Twelve scheduled banks including eight state-run banks held 70.06 per cent of the total defaulted loans in the banking sector as of December 31, 2014 as they disbursed huge amount of loans unlawfully to their clients, said Bangladesh Bank officials.

Three out of the 12 banks also failed to keep required provision against their disbursed loans and advances after the end of 2014 due to drop in their operating profits.

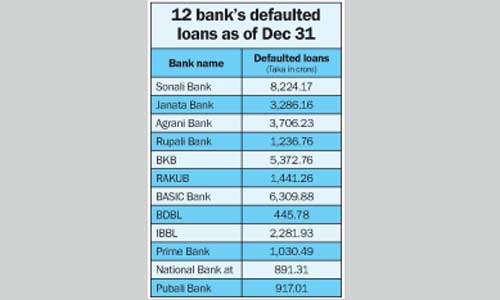

The 12 banks are: Sonali Bank, Janata Bank, Agrani Bank, Rupali Bank, Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank, BASIC Bank, Bangladesh Development Bank, Islami Bank Bangladesh, Prime Bank, National Bank and Pubali Bank.

The defaulted loans in the 12 banks stood at Tk 35,143.75 crore, or 70.06 per cent of the total classified loans amounting to Tk 50,155.77 crore in the banking sector as of December 31, 2014.

A BB official told New Age on Thursday that the defaulted loans in the banking sector including that in the state-run banks declined significantly in the last quarter of 2013 after most of the banks had gone for rescheduling of their defaulted loans during two months before the national elections held on January 5, 2014.

Businesses, mostly loyal to the ruling parties, and political leaders had gone for massive rescheduling of their defaulted loans just before the national polls, he said.

But, the majority of the clients who were allowed to reschedule their loans became defaulters again between second and third quarter of 2014 as they did not regularise their defaulted loans maintaining proper rules and regulations, the official said.

Against the backdrop, the central bank relaxed the defaulted loan rescheduling policy further in December of 2014 to decrease the classified loan in the banking industry at any cost, he said.

Despite the relaxed policy, the 12 banks failed to decrease the defaulted loan in line with the optimum standard for a bank as they disbursed huge amount of loans violating the rules and regulations, the central banker said.

The defaulted loans stood at 9.69 per cent of the total outstanding loans of Tk 5,17,837.43 crore in the banking sector as of December 31, 2014. It was 8.93 per cent of the total outstanding loans of Tk 4,54,435.26 crore as of December 31, 2013.

The three banks which failed to maintain the provision against their loans and advances in 2014 are

BKB, RAKUB and National Bank.

Another BB official said the existing sluggish business situation amid the political uncertainty and the recent bank scams were the key reasons for the large amount of the defaulted loans in the 12 banks.

The banks sanctioned huge amount of loans without proper scrutiny which pushed up their defaulted loans, he said.

Three out of the 12 banks also failed to keep required provision against their disbursed loans and advances after the end of 2014 due to drop in their operating profits.

The 12 banks are: Sonali Bank, Janata Bank, Agrani Bank, Rupali Bank, Bangladesh Krishi Bank, Rajshahi Krishi Unnayan Bank, BASIC Bank, Bangladesh Development Bank, Islami Bank Bangladesh, Prime Bank, National Bank and Pubali Bank.

The defaulted loans in the 12 banks stood at Tk 35,143.75 crore, or 70.06 per cent of the total classified loans amounting to Tk 50,155.77 crore in the banking sector as of December 31, 2014.

A BB official told New Age on Thursday that the defaulted loans in the banking sector including that in the state-run banks declined significantly in the last quarter of 2013 after most of the banks had gone for rescheduling of their defaulted loans during two months before the national elections held on January 5, 2014.

Businesses, mostly loyal to the ruling parties, and political leaders had gone for massive rescheduling of their defaulted loans just before the national polls, he said.

But, the majority of the clients who were allowed to reschedule their loans became defaulters again between second and third quarter of 2014 as they did not regularise their defaulted loans maintaining proper rules and regulations, the official said.

Against the backdrop, the central bank relaxed the defaulted loan rescheduling policy further in December of 2014 to decrease the classified loan in the banking industry at any cost, he said.

Despite the relaxed policy, the 12 banks failed to decrease the defaulted loan in line with the optimum standard for a bank as they disbursed huge amount of loans violating the rules and regulations, the central banker said.

The defaulted loans stood at 9.69 per cent of the total outstanding loans of Tk 5,17,837.43 crore in the banking sector as of December 31, 2014. It was 8.93 per cent of the total outstanding loans of Tk 4,54,435.26 crore as of December 31, 2013.

The three banks which failed to maintain the provision against their loans and advances in 2014 are

BKB, RAKUB and National Bank.

Another BB official said the existing sluggish business situation amid the political uncertainty and the recent bank scams were the key reasons for the large amount of the defaulted loans in the 12 banks.

The banks sanctioned huge amount of loans without proper scrutiny which pushed up their defaulted loans, he said.

Source: New Age