Highlights:

- General inflation has remained above 9% for the past two years, since March 2023

- Winter vegetables helped cool down food inflation

- However, non-food inflation shows a slight upward trend

- For the past three years, since February 2022, wage growth has failed to keep pace with inflation

- Even wage growth for low-paid labourers slowed to 8.12% in Feb 2025 from the previous month’s 8.16%

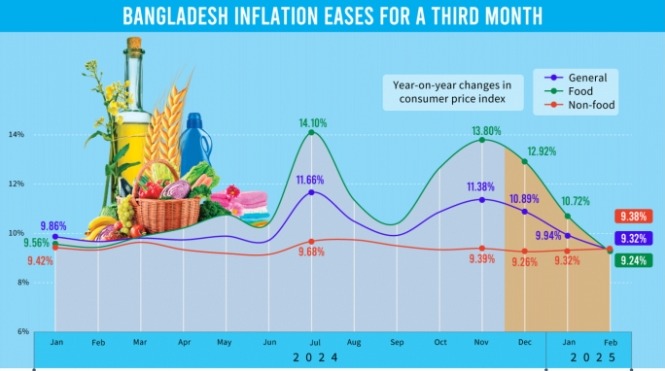

Inflation in Bangladesh continued its downward trend in February, reaching 9.32%, down from 9.94% in January, according to the latest data from the Bangladesh Bureau of Statistics (BBS) released today (6 March).

The general point-to-point inflation at the national level was 9.67% in February last year.

This is the second time in five months that inflation has fallen to a single-digit level. The last time inflation was below 10% was in September 2024, when it stood at 9.92%. With February’s decline, overall inflation has hit a 22-month low.

The figure for general inflation stood at 12.92% in December and 13.8% in November.

Food inflation in February cooled down to single digits after 10 months, coming down to 9.24% compared to 10.72% in the previous month – a decline by 2.2 percentage points. From April 2024 to January this year, the country grappled with persistent double-digit food inflation.

Non-food inflation, however, stood at 9.38% in February, slightly higher than 9.32% in January.

Economists have attributed the decline in inflation to seasonal factors and monetary policies, but concerns remain about sustainability.

Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), told The Business Standard that the overall inflation rate and food inflation are consistently decreasing, which is a positive trend.

“The reduction in inflation can be attributed to monetary policy and the supply of winter vegetables. However, non-food inflation has not decreased and has, in fact, increased,” she said.

“The reason for this is that non-food inflation is largely energy-driven,” she said, adding that fuel prices have not been reduced in Bangladesh, and costs in housing, transportation, and utilities have risen.

However, the economist believes that it is too early to say whether the downward trend in inflation will be sustainable.

She stated that even though inflation has decreased, low-income or common people are not feeling relieved.

“People are still lining up at OMS [Open Market Sale] shops or trucks. Therefore, it remains to be seen how inflation rates appear in the upcoming months of March and April. If inflation decreases, then this trend can be considered sustainable,” she said.

However, Fahmida said she believes that the government’s target for inflation by the end of the fiscal year will not be achieved.

South Asian Network on Economic Modelling (Sanem) Executive Director Selim Raihan told TBS that food inflation has come down due to the fall in prices of seasonal products, driven by an increase in supply.

“Monetary policy does not seem to have played a special role in bringing down inflation. The prices of major commodities, especially rice, pulses, fish, meat, and edible oil, are still high. As a result, there is concern about whether the trend of falling inflation will be sustainable,” he said.

“If the supply of goods cannot be maintained, there is a fear of rising inflation in the coming days,” he notes.

The economist said in addition to ensuring the supply of goods, monetary policy must be coordinated with fiscal policy. “Which is not happening.”

Earlier on 4 February, Finance Adviser Salehuddin Ahmed said it would take another two to three months for inflation to decrease as government measures take effect.

Acknowledging that high inflation is causing difficulties, he said several initiatives have already been implemented to address the issue.

The adviser also stated that further steps would be taken to stabilise the prices of essential commodities during Ramadan.

The government expects these measures to help bring average inflation down to 6%–7% by June.

According to data from the Bangladesh Bureau of Statistics (BBS), monthly overall inflation has remained above 9% for over two and a half years.