Summary:

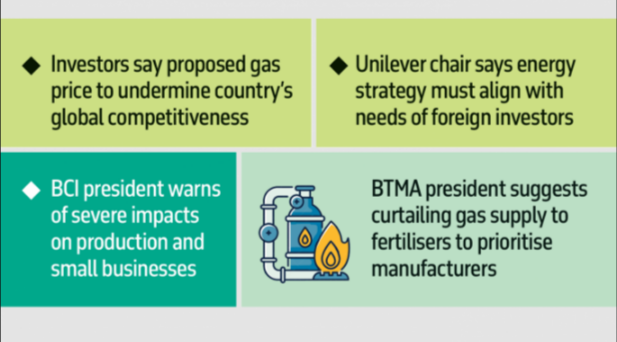

- Investors say proposed gas price to undermine country’s global competitiveness

- BCI president warns of severe impacts on production and small businesses

- Unilever chair says energy strategy must align with needs of foreign investors

- BTMA president suggests curtailing gas supply to fertilisers to prioritise manufacturers

Expressing strong opposition to the government’s plan to raise gas prices in the industrial sector, both local and foreign investors have threatened to pull their investments from Bangladesh, warning that the proposed hike would undermine the country’s global competitiveness and create an unfair divide between existing and new investors.

Business will not survive in the country if the government remains adamant on the proposed gas price hike, they said while addressing at a seminar on “Policy Considerations for Energy Affordability and Impact on Industrial Competitiveness” yesterday.

Investors sounded the alarm bells ahead of the mass hearing on the gas price hike in the industrial sector to be organised by the Bangladesh Energy Regulatory Commission (BERC) on 26 February.

According to the proposals placed by several gas companies, industrialists and captive power users would have to pay Tk75.72 per cubic metre of gas beyond the sanctioned load. At present, they pay a flat Tk30.75 per cubic metre. However, new industrial and captive connections will have to pay Tk75.72 per cubic metre throughout.

There will be discrimination between existing businesses and new businesses wanting to set up in Bangladesh. Given this, who will want to invest in Bangladesh? Nobody.

Not willing to expand business

At the seminar, Anwar-Ul-Alam Chowdhury, president of the Bangladesh Chamber of Industries, said Bangladesh’s industrial sector flourished due to the perception of having abundant, affordable energy.

“Despite 30% of total investments going into infrastructure development, we remained competitive because energy was cheap,” said Anwar, also a former president of the BGMEA.

He noted that gas prices have risen by 269% over the past five years, and a new entrepreneur setting up an industry would face a 150% increase in gas costs.

He added, “The interim government has failed to provide safety and security. The banking sector is bankrupt, interest rates are high, and the NBR poses another problem. If energy prices increase and there is insufficient supply, industries will not survive in the country.”

In a sarcastic tone, he added, “I appreciate the government for such an initiative. A 150% gas price hike for industry expansion? Fine. We are not willing to expand our businesses either.”

He further highlighted that the cost of business operations has increased by 30%. Bank borrowing interest rates have risen from 4% to 16-17%, and at the micro-level, rates have reached 19-20%. Production has dropped by 30-40%, and more than 45% of small businesses have gone under.

“Considering all indicators, we must assess where we stand now,” he said.

He also expressed concern about making business decisions in an uncertain environment, where the supply and price of gas remain unclear due to the government’s indecision.

Outlining how gas prices affect yarn prices in the country, he said, “When gas prices increased, the price of yarn in Bangladesh rose by $2.45 per kg, while I can import yarn from India for $2.15. LC opening costs for importing yarn increased by 39%. Does the government not realise this after so much observation?”

Chowdhury posed a question to the government: “Who are we working for? Do we want the manufacturing industry to stay in the country, or don’t we need it here? By deciding to hike gas prices, the government seems to think there is no need for industry in the country. Are we moving towards a service-sector-oriented economy instead of a manufacturing-driven one?”

The banking sector is bankrupt, interest rates are high, and the NBR poses another problem. If energy prices increase and there is insufficient supply, industries will not survive.

‘Investors have choices’

Zaved Akhtar, chairman and managing director of Unilever Bangladesh, said, “Many people frequently ask why investors don’t want to invest in Bangladesh. Many believe it’s a birthright to attract investment. We must understand that investors have choices.”

Akhtar, also president of the Foreign Investors’ Chamber of Commerce & Industry (FICCI), said, “When it comes to energy, there are two perspectives: cost and sustainability. When foreign investment comes here, they have net-zero carbon commitments. Bangladesh’s energy strategy is not aligned with the energy solutions foreign investors need.”

He urged the government to adopt a broader perspective on how energy strategy can support business growth. “If businesses grow, energy revenue will ultimately grow, and so will the country’s revenue.”

Discrimination for existing, new businesses

Nuria Lopez, president of the European Chamber of Commerce in Bangladesh (EuroCham), labeled the proposed gas price hike as discriminatory in her speech.

She stated, “There will be discrimination between existing businesses and new businesses wanting to set up in Bangladesh. Given this, who will want to invest in Bangladesh? Nobody. The proposed gas price hike is abhorrent and shocking to me.”

She urged the government to withdraw the bid for the gas price hike, saying, “European investors will perceive this country as unfriendly to European investors, meaning existing companies will not expand. How can we tell another investor to come to Bangladesh when we face so many challenges? The proposed gas price hike is discriminatory for existing companies.”

She also expressed dissatisfaction about Bangladesh’s graduation from the Least Developed Country (LDC) category in 2026, saying, “LDC graduation will pose strong challenges, and I am deeply concerned about it. No businessman in the country wants LDC graduation. Only politicians and bureaucrats want it. Bangladesh’s businessmen are not ready for LDC graduation yet.”

LDC graduation could be ‘suicidal’

Mohammed Hatem, president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), shared the same view on LDC graduation. He stated, “The LDC graduation plan was devised by the previous regime based on manipulated data. We lack the foundation and environment for LDC graduation. Pursuing this will be suicidal for business. The government should stop the LDC graduation process immediately.”

Showkat Aziz Russell, president of the Bangladesh Textile Mills Association (BTMA), stated that given the current business environment, the government should consider lowering gas prices instead of raising them.

He suggested curtailing gas supply to fertilisers in favour of the manufacturing sector.

The seminar was jointly organised by the Economic Reporters Forum (ERF) and Policy Exchange Bangladesh (PEB) in Dhaka. Doulot Akter Mala, president of ERF, chaired the programme and delivered the welcome address. Masrur Reaz, chairman and CEO of PEB, moderated the event.

Jalal Ahmed, chairman of the BERC, attended as the chief guest. The programme was also addressed by energy expert Ijaz Hossain; Aameir Ali Hussain, managing director of BSRM; and Tamim Hussain, barrister at Law, partner at Kamal Hossain and Associates.