Production of Emerald Oil, a listed rice bran oil producer, has discontinued since 2017, so it has been incurring losses every year since then. But its stock has risen a staggering 223 per cent in the last one year.

The astounding surge has propelled the manufacturer to the list of the top 20 gainers of the Dhaka Stock Exchange (DSE).

Emerald Oil is not the single case. Rather, some other junk stocks are also on the list, raising the question about the overall efficiency of the market.

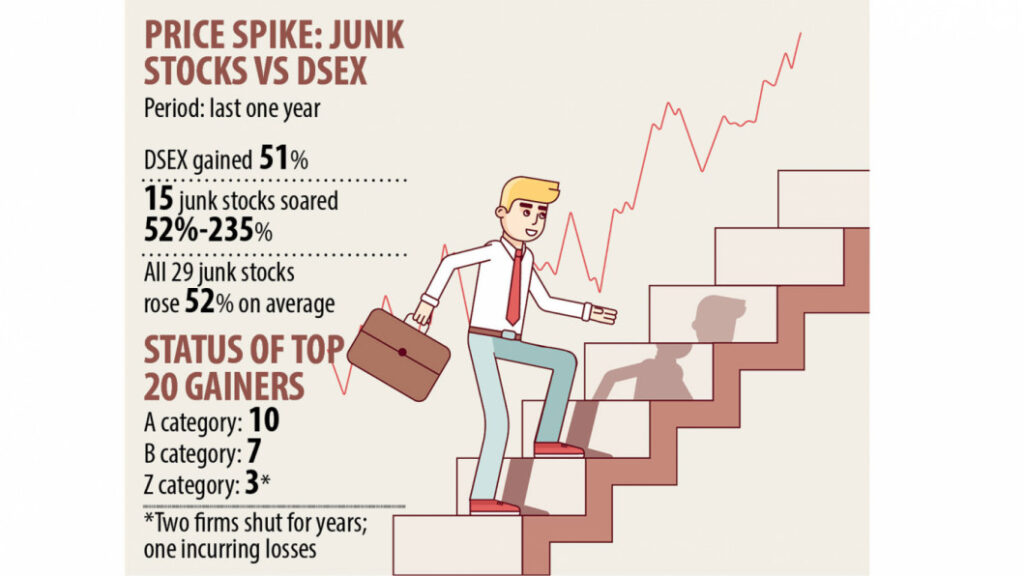

Since October 2020, 10 companies in the list were from the B and Z category. Of them, seven were from the B category and three from the Z category.

When a company does not provide at least 10 per cent dividend, it is categorised in the B category. It is included in the Z category, if it fails to make a profit or halts production.

“I am happy to see the market index is rising after a long time. But I am not happy to see the abnormal rise of such companies,” said Faruq Ahmed Siddiqi, a former chairman of the Bangladesh Securities and Exchange Commission (BSEC).

“The abnormal rise of these companies proves that our stock market is driven by rumour, greed and manipulation.”

He says some people trade among themselves to bid up the prices and spread speculations. Out of greed, general investors poured funds into these stocks.

“Quality investment is rare in the market, so the index is also unrelated to the economy. Therefore, when profit-taking takes place, people panic.”

Among the 10 low-performing companies, the production of C&A Textiles and Emerald Oil has been closed for several years. Aramit Cement, another Z category stock, has been in the red since 2017.

Dacca Dyeing, Maksons Spinning, Salvo Chemical, RD Food, Beacon Pharmaceuticals, Metro Spinning, and Mozaffar Hossain & Spinning Mills are placed in the B category for declaring an insignificant amount of dividends for years.

“The abnormal price surge of these companies indicates that the market has inefficiency, and it is driven by speculation,” said Shahidul Islam, CEO of VIPB Asset Management Company.

“This is not a good sign for a market.”

When poor companies outpace the growth of the index, the fundamental purpose of the capital market, which is capital allocation, is hampered, Islam clarified.

The DSEX, the benchmark index of the premier bourse of the country, went up 51 per cent between October last year and October 12 this year.

The junk stocks collectively rose 52.08 per cent, on average, during the same period, DSE data showed.

“These companies were mainly low paid-up capital-based, and it is easy to manipulate since the number of their shares is low. So, they are targeted by rogue traders,” said Ahsanur Rahman, CEO of Brac EPL Stock Brokerage.

“If a company has no expansion plan, its stock should not rise. But speculation fuels their price.”

Attracted by the price movement, some investors rushed to the stock market in the last one year to make quick bucks, Rahman said. “But they should not invest in such stocks.”

Earlier this year, rumours were going round that a foreign investor was going to buy Emerald Oil. But in a regulatory filing, the local company ruled out the possibility.

A top official of a merchant bank, preferring anonymity, says the junk and low-performing companies have surged mainly due to the speculations, and company officials are often involved with it.

Referring to the Emerald Oil case, he said the company’s disclosure raised a question.

On July 12 this year, it said the board of Emerald Oil decided to start its full-fledged commercial operation from September 1 with a daily output capacity of 48 tonnes of rice bran oil.

But on August 26, it said the company was not in a position to begin the commercial operation.

As offices were closed from July 23 to August 10 due to the strict lockdown, the company could not renew or obtain most of the required licences, according to a disclosure on the website of the DSE.

“The BSEC should monitor the activities of the companies to cut the opportunities for manipulation. Otherwise, the goodwill of the market will be hampered,” the merchant banker said.

Like its predecessors, the present commission of the BSEC pays more attention to whether the index is rising or falling though it is not its duty, he added.

So, investors need to be cautious and invest after assessing the potential of companies. “Otherwise, they will lose money,” Siddiqi said.

VIPB CEO Islam added: “If investors invest in good stocks, it will give them a better return in the long run.”

Mohammad Rezaul Karim, a spokesperson of the BSEC, says people investing in low-performing stocks is not unusual in a bullish market.

“But at a certain stage, investors return to the stocks with good fundamentals. The same will happen soon,” he said, adding that the commission was trying to raise awareness among the investors.