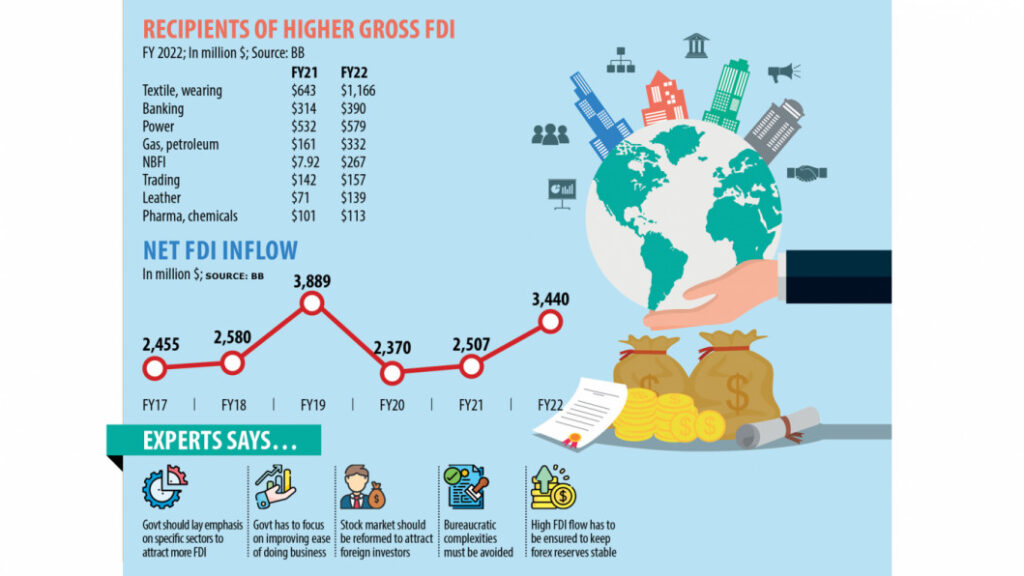

Net foreign direct investment to Bangladesh rose 37 per cent year-on-year to $3.43 billion in the last fiscal year, a positive development for the economy amidst the ongoing foreign exchange volatility.

The country is suffering from the deterioration of the foreign exchange reserves, caused by higher import bills and lower-than-expected export and remittance receipts.

Net FDI inflows are the value of inward direct investments made by non-resident investors, including reinvested earnings and intra-company loans. This excludes the amount that goes out of a country through the repatriation of capital and repayment of loans.

Fresh investment, or equity capital, surged 65 per cent year-on-year to $1.35 billion in the financial year that ended on June 30, data from the Bangladesh Bank showed.

The injection of equity capital is considered the most important component of FDI inflow as it usually gives an indication that foreign investors have set up new plants or expanded their existing ones.

“The net inflow of FDI along with the rise in equity capital is certainly a positive indicator for the economy,” said Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue (CPD).

He thinks that investment might have been on the rise in the economic zones, pushing up the FDI flow as a whole.

At least 29 industrial units have begun their production in some of the country’s economic zones, and another 61 units are scheduled to go into production. The investors have come from the countries such as Japan, China, India, Australia, the Netherlands, the US, the UK, Germany, Singapore, South Korea and Norway.

The government plans to establish about 100 economic zones across the country.

“We should keep up the flow of FDI in the interest of the economy. If the upward trend continues this financial year, the foreign exchange reserves will receive a major boost,” Rahman said.

The reinvestment of earnings, which shows the foreign investors’ desire to expand their business using the proceeds from the existing operations, stood at $2.04 billion, up 29 per cent a year prior.

Intra-company loans, however, dipped to $48 million in FY22 in contrast to $105 million in FY21.

CPD’s Rahman says that the red tape is still a major barrier to drawing the desired level of FDI.

“The policymakers should improve the ease of doing business as it plays a pivotal role in attracting foreign businesses.”

A central banker says it might be difficult for Bangladesh to maintain an upward trend of the FDI flow in the ongoing fiscal year owing to the ongoing volatility in the foreign exchange regime.

Foreign exchange reserves stood at $35.85 billion on Wednesday, down 23 per cent from a year ago.

Foreign businesses usually look at the strength of a country’s foreign exchange reserves before deciding on an investment.

“Both the government and the central bank should give efforts to fortify the reserves,” said the BB official.

Monzur Hossain, research director of the Bangladesh Institute of Development Studies, says that there is no scope for complacency following the higher FDI flow.

“We do not have any specific sector where foreign businesses can feel comfortable while investing. Businesses usually invest in this country on an ad hoc basis,” he said.

“So, Bangladesh has a long way to go to make the FDI environment vibrant.”

The weak financial sector is a challenge to the country’s FDI hope. The sector is facing corruption and nepotism.

“This discourages investors from making the country their investment hub,” Hossain said.

The economist feels that the tax regime should be reformed as well.

Another barrier comes from the stock market and investors hardly raise any funds from the bourses.

“If we can’t address these issues, there will be no scope to draw a higher level of FDI in the coming years,” he said.

The textile sector was the biggest gross FDI recipient, netting $1.16 billion in the last fiscal year, an increase of 81 per cent year-on-year.

The power sector received $579 million from $532 million earlier while non-bank financial institutions secured $7.92 million compared to $267 million a year ago.