TBS

High duties, subdued demand drive down car imports, denting govt revenue

The government’s decision to impose restrictions on the import of luxury goods, including cars, since early 2022 to stabilise foreign currency reserves has been a major contributing factor

Highlights:

- Reconditioned car imports dropped amid sluggish economy and high duties

- Government revenue from imports fell over 6% in FY25

- Sales halved; dealers cite low demand and economic pressure

- Import restrictions and tax hikes raised vehicle import costs

- Rising Japanese prices make sourcing affordable cars difficult

- Importers urge easing rules, allowing older reconditioned cars

The country’s reconditioned car market is facing significant challenges as imports declined amid a sluggish economy, resulting in a drop in government revenue during the 2024–25 fiscal year. The downturn is attributed to a combination of factors, including higher duties, subdued consumer demand, a prolonged dollar crisis, and import restrictions.

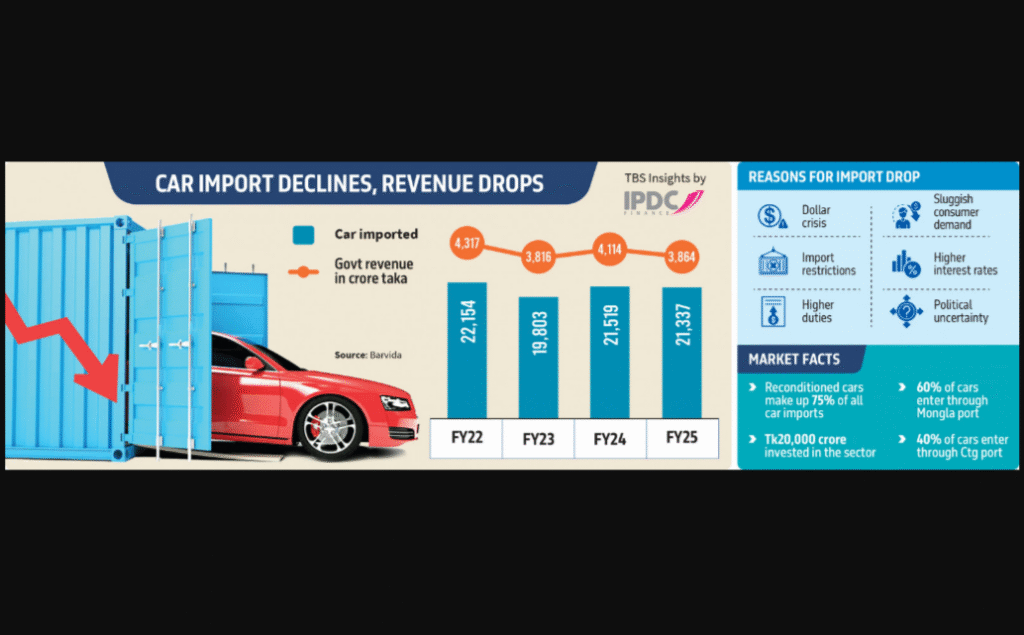

According to the Bangladesh Reconditioned Vehicles Importers and Dealers Association (Barvida), 21,337 reconditioned cars were imported in FY25, a slight decrease from the 21,519 imported in the previous year. However, the revenue generated from these imports saw a more substantial drop of over 6%, falling to Tk3,864 crore, a reduction of Tk453 crore compared to FY22.

Industry insiders note that these challenges have had a direct impact on sales. Masud Alam, proprietor of Car Market in Chattogram, told TBS, “Earlier, showrooms would sell 15-20 cars per month on average; now that number has dropped by half.”

The government’s decision to impose restrictions on the import of luxury goods, including cars, since early 2022 to stabilise foreign currency reserves has been a major contributing factor. These measures, combined with rising taxes and advance income tax (AIT), have made vehicle imports more expensive. The latest budget saw AIT on car imports increase from 5% to 7.5%.

Abdul Haque, president of Barvida, highlighted the dual pressure on the sector, saying, “The rising cost of importing vehicles, along with a higher booking rate in Japan – the main source of reconditioned cars – has made it harder for importers to sustain their business. Meanwhile, domestic buyers are also holding back due to the economic slowdown.”

Data from Japan indicates a surge in demand for used vehicles less than five years old, which has driven up prices and made it more difficult for Bangladeshi importers to source affordable stock.

“Rising import costs and higher booking rates in Japan are squeezing importers, while local buyers hold back amid the economic slowdown.”

Historical import data over the past four fiscal years shows fluctuations, with 22,154 cars imported in FY22 generating Tk4,317 crore, 19,803 in FY23 generating Tk3,816 crore, 21,519 in FY24 generating Tk4,114 crore, and 21,337 in FY25 generating Tk3,864 crore.

The reconditioned car sector is a significant part of the country’s economy, with investments estimated at around Tk20,000 crore. Reconditioned vehicles make up approximately 75% of the total cars imported into Bangladesh, with the remaining 25% being brand-new. Currently, 60% of these imports arrive through Mongla Port, and Chattogram Port handles the remaining 40%.

Habibullah Don, a former president of Barvida, warned that a recovery could be slow. “The automobile business has faced severe disruptions from the dollar crisis, LC complications, and rising costs. It will take time for the market to stabilize,” he explained.

Dealers also cite challenges in securing bank loans, political uncertainty, and increased interest rates as additional hurdles. They note that even when loans are available, the higher interest rates are deterring potential buyers.

To revitalise the sector, importers are calling on the government to ease restrictions and permit the import of reconditioned vehicles up to seven years old. They believe this policy change could help lower costs and increase the availability of cars.