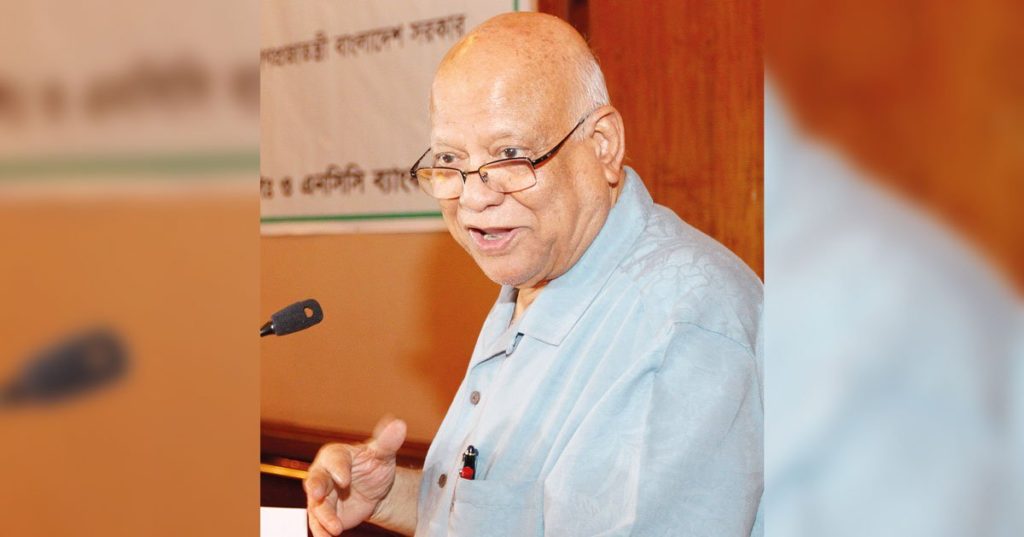

A letter signed by Finance Minister AMA Muhith recently, was sent to BSEC to consider extending the duration to 10 years of the mutual funds which will mature by 2023

The Ministry of Finance has recommended that the Bangladesh Securities and Exchange Commission (BSEC) extend the tenure of closed-end mutual funds by 10 years. That is, those which mature by December 2023.

A letter signed by Finance Minister AMA Muhith recently, was sent to BSEC to consider extending the duration to 10 years of the mutual funds which will mature by 2023.

Earlier on June 18, the finance minister sent a non-formal letter to the commission asking it to take necessary measures to extend the time limit of mutual funds, which played a vital role in stabilizing the capital market after the 2011 market crash.

BSEC later replied to the finance minister’s letter stating a number of issues with regard to executing the proposal.

The commission said in the letter, 10 mutual funds were converted to open-end mutual funds and four winded up under a notification, issued in January 24, 2010, that limits the tenure of closed-end mutual funds to 10 years and Grameen One: Scheme Two was abolished by order of the appellate division of the Supreme Court.

On August 6, a letter signed by Finance Ministry Senior Secretary, now retired, Md Eunusur Rahman said: A secret report has come in hand from a special organization on May 31, on how to overcome the latest situation going on in the Capital markets.”

The report pointed out that extending the period of mutual funds was effective in stabilizing the market after the stock market crash back in 2011.

In such case, the finance, law ministries, and responsible parties, should play a positive role. If necessary, the policy must be changed by issuing a statement.

According to the note from the BSEC chairman, from 2018-2028, 36 existing closed-end mutual funds valued at TK5302.38 crores, should be dissolved . The note also mentioned that increasing the duration is against the terms of the trust document.

To make the capital market stable, a number of initiatives were taken, including administrative reforms, but at the start of 2018, the DSE lost 1000 points. In the same way, trading has gone down, as well as the market price of shares.

This is causing investors to lose their savings. Investors are losing interest in investing in the market and if the market decline continues, more investors will lose interest in the stock market.

The termination of termed mutual funds can be harmful to investors. If it happens, there is no assurance that small investors will get the right price for their investments.

When term funds which hold huge amounts of money valuation are terminated, there will be a high possibility that the index will see a downfall in the capital market.

As a result, not only will small investors bear losses for investing in the funds, but this will also affect their overall portfolio.

Points suggested to stabilize the market

To stabilize the abnormal rise and fall in index points of the capital market, increasing fund durations will have a positive impact on the market which will stabilize the stock market as well.

Though there in no market maker to stabilize the stock market, the mutual fund association can play the role of market maker, which in turn will secure the portfolios of small investors in the stock market.

So, the BSEC has been requested to extend the duration of the mutual funds ten more years for those ending in December 2023.

Source: Dhaka Tribune.