Bangladesh PM Sheikh Hasina will be in India to attend the G20 summit and it is an opportunity for us to join many notable global thought leaders in urging a halt to the harassment of Yunus, who helped or inspired so many of India’s microfinance institutions take the first steps on the long road to success

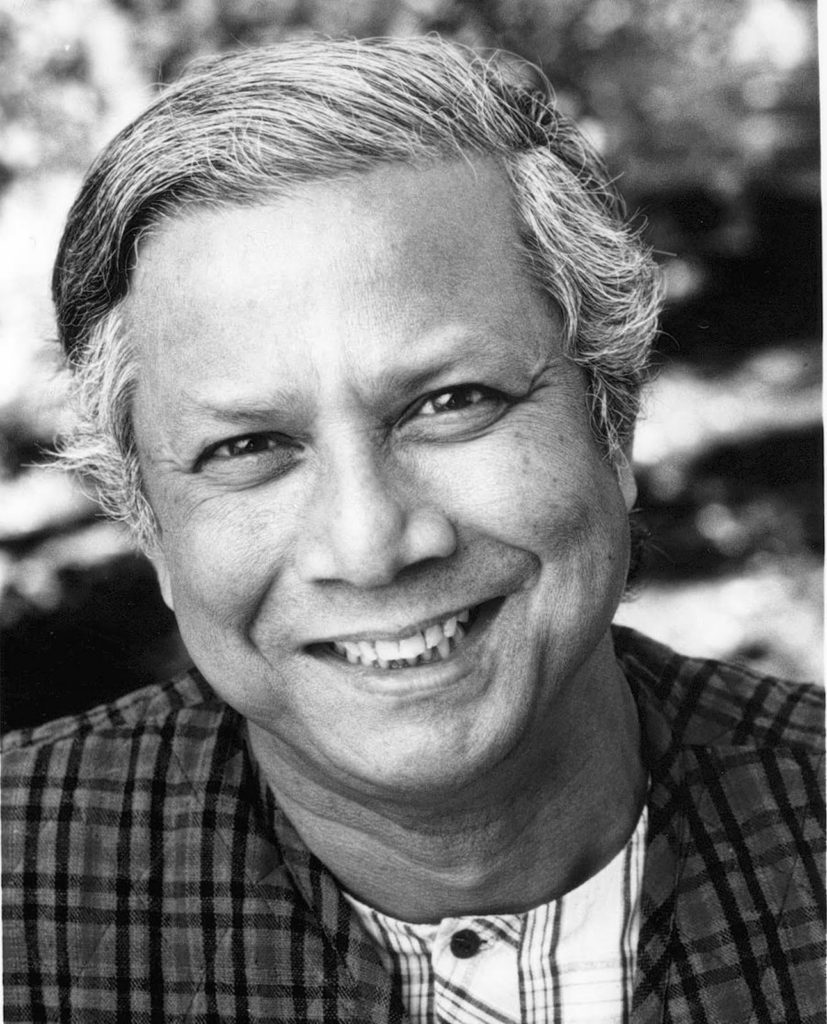

Many notable global thought leaders have urged Bangladesh to halt to the harassment of Grameen Bank founder Muhammad Yunus.

India should throw its weight behind the call to Bangladesh Prime Minister Sheikh Hasina by 170 global leaders, including former US Presidents Barack Obama and Bill Clinton, former United Nations Secretary-General Ban Ki-moon and over a 100 Nobel laureates, to stop the judicial harassment of Bangladeshi Nobel Peace Prize winner Muhammad Yunus. We owe a huge debt of gratitude to the Grameen Bank founder who is the pioneer of microfinancing, not just in Bangladesh, but also in India.

There is consensus across the board on Yunus’s direct contribution to the growth of India’s microfinancing institutions (MFIs), small finance banks and NBFCs whose gross loan portfolio (GLP) on March 31, 2023 stood at nearly Rs 3.5 lakh crore with 6.5 crore borrowers. According to Microfinance Institutions Network (MFIN), the segment’s apex body, the GLP grew by 22 percent since March 31, 2022 highlighting the sector’s upward trajectory which is crucial for India’s poor.

How Yunus Helped India

Leading lights of Indian MFIs who spoke to me have paid glowing tributes to the Bangladeshi economist, describing him respectfully as a “lighthouse”, “inspiration”, “visionary”, and “guru” for his mentoring and hand-holding. One of them described Yunus to me as the father of microfinancing in Bangladesh – and India.

In fact, the four biggest players today – Bandhan, Bharat Inclusion Financial Limit, CreditAccess Grameen and Ujjivan – are modelled on Yunus’s Grameen Bank and owe a great deal to him for his generous support and guidance.

The three living doyens of MFIs in India are Vijay Mahajan (Basix), Chandra Shekhar Ghosh (Bandhan) and Samit Ghosh (Ujjivan).

Samit Ghosh, 73, Ujjivan founder and chairman of Ujjivan Financial Services Ltd, the holding company, and ex-chairman of MFIN, recalled that he approached Grameen Bank in 2004, underwent a two-week training programme in Dhaka, and was then sent to rural branches in Bangladesh.

Ghosh said that when he started his venture in 2005, Grameen even sent experts to guide his team and that Yunus himself took classes and helped them develop a business model. When Ujjivan received an NBFC licence to open a small finance bank in 2017, Yunus was the chief guest at the launch.

Besides Ujjivan, Yunus also helped CreditAccess Grameen in Bengaluru, ESAF in Kerala, and close to 100 other microfinancing institutions in India. In 1999, an NGO called Grameen Koota was launched to provide microcredit to the poor around Bengaluru. It was later renamed CreditAccess Grameen. Its ex-MD Suresh Krishna said that Grameen Koota received seed capital funding from Yunus’s Grameen Trust, a sister organisation of the world famous Grameen Bank.

