A key role of central banks is to conduct monetary policy to achieve price stability and help attain targeted economic growth.

But central banks in many countries are currently struggling to fight against runaway inflation caused by global supply chain disruptions stemming from the Russia-Ukraine war and the coronavirus pandemic.

The Bangladesh Bank, the central bank of Bangladesh, is also finding it hard to rein in the soaring inflation as it is set to draw up its monetary policy for the next fiscal year, beginning from July 1.

The latest inflation data, for May, released by the Bangladesh Bureau of Statistics on Monday has intensified further pressure on the central bank as it plans to unveil the monetary policy for FY2022-23 this month.

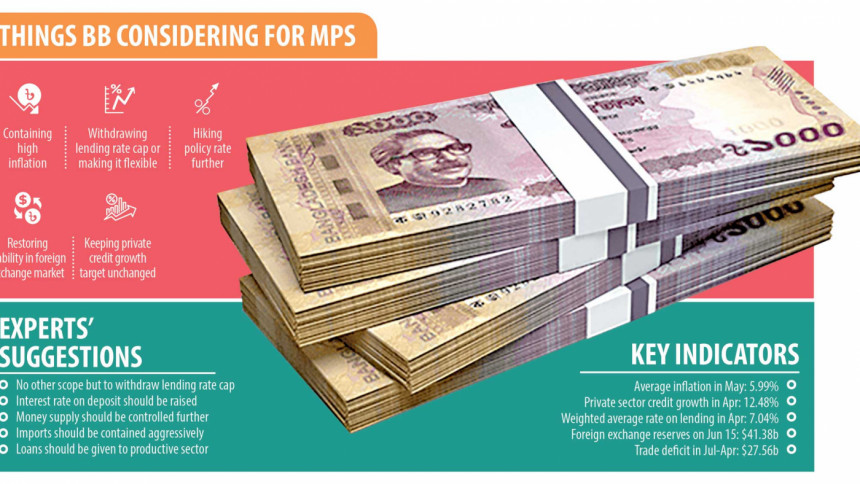

Point-to-point inflation surged to an eight-year high of 7.42 per cent in May, driven by a hike in food costs, exacerbated by global commodities price leaps, the depreciation of the local currency and supply bottlenecks.

The average inflation rate stood at 5.99 per cent during the July-May period, data from the BBS showed, against the revised target of 5.7 per cent set for the outgoing fiscal year, ending on June 30.

Central banks usually hike their key interest rate, also known as the repurchase agreement (repo) in Bangladesh, so as to contain price pressures since the move reduces the money supply.

The Federal Reserve, the central bank of the United States, last week approved its biggest interest rate increase since 1994 to tackle an inflation that is running at a four-decade high.

The key interest rate is followed by commercial banks to set the interest rates on both loans and deposits. Banks also take short-term loans from the central bank on the basis of the rate.

But the situation is quite different in Bangladesh as the central bank has been maintaining a 9-per cent cap on lending since April 2020, meaning borrowing from banks is cheaper if the inflation rate is considered.

Amid a sharp increase in price pressures, the central bank raised its key interest rate for the first time in a decade on May 29 in order to contain inflation as it raised the repo rate by 25 basis points to 5 per cent.

Although banks now feel discouraged to disburse loans to borrowers due to the increase in the key interest rate, the measure has hardly had any impact on reducing the demand for funds.

What is more, the upward trend of inflation may continue in the coming months as the exchange rate of the taka against the US dollar is trending lower due to the shortage of the American greenback amid an abnormal hike in import payments.

Still, the government has set an average inflation target of 5.6 per cent for FY23 although it has failed to hit the goals, set at similar ranges, in the last three fiscal years, including the outgoing FY22.

Inflationary pressures will also worsen due to the recent floods.

BB officials, who are working to formulate the monetary policy statement, admit that the central bank has been left with one single tool – withdrawing the lending rate cap – to fight against inflation.

Although the BB is the authority to lift the cap, it can’t do so in a true sense: it had to impose the ceiling in line with the government’s instruction.

The BB may go for a withdrawal of the cap or make it more flexible such that funds will become costlier.

“We are now discussing to this end. We hope that a positive decision will be declared while unveiling the next monetary policy,” said an official.

The key interest rate might be hiked once again if the lending rate is finally lifted, he said.

Ensuring stability in the foreign exchange market is another priority for the central bank’s monetary policy.

The foreign exchange reserves stood at $41.38 billion as of June 15 in contrast to $46.15 billion on December 31.

The soaring import payments have contributed to the instability in the foreign exchange market.

Between July and April, imports went up by 41 per cent to $68.66 billion, while exports grew by 35 per cent to $41 billion. This resulted in a record trade deficit of $27.56 billion, up 53 per cent year-on-year.

Withdrawing the lending cap will also help bring back discipline to the foreign exchange market as the cost of import financing will go up.

The BB official says it will keep unchanged the private sector credit growth for the next fiscal year to disburse funds to the productive sector smoothly.

Riding on the economic recovery, private sector credit growth improved to 12.48 per cent in April, against the full fiscal year’s goal of 14.8 per cent.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said that the central bank had already sold a huge amount of dollars in exchange for the taka to keep the market stable.

“This has reduced the money supply, but we have to protect our foreign exchange reserves. And it is not expected that dollars are injected to squeeze the money supply.”

The central bank has supplied more than $7 billion into market this fiscal year.

Depositors will also feel encouraged in keeping their funds with banks if the cap is withdrawn.

As per a central bank instruction, banks can’t offer an interest rate to fixed depositors that is below the average inflation figure.

But it will be harmful for banks as they have to give out loans at 9 per cent, Mansur said. “There will rarely be any margin for banks if the lending cap is not scrapped.”

Rizwanul Islam, a former special adviser for the employment sector at the International Labour Office in Geneva, thinks standard monetary policy would not be the appropriate instrument for fighting this inflation.

“It would be necessary to address the supply side of the issue and see where the problems are and address them accordingly. While that is done, it would be important to find instruments to provide protection to those who are being affected more by this inflation.”

Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, said that the upcoming monetary policy should take adequate measures to protect the private sector as the government has set a large borrowing target from the banking sources.

Shah Md Ahsan Habib, a professor of the Bangladesh Institute of Bank Management, urged the central bank to focus on curbing inflation and think of making the lending rate cap flexible.

The increase in the repo rate is weightless when the lending rate is capped, said Zahid Hussain, a former lead economist of the World Bank’s Dhaka office.

“The latter is the policy rate for all practical purposes. It needs significant upward adjustment, if not removal.”