The Bangladesh consumer has probably never had it so good. Remittances provide a source of income for many families and the government’s decision to raise the tax threshold for individuals to BDT250,000 (cUSD3,180) from BDT220,000 (cUSD2798) will boost disposable income.

In addition, the fall in global crude prices has not yet been passed on to consumers. Fuel prices are set by the government and recent news reports suggest that the government is likely to adjust domestic fuel prices to international prices. This would lower government income but put even more money in consumer pockets.

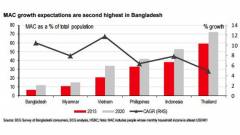

And there’s more – the World Bank estimated that, with a gross national income per capita of USD1,046, Bangladesh broke into its “lower middle-income” category in July 2015. The proportion of middle and affluent class (MAC) is still low at 7% of total population. The Boston Consulting Group expects the number to rise to 17% of population by 2025 with a double digit compounded annual growth, one of the fastest in the region.

This makes Bangladesh consumers a force to be reckoned with. While Bangladesh has traditionally relied on its strong external sector – RMG exports and remittances – we think the growing middle class could dramatically change the outlook for domestic industries.

A strong, vibrant consumer class, with ample lifestyle choices, provides a huge opportunity for the consumer sector. And Bangladeshi consumers appear to be an optimistic lot, as reflected in a high score in the latest ‘MasterCard Worldwide Index of Consumer Confidence. Although the reading has come down from the start of the year, it is still well above the regional average.

As shown in other parts of Asia, the evolution of consumer aspirations provides a huge opportunity for firms in the consumer discretionary sector. In Bangladesh, this comes with modern characteristics. For example, a tech-savvy paint company we visited in Dhaka has developed a mobile app so customers can choose the colour they want. It has been a huge hit, with over 12,000 downloads per week.

While innovative marketing is important, traditional methods of ensuring the correct product mix and establishing extensive distribution networks are not being ignored. We visited a biscuit company that is using modern production technology alongside a traditional distribution system based on trucks, warehouses and small shops. This seems to work. The company recorded c35% growth in profits for FY15, and is now planning to spend USD6m to add more production lines.

Pharma sector: great potential

Another sector with strong growth potential is the pharmaceutical industry. The size of pharma market in Bangladesh is around USD2.1bn, with over 100 companies vying for business. It’s effectively an oligopoly – the top six companies have c65% of market share. The bulk of the products are consumed domestically through retail and hospital chains and less than 5% of sales revenue comes from exports. But exports are growing – in the last five years, export earnings in the pharma sector have risen at a CAGR of 12.1% (to June 2015).

Square Pharma (SQUARE BD, Not Rated) and Beximco Pharma (BXPHAR BD, Not Rated) are the two market leaders (both are listed). They recently received US FDA approval, the first time ever for Bangladeshi firms. This opens the door to the lucrative, higher-margin US pharma market. The pharma company we visited is aiming for net margin of 20% for exports and 15% for domestic products. The company expects the domestic market to grow 15% annually for the next decade and has already earmarked USD120m as capex for the next two years.

Government policies have been supportive as well. Recently, the government announced cash incentives for boosting non-traditional exports, including pharmaceuticals and shipbuilding. Bangladesh exports pharmaceutical products to 107 countries across the world.

Going forward, we expect the pharma sector to also benefit from a lower corporate tax rate and the increase in the VAT exemption limit for sample medicine exports to rise to BDT100,000 (from BDT30,000 earlier).

Banks: beware of fish bones

In between the traffic jams and company meetings, this strategist never misses an opportunity to try the local cuisine. Hilsa, a fish cooked with mustard seed paste, was delicious but came with downside risks in the form of fish bones, potentially more dangerous than some of the issues warned of by the travel desk.

The Bangladeshi banking system, too, has its own fish bones to digest. This sector, which makes up c26% of total market capitalization, struggles with stubbornly high bad assets. By end FY2015, non-performing loans in the banking system stood at 9.8% (of total loans). So far in FY2016, things have not been very encouraging either, with bad loans rising by 4.17% q-o-q to BDT547.1bn by end-September. Asset quality is especially poor for state-owned banks, where the NPL ratio hovers around 22%. Private commercial banks have NPLs of c6%.

Bangladesh Bank, the local central bank, monitors these bad assets closely and is looking to improve the risk framework. Recently it extended the deadline for the banks to reduce their exposure to capital markets by two more years. Now, all scheduled banks have until July 2018 to reduce investments in capital markets to 25% of the total capital. Of the total 56 scheduled banks, only 27 have investments in the stock market at or below 25% of their total capital, while for the rest, investments hover c50%.

While monitoring bad assets and putting a cap on risky investments are welcome initiatives, more concrete programmes are required to handle existing bad debts.

The prevalence of bad debt has given the banking system indigestion and private sector credit growth has moved sideways in the low teens for some time now. It has even declined in recent months. All the banks that we met during our trip are focused on risk-management rather than growing balance sheets. In so far as they are looking for growth, private banks prefer SMEs and the household sector to large corporates where debt repayment seems to be more of an issue. One bank told us that in 2013 over 70% of its loans went to larger companies but after some big defaults this had fallen to 60%; the balance was spilt equally between SMEs and retail (i.e. to households).