According to Krishna, Grameen Trust provided seed capital and technical support to 20 Indian NGOs and companies between 1997 and 2003. In 2016, Krishna left CreditAccess Grameen to launch an NBFC with Vanitha Reddy – and named it Yunus Social Business Fund to underline his admiration and gratitude.

The goal of Rajat Singh’s InPrime Finserve in Bangalore is to take microfinancing to the next level by using emerging technology and data. He acknowledged that microfinancing is such a flourishing and impactful business in India because we have copied Yunus’ joint liability group (JLG) model pioneered by his Grameen Bank.

Singh said India’s MFIs adopted the JLG model over the Latin American individual lending model and even the self help group (SHG) model advocated by the Reserve Bank of India. He said these choices helped lift Indian MFIs to great heights.

Singh said that in 2006, when Yunus won the Nobel Prize, he was in IIT Kharagpur waiting for his placement, but was so completely bowled over by Yunus’ ideas that he plumped for a career in microfinancing instead of engineering. He joined Ujjivan in 2007 and left it after 14 years to set up InPrime Finserve.

Leading lights of Indian MFIs who spoke to me have paid glowing tributes to the Bangladeshi economist, describing him respectfully as a “lighthouse”, “inspiration”, “visionary”, and “guru” for his mentoring and hand-holding. One of them described Yunus to me as the father of microfinancing in Bangladesh – and India.

In fact, the four biggest players today – Bandhan, Bharat Inclusion Financial Limit, CreditAccess Grameen and Ujjivan – are modelled on Yunus’s Grameen Bank and owe a great deal to him for his generous support and guidance.

The three living doyens of MFIs in India are Vijay Mahajan (Basix), Chandra Shekhar Ghosh (Bandhan) and Samit Ghosh (Ujjivan).

Samit Ghosh, 73, Ujjivan founder and chairman of Ujjivan Financial Services Ltd, the holding company, and ex-chairman of MFIN, recalled that he approached Grameen Bank in 2004, underwent a two-week training programme in Dhaka, and was then sent to rural branches in Bangladesh.

Ghosh said that when he started his venture in 2005, Grameen even sent experts to guide his team and that Yunus himself took classes and helped them develop a business model. When Ujjivan received an NBFC licence to open a small finance bank in 2017, Yunus was the chief guest at the launch.

Besides Ujjivan, Yunus also helped CreditAccess Grameen in Bengaluru, ESAF in Kerala, and close to 100 other microfinancing institutions in India. In 1999, an NGO called Grameen Koota was launched to provide microcredit to the poor around Bengaluru. It was later renamed CreditAccess Grameen. Its ex-MD Suresh Krishna said that Grameen Koota received seed capital funding from Yunus’s Grameen Trust, a sister organisation of the world famous Grameen Bank.

According to Krishna, Grameen Trust provided seed capital and technical support to 20 Indian NGOs and companies between 1997 and 2003. In 2016, Krishna left CreditAccess Grameen to launch an NBFC with Vanitha Reddy – and named it Yunus Social Business Fund to underline his admiration and gratitude.

The goal of Rajat Singh’s InPrime Finserve in Bangalore is to take microfinancing to the next level by using emerging technology and data. He acknowledged that microfinancing is such a flourishing and impactful business in India because we have copied Yunus’ joint liability group (JLG) model pioneered by his Grameen Bank.

Singh said India’s MFIs adopted the JLG model over the Latin American individual lending model and even the self help group (SHG) model advocated by the Reserve Bank of India. He said these choices helped lift Indian MFIs to great heights.

Singh said that in 2006, when Yunus won the Nobel Prize, he was in IIT Kharagpur waiting for his placement, but was so completely bowled over by Yunus’ ideas that he plumped for a career in microfinancing instead of engineering. He joined Ujjivan in 2007 and left it after 14 years to set up InPrime Finserve.

Sheikh Hasina is scheduled to attend the G20 Leaders’ Summit to be held on September 9 and 10 in New Delhi as the head of one of the nine guest nations that the Modi government has invited to the landmark diplomatic event it is hosting.

As Yunus has done so much for us, India should not miss the opportunity that Hasina’s visit provides to urge her to drop the legal proceedings against the grand old man facing a string of anti-corruption and labour law cases, which global leaders who have written to the Bangladeshi premier say are nothing but trumped up charges to persecute Yunus.

Arguably, there is a lot of bad blood between him and Hasina. The genesis of the conflict dates back to 2007 when both Hasina and Begum Khaleda Zia were thrown into prison by the army-backed interim administration. As Bangladesh’s most famous son, Yunus responded to calls by ordinary Bangladeshis to form a political party and defeat the Awami League and Bangladesh Nationalist Party headed by Hasina and Zia respectively, to weed out corruption from governance.

He formally launched a party called Nagarik Shakti, or Citizens’ Power, and dramatically announced: “I just can’t keep myself away from politics any longer. It’s high time to do something.”

Although he abandoned his political career in two months, he is still paying the price. Hasina, who won the 2008 elections, hasn’t forgiven him for wading into politics and calling politicians corrupt. After winning three successive national elections in 2008, 2014 and 2018, she is keen to become the PM for a record fourth term.

India also wants Hasina to get re-elected at any cost because of excellent relations between the two governments and warm personal ties between the two premiers.

As things stand, the situation is ripe for Modi to urge Hasina to let bygones be bygones and allow Yunus to live in peace. At 83, he doesn’t pose a challenge or threat to an all- powerful politician like her. If Hasina listens to Modi and leaves Yunus alone, Modi’s own stock will go up in the US-led Western bloc of nations – and among more than 100 Nobel laureates – standing firmly by Yunus.