Bangladesh’s annual foreign debt repayment crossed $4 billion for the first time in the just-concluded fiscal year, amid growing pressure from maturing mega project loans and tighter grace periods on budget support borrowing.

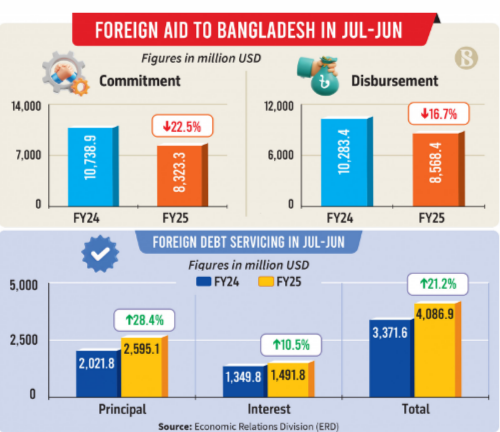

According to a report released by the Economic Relations Division (ERD) today (27 July), the country repaid $4.087 billion in principal and interest to development partners in FY25, marking the highest annual repayment on record. This represents a 21.2% increase from $3.37 billion paid in the previous fiscal year.

Breakdown of the data shows principal repayments rose 28.8% year-on-year, amounting to $2.595 billion compared to $2.02 billion the year before. Interest payments also rose by 10.5%, reaching $1.491 billion, up from $1.349 billion in FY24.

ERD officials said the rise in debt servicing was due to the expiration of grace periods on large loans for infrastructure projects and budgetary support, taken over the past decade.

They warned that repayment pressure is expected to intensify further as grace periods for several more loans – including the Rooppur nuclear power plant – are set to expire within the next one to two years.

Economists echoed the concern, saying the country’s foreign borrowing has grown rapidly in recent years.

M Masrur Reaz, chairman of Policy Exchange Bangladesh, said, “From FY2016-17, debt management came under significant strain as the government took on numerous large projects, some unnecessary and poorly planned.”

He said many of the loans lacked proper feasibility studies, had inflated budgets, or yielded limited economic return. “Because of weak revenue mobilisation, Bangladesh relied on foreign loans. As a result, our external debt has doubled in just seven years. Both the pace and nature of this growth are worrying.”

The economist noted a sharp rise in hard-term loans, characterised by higher interest rates, shorter grace periods, and compressed repayment schedules.

“After the Covid-19 shock and amid the Russia-Ukraine war, we also had to take multiple budget support loans to stabilise our balance of payments. Some of these came with very short grace and repayment windows, and now the bills are coming due,” he added.

He warned that the debt servicing burden is putting Bangladesh’s fiscal discipline and budget space under pressure, adding that the country must now reframe its fiscal strategy to align borrowing with repayment capacity.

Loan disbursements, commitments decline

While repayments surged, both fresh commitments and disbursements of foreign loans declined during the year.

Bangladesh signed new loan agreements worth $8.323 billion with development partners in FY25, down from $10.739 billion the previous year, according to ERD data.

Disbursements also fell to $8.568 billion from $10.283 billion.

ERD officials said the slowdown was due to uncertainty following the transition to an interim government and resulting instability across several administrative sectors.

“In some cases, foreign contractors have pulled out, disrupting implementation of development projects,” said one official. “This has slowed disbursements.”

They added that the interim government, as part of its medium-term debt strategy, reduced borrowing for development projects. However, it received a record $3.4 billion in budget support from various development partners to manage the ongoing economic crisis.

Top lenders and commitments

The World Bank topped the list of foreign loan commitments in FY25, pledging $2.84 billion, including $1 billion in budget support. The Asian Development Bank followed with $2 billion, including $1.5 billion in budgetary support. Japan committed $1.89 billion, while the Asian Infrastructure Investment Bank pledged $561 million.

ADB also led disbursements, releasing $2.52 billion, followed by the World Bank with $2.012 billion. Other major disbursing partners included Japan ($1.58 billion), Russia ($675 million), AIIB ($527 million), China ($415 million), and India ($185 million).