Another factor driving down credit growth is the slowdown in trade. Revenue from RMG exports has been below target. According to the Exports Promotion Bureau, net earnings from exports of knitwear and woven garments grew by 5.5% y-o-y to USD8.2bn in the first four months of FY16. However, this was c10% below the target of USD8.5bn set by the government. Increased scrutiny from major international brands after the Rana Plaza tragedy and the suspension of GSP status6 are two major issues affecting RMG exports, in our opinion.

Overall, the business community looks reluctant to take on large amounts of credit, perhaps a reflection of the recent political problems. While calm has returned to the streets, the businesses that we met still appeared to be quite cautious (see Asia Frontier Insights – Bangladesh: Getting back to business, 30 June 2015)

A third reason for the decline in credit growth at local banks is the availability of cheap loans from foreign banks. For example, one big pharma company that we met during our trip has decided to finance part of its capex of USD120m for its new facility from a German bank. Thus, competition for customers has allowed interest rates on loans to fall to 12%, from c14% a couple of years ago.

Rates can fall further as inflation has declined and these factors are likely to have negative consequences for interest margins. Our bottom-up analysis of listed Bangladeshi banks reveals the same. Interest margins for banks have fallen to 4.6% in 2014, compared to 6.4% back in 2010. Banks’s ROE are under pressure as well, declining from 23% to 12%, between 2010 and 2014.

One would think that there are plenty of loan growth opportunities for local banks in financing “hard” infrastructure. Bangladesh still lacks basic amenities, such as proper road connectivity and uninterrupted power supply. The plans to address this are there but the government’s Annual Development Plan (ADP) is often underutilized. According to the latest stats, total ADP utilization in 1Q FY16 was only 4.6% of the annual allocation, the lowest in four years. Timely policy implementation is essential.

To be fair, infrastructure is improving slowly and remains a policy priority. The Bangladesh Board of Investment has announced infrastructure investment worth USD8bn over the next few years. Several projects, including an economic zone in Chittagong, are already underway. Our economists believe that government spending on development is likely to increase to 6% of GDP in FY2016, from 5.3% currently. There are positive signs at ground level. For example, local newspaper reports suggest that cement makers are optimistic about growth in demand. Holcim Bangladesh estimates that cement consumption for 2015 could grow by 13%-14%, against 12-13% last year, as flurry of infra and housing projects supports demand.

There are signs of optimism elsewhere. The first Bangladesh taka bond in the international market will be used for infrastructure projects and the manufacturing and electricity index has picked up.

As a result, the country’s FX reserves also climbed to an all-time high of USD27bn in October. At this level, FX reserves can fund 8.2 months of import bills (12-month average), up from 6.5 months at the same time last year.

Earnings and valuations

Major sectors in the Bangladesh equity market by market capitalization are financials (26%), telecom (14.7%), materials (13.1%) consumer staples (12.7%), and pharma (12.6%). So far we have made many positive comments on potential growth. And Bangladesh has some companies which have generated consistent growth in the last few years. – Grameenphone (GRAM BD, Not Rated), Olympic (OLYMPI BD, Not Rated), and Square Pharma for example. But overall corporate earnings have remained below trend. For results available for the quarter ending September 2015, sales revenue for DSE30 index companies (ex-banks) have increased by 4.7% y-o-y, but operating earnings were down 3.9% y-o-y – led by a fall in operating margins.

Increased competition, as new players enter markets to harvest these growth opportunities and drive down margins, is one likely explanation. Another reason could be that most of the development initiatives are in the public sector domain. Thus, the private sector capex outlook remains lacklustre, except for the pharma and consumer names we mentioned elsewhere. Having said that, once the government’s infrastructure development programme starts to make an impact, we believe this will ‘crowd in’ private investments. Needless to say, credit growth needs to firm up to provide support. Of course, a stable political environment remains a prerequisite for sustainable corporate sector growth.

Meanwhile, following the recent sell-off, market valuations are looking more reasonable now. At a 12m trailing PE of 15.2x, the equity market is at a 3.5% discount to its five-year average. However, the valuation still looks quite expensive compared to 10.5x PE for the MSCI Frontier Market index.

Another area of concern is the decline in daily turnover, which could be a major issue for foreign investors in search of liquidity. The 20-day average daily turnover has declined to USD40m from cUSD90m just a couple months ago. FII flows into the equity market have been subdued, with the country receiving total portfolio inflows of USD431m last year. Arguably, this is in line with broader trends in foreign investment in the country. According to UNCTAD, Bangladesh net FDI flows were down 4.7% in June 2015 (compared to the previous year)

The combination of high valuations, low liquidity, margin compression, and a high level of bad debt still weighs on the equity market. Thus, we remain neutral. But given that few investors have little exposure to this market, we believe it still warrants a visit, especially for well-travelled Asia-focused investors who may not want to miss out on this market.

This is an edited version of a longer HSBC research report written by Devendra Joshi and Herald Van der Linde (Head of Equity Strategy, Asia Pacific)

Source: Dhaka Tribune