Assistance includes reforming laws and regulations of Islami banking to stop dubious transactions

The government has signed four primary deals with the World Bank to help develop financial sector of Bangladesh and ensuring better facilities for the stakeholders.

The four are the central bank strengthening project, software security switch gateway project, agriculture insurance project and Islamic bank strengthening project, official sources said.

The agreements were signed on the sidelines of a seminar on the bank’s financial assistance programmes in Washington DC early this month, Bank and Financial Institutions Division Secretary M Aslam Alam told the Dhaka Tribune yesterday. He attended the seminar.

“We have discussed various projects concerning the development of banking sector and the bank has agreed to send four missions for developing the projects.”

He said the World Bank agriculture insurance mission will visit Dhaka to prepare a report regarding insurance project on agricultural production. “The country’s insurance sector is weak, so we want to take assistance from the World Bank to strengthen the sector.”

He added that there are chances that some projects, including the one – central bank strengthening project, will start immediately.

Agriculture insurance

The crop insurance project was commenced in 2013. The Japan Fund for Poverty Reduction provided a $2 million grant for the “Pilot Project on Weather Index-Based Crop Insurance” under the Asian Development Bank while the Government of Bangladesh is also providing in-kind support of $420,000.

The crop insurance project will be extended across the country in association with the commercial banks.

Bangladesh Bank strengthening project

The WB-funded project for strengthening the central bank was launched in 2003 whose duration had been extended several times over the years.

The central bank’s internal control and auditing system had been strong over the last couple of years, but now without the task of supervision, Bangladesh Bank is seemingly weak that leads to worsening of the financial health of private and foreign banks.

Development of software security switch gateway project

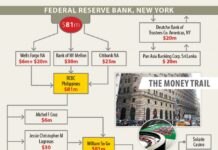

The banking division secretary said the country’s banking sector specially state-owned banks needed extra protection for their e-transfer of money from Bangladesh to other countries and the World Bank is keen to give technical support to strengthen the transfer mechanism.

Recently, BFID asked the financial Intelligence unit of BB to investigate into the incident of money looting of $0.25 million occurred in the Sonali Bank UK in September last year.

According to the recent meeting, officials and staff members won’t be allowed to go outside their respective workstations without logging off the swift system and departmental punishment will be awarded to the alleged officials of state-owned Sonali Bank who were allegedly responsible for the hacking incident.

In a rare incident in September last year, Turkish hackers looted the money.

Islami Bank strengthening project

Recently, the central bank found several violations of rules by the Islami Bank Foundation, a welfare foundation associated with the Islami Bank Bangladesh Limited. A Bangladesh Bank probe discloses that the foundation has not been transparent in allocating over Tk123.6 million grant to one organisation named Centre for Strategic and Peace Studies and in allocating Tk5.52 million to another organisation named Education Aid.

Besides, other Islamic banks have been found involved allegedly with massive irregularities.

Banking Division Secretary M Aslam Alam said the World Bank wants to give its assistance to developing Islamic bank laws and regulations.

Meanwhile, after the bank-fund meeting, Finance Minister AMA Muhith is likely to sign a $500 million agreement with the WB for budgetary support following a five-year break.

The WB has recently responded positively to the Bangladesh government’s request for deficit financing of the national budget on conditions that the local government and banking sectors will be reformed.

A WB team visited Bangladesh in August for reviewing the necessity of budgetary credit support.

In the last annual meeting of the WB and IMF in 2013, Muhith placed a request for the bank to extend budgetary support for Bangladesh.

Source: Dhaka Tribune