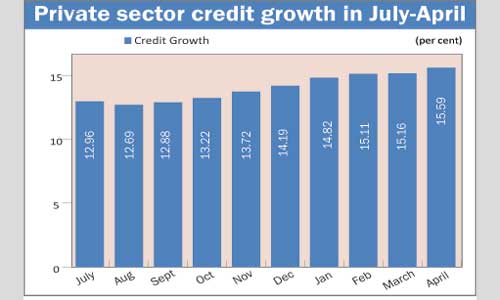

The country’s private sector credit growth continued to maintain an upward trend in April, eighth month in a row, as banks are now disbursing a huge amount of consumer and farm loans to sustain their profitability, said Bangladesh Bank officials.

According to the latest BB data, the year-on-year credit growth rate in the private sector increased to 15.59 per cent in April from 15.16 per cent in March.

The April growth is the highest in the last 39 months while it is well above the 14.80-per cent target set by the Bangladesh Bank in its monetary policy for January-June.

Credit flow to the private sector stood at Tk 6,44,733.60 crore as of April 30 against Tk 5,57,775.90 crore as of April 30, 2015. It was Tk 6,36,442.40 crore in March 2016 compared with that of Tk 5,52,668.10 crore in March 2015.

BB officials said that the banks were disbursing a huge amount of consumer loans by cutting down the interest rate to 11-14 per cent as they were overburdened with excess liquidity.

Besides, in the first 10 months of 2015-16, the farm loan disbursement registered a 13.94-per cent growth compared with that in the same period of FY15, the BB data showed.

Banks handed out Tk 14,128.15 crore in farm loans in July-April of FY16 against Tk 12,399.18 crore in the same period of FY15.

Besides, some of the businesspeople have in recent times started borrowing from the banks to expand their businesses after a prolonged lull, they said.

Former adviser to interim government Mirza Azizul Islam told New Age on Tuesday that the central bank should examine whether the recently injected credit went to the industrial sector.

‘I think bulk of the credit was injected to the trading

or consumer sector as the expected business-friendly environment is yet to come back in the country’s industrial sector. The businesspeople are still reluctant to take loans from the banking sector,’ he said.

The BB data showed that the year-on-year private sector credit growth increased to 12.21 per cent in July-April compared to 9.88 per cent during the same period a financial year ago.

The BB data showed that the year-on-year overall credit growth also improved to 11.82 per cent in April from 11.42 per cent in March this year.

The total credit by banking sector stood at Tk 7,59,415.80 crore as of April 30, 2016 against Tk 6,79,168.80 crore as of April 30, 2015. It was Tk 7,53,490.90 crore as of March 31, 2016 compared with that of Tk 6,76,235.20 crore as of March 31, 2015.

Source: New Age