The government is expecting the shrinking foreign currency reserves will buck the trend and hit $37.7 billion by June thanks to lower imports and budget support from development partners.

As of January 25, foreign currency reserves stood at $32.3 billion, down 28.5 percent from a year earlier, according to data from the Bangladesh Bank.

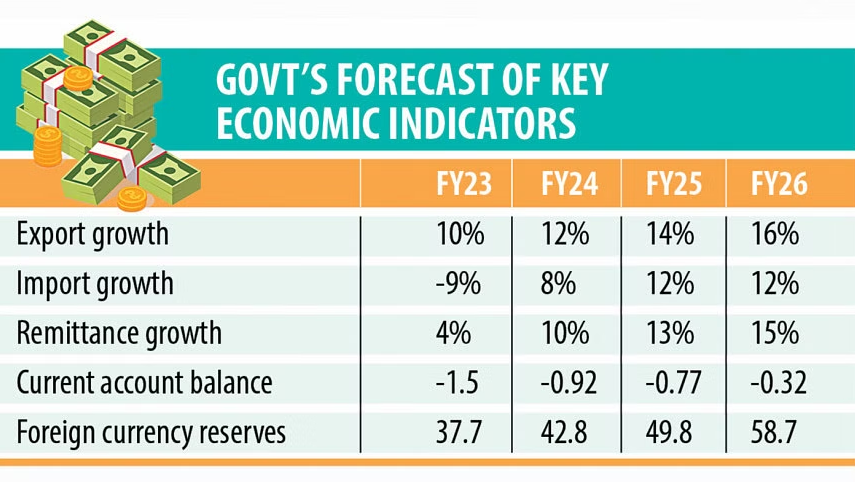

The higher reserves will be courtesy of a 9 percent decline in imports, a 10 percent export growth and a 4 percent increase in remittance inflows, according to the finance ministry’s projections, which were presented at the meeting of the fiscal co-ordination council last month.

As a result, the current account deficit — which is the shortfall between the money received by selling products to other countries and the money spent to buy goods and services from other nations — would be 1.5 percent of GDP.

The estimates are lower than the projections used to draft the budget for this fiscal year.

When the budget was drafted, the finance division was banking on a 20 percent export growth and a 16 percent remittance growth, which would offset the 12 percent increase in imports. Subsequently, foreign reserves would soar to $45.3 billion.

Although the export growth last fiscal year was more than 36 percent, the percentage increase in export receipts would be comparatively lower this fiscal year because of the global economic situation, the elevated inflation levels around the world and a recession in the EU and the US, the main shipment destinations, the finance division said while making its new projections.

The government has taken several steps to bring down imports given the pressure on foreign exchange reserves and a widening current account deficit. As a result, imports will drop substantially.

The continuation of the 2.5 percent cash incentive for sending remittance through the official channel, lowering the cost of sending remittance and an uptick in fresh migrant workers will ensure positive remittance growth.

Besides, substantial budget support is expected from development partners such as the International Monetary Fund.

Subsequently, there will be an improvement in the foreign currency reserves and current account deficit situation, the finance division added.

Economists though deem the forecasts to be too good to be true.

“This is unrealistic,” said Zahid Hussain, a former lead economist of the World Bank’s Dhaka office.

If the reserves have to increase to that extent, the balance of payment (BoP) must be in surplus: the surplus in the financial account must overcome the deficit in the current account.

“But both are in deficit at the moment. So how the overall BoP will turn surplus is not clear.”

The financial account shows the net acquisition and disposal of financial assets and liabilities.

The amount of budget support being expected is not realistic, Hussain said, adding that at best $1.5 billion can come in.

“That would not turn the financial account into surplus.”

The finance division is expecting more than $2 billion in budget support, according to officials who were involved in making the projections.

Besides, there is no policy action on the government’s part to boost the reserves, he said.

“What might happen is that the current account deficit will narrow. The unrealistic part is that the financial account surplus will overcome the current account deficit,” Hussain added.

In the first five months of the fiscal year, the current account was $5.7 billion in the deficit, according to data from the BB.

The statistic so far from this fiscal year does indicate that the current account deficit may contract later on.

In the first six months of the fiscal year, the export growth was 10.58 percent and the remittance growth 1.66 percent.

The import growth in the first five months of fiscal 2022-23 was 4.41 percent.

“It is highly optimistic to assume that the reserves will increase,” said Mustafizur Rahman, distinguished fellow at the Centre for Policy Dialogue.

He went on to predict that the reserves will be hovering around the $32 billion mark by the end of the fiscal year.

“The major issue in the government’s forecasts is the import curtail. A 9 percent drop in imports is too much — it will have a major effect on the economy.”