Tk900 crore on 18 September without collateral, as the loan documents show.

The borrower also was given time until December to provide the Document Verification Code and credit rating report.

A 37-year-old man, Samiul Alim, with a higher secondary school background is the chairman of the company.

When asked about the borrower, the manager of the VIP Road branch of Islami Bank told TBS that the bank could not talk about the issue.

The loan was approved by the head office, he said, and suggested that the head office be contacted in this regard.

Marts Business

The company was registered on 11 September and applied to the Farmgate branch of Islami Bank on 28 September for a loan of Tk900 crore.

The bank approved the loan on 24 October without taking collateral, according to the loan documents.

A 30-year-old man named Abdullah Shaikh is the managing director of the company, with a 50% share in it.

Asked about the matter, the branch manager said that he was not well aware about the borrower.

He said the loan was approved by the head office and suggested that the reporter get in touch with the head office.