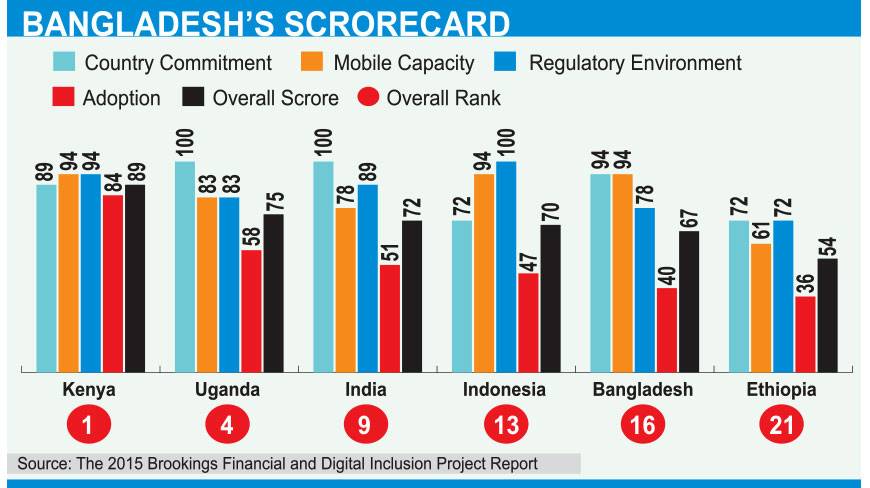

Bangladesh has been ranked 16th of 21 countries on its financial and digital inclusion efforts, according to the 2015 Brookings Financial and Digital Inclusion Project (FDIP) report.

The Brookings Institution is a nonprofit public policy organisation based in Washington, DC.

Kenya has ranked one, followed by South Africa and Brazil. Ethiopia came last on the list.

The 2015 FDIP report evaluates and ranks countries based on four dimensions of financial inclusion – the country’s commitment to increasing financial inclusion, its mobile capacity, the regulatory environment and adoption of traditional and digital financial services.

The 21 countries selected are Afghanistan, Bangladesh, Brazil, Chile, Colombia, Ethiopia, India, Indonesia, Kenya, Malawi, Mexico, Nigeria, Pakistan, Peru, the Philippines, Rwanda, South Africa, Tanzania, Turkey, Uganda, and Zambia. The rationale for selecting these countries was that all of them have made recent commitments to financial inclusion, all reflecting political, economic, and geographic diversity.

Bangladesh’s overall score was 67%. It scored 94% on its commitment to financial inclusion. This score is based on the country’s digital financial service commitments, its financial inclusion strategy, quantified targets, a dedicated financial inclusion body and surveys which measure financial inclusion.

On mobile capacity, which is based on unique mobile subscribership, 3G mobile network coverage, mobile money deployments, domestic transfers through mobiles, bill payment facilities, it scored 94%.

On regulatory environment that facilitates competition by allowing non-banks to provide financial services, encouraging providers to improve interoperability, and limiting agent exclusivity through regulation helps foster the emergence, it scored 78%.

On adoption of innovative and affordable services, it scored 40%.

While Bangladesh has demonstrated its commitment to providing access to qualify financial services for the under-resourced through a responsive regulatory environment and emphasis on digital financial services, further works remain, said the report.

It said an early leader in mobile financial services (MFS), bKash, provides a useful snapshot of mobile money emergence and operation.

Bkash approach was a valuable since unlike many mobile companies, bKash is not a mobile network operator and therefore did not have a pre-existing customer base.

Greg Chen who works for CGAP (Consultative Group to Assist the Poor) and Stephen Rasmussen who heads CGAP’s Technology and Business Model Innovation Team stated that Bkash’s success is mainly due to three reasons: its identity as a specialised organisation built to deliver mobile financial services, its shared vision for scale among a diverse group and an enabling and flexible regulatory environment.

“The drafting of a national financial inclusion strategy under a committee led by Bangladesh Bank governor was underway as of April 2015. Completion of this strategy as well as the undertaking of another national-demand-side financial services survey could help Bangladesh better identify and advance specific financial inclusion targets,” said the report.

Source: Dhaka Tribune