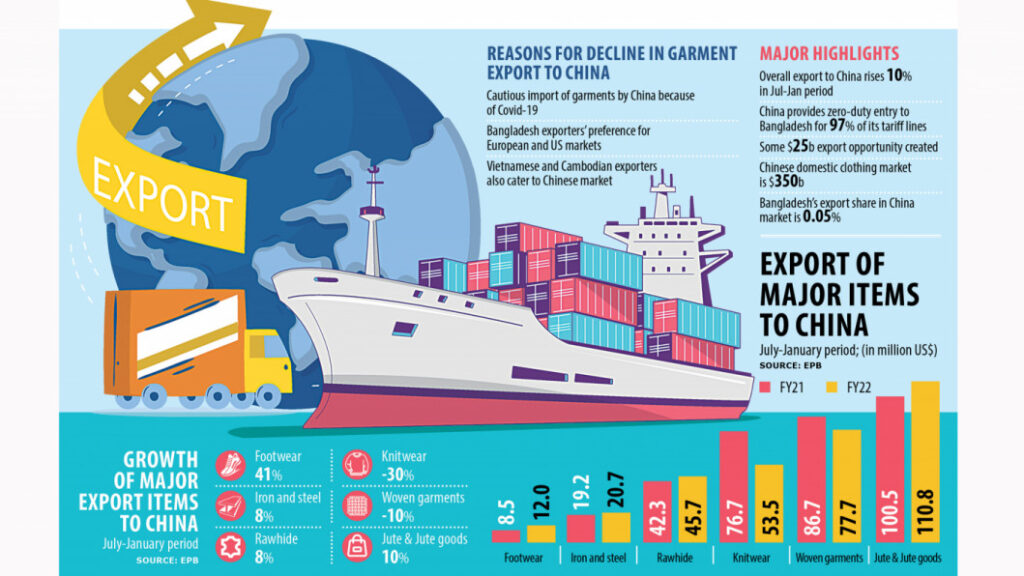

Although Bangladesh’s overall export earnings from China increased 9.81 per cent year-on-year to $426.14 million in the last seven months, apparel shipments to the East Asian nation failed to meet expectations despite enjoying duty benefits.

Apparel shipments to China fell to $131.20 million in the July-January period of the current fiscal year, a decrease of 19.66 per cent from $163.30 million in 2020-21.

Of the total garment exports to the world’s second-largest economy during the period, knitwear shipments brought home $53.53 million and woven products fetched $77.68 million, registering a negative growth of 30.77 per cent and 10.36 per cent respectively, data from the Export Promotion Bureau showed.

China became a highly promising export market for local apparel products after Beijing extended duty-free benefits to 97 per cent of Bangladesh’s garment items considering its status as a least-developed country in July 2020.

Products that now enjoy duty-free access to the world’s most populous nation include 299 garment items, of which 226 products are also covered by the Asian Pacific Trade Agreement.

Under the garments category, Bangladesh mainly exports woven T-shirts, polo shirts, trousers, sweaters, and other knitted items to China, the world’s largest apparel producer and exporter.

Other items that enjoy the same benefit are jute and jute goods, leather and leather goods, live and frozen fish, and agricultural products.

With China’s move to allow duty-free access for Bangladeshi apparels, an opportunity to export $25 billion worth of garment items has opened up, according to a number of research papers showed.

To be more precise, Bangladesh’s exports to China could grow to $25 billion if local suppliers just grab an additional 1 per cent share of the Chinese apparel market of $350 billion.

Currently, the country’s share of exports to the Chinese market is 0.05 per cent, which is equivalent to a bit above $1 billion.

Syed Sadek Ahmed, chairman of Space Sweater Ltd, said he has been exporting sweaters to China for many years but the number of shipments is on a downward path. He declined to elaborate.

However, Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), did speak extensively on the matter.

Garment exports to China fell in recent months for mainly two reasons, he said.

First, China has almost completely stopped importing garment items as a part of its zero-tolerance policy towards the spread of Covid-19.

Second, Chinese consumers were affected by a recent depreciation in their local currency.

“So, the Chinese government is encouraging the production of their own garment items, which negatively impacted Bangladesh’s exports,” Hassan said.

He is hopeful that the export to China will grow with the easing of coronavirus restrictions.

Commerce Minister Tipu Munshi said the government has been monitoring the China export situation amid the country’s ongoing recovery from the pandemic-induced shocks.

However, the shipment to other countries such as the US and those in the EU has risen significantly at this stage and so, local exporters are keener about these destinations, Munshi added.

Azizul Akil David, senior vice-president of the Bangladesh China Chamber of Commerce and Industry, said Bangladesh should not target Chinese markets for garment shipments as China itself is the world’s largest apparel producer.

“So, the export of jute and jute goods, leather and leather goods, freshwater fish and other high value-added items might be a better choice for Chinese markets.”

MA Razzaque, a research director of the Policy Research Institute who follows Chinese markets, says a major reason behind the decreased garment exports to China is the rising demand for locally made apparel items in the EU and the US.

Both the European and US markets have been buoyed by stimulus payments to consumers, helping Bangladesh recover quickly as well in its two major export destinations.

Moreover, there is a global inflationary pressure, which also influenced buyers to purchase more affordable consumer goods at competitive prices.

Bangladesh’s current production capacity is mainly tailored for European and US markets, Razzaque said.

He also agreed that the scope of exporting garment items to Chinese markets is more limited than that of the EU and US as China is mostly self-sufficient in garment production.

“Besides, Vietnam, China and Cambodia have formed a strong regional apparel supply chain that is very active now. So, imports from other countries have declined.”