The balance of payment surplus in the first half of the fiscal has crossed all the previous marks, setting an all-time record.

Analysts, however, are not pleased with it. They say it’s ‘not a good sign’ for the economy.

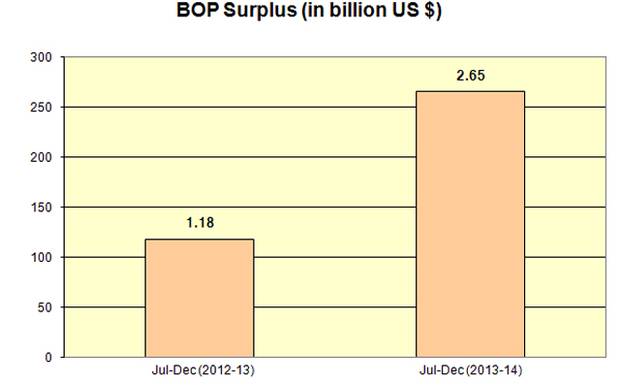

Bangladesh Bank figures say balance of payment (BOP) surplus in the Jul-Dec period of the 2013-14 fiscal stood at $ 2.65 billion, about two and half times more than the same period of the previous fiscal.

BOP surplus was at $ 1.18 billion in the first half of the 2012-13 fiscal while it was at $ 2.52 billion during the entire 12 months.

Former central bank governor Mohammed Farashuddin, however, says the economy will suffer due to this.

“Usually huge BOP surplus is considered as a good thing. It indicates the economy is getting stronger. It has further augmented due to the high forex reserve,” he said on Saturday while speaking to bdnews24.com.

According to the former bureaucrat, the case for Bangladesh is different. He says it’s not yielding any good for the economy.

“Our economy is mainly driven by imports. And it’s not keeping up with the way exports are going up.”

Forex reserve is spilling up due to this trend, which may lead to inflation and may also cause the US dollar to fall, hurting export incomes and remittance inflows, said Farashuddin.

The Bangladesh Bank should now focus to attract imports which will spur investment and should put money on infrastructure developments to attract local and foreign investments.

Economist Zaid Bakht agreed with the former central bank chief.

According to him, economic activities especially, investments have been stagnant for quite some time due to the instability over the national elections leading to a fall in imports.

“It seems for the time being the political situation is congenial. If this prevails then imports will rise in the fiscal’s remaining six months. The BOP surplus may not be then this high,” said Bakht, who is with the Bangladesh Institute of Development Studies (BIDS).

The budget’s targeted 7.2 percent economic growth for 2013-14 fiscal cannot be achieved if investments do not rise, according to the BIDS Research Director.

The current account balance reflects whether the country has a deficit or surplus. A surplus in the balance means the country can continue its regular transition without being a debtor. In case of a deficit in the balance, the government needs to take loan to meet the shortfall.

BOP surplus in 2012-13 FY was at $ 2.52 billion, however, the previous one had a deficit of $447 million.

Export earnings has increased despite all the odds, posting a 16.56 percent growth in the six months until Dec, 2013, said Bakht noting that remittance inflow has also picked up the pace since Jan, 2014.

“And that’s why I’m saying, the huge BOP surplus is not bringing any good for the economy. If it was against the backdrop of a regular import scenario, then it could have been good,” he added.

Forex reserves stood at $ 18.1 billion as of Thursday (Feb 6), according to Bangladesh Bank statistics.

Meanwhile, imports dropped by 0.11 percent in Jul-Dec of 2013-14 FY compared to the same period of the previous fiscal.

Asked the reason behind the rise of capital machinery imports, Bakht said: “I’ve been saying for quite some time that money laundering is happening through this. I have requested the central bank to intensify monitoring on this.”

Letter-of-Credit (LC) opening for capital machinery imports rose by 67.23 percent in the six months of the current fiscal while LC settlements rose by 16.60 percent.

Source: bdnews24