Court says central bank is discriminating against genuine businessmen by making them pay 14%-15% interest on loans

The High Court on Tuesday ordered a halt to the June 24 Bangladesh Bank circular that granted a huge waiver to loan defaulters to expedite debt servicing in the banking sector.

The bench of Justice FRM Nazmul Ahasan and Justice KM Kamrul Kader issued the order after hearing a petition filed by lawyer Manzill Murshid on behalf of Human Rights and Peace for Bangladesh.

With the May 16 circular, the central bank aimed to allow defaulters to regularize their bad loans by paying a 2% down payment only, instead of 10% to 50%.

After it was issued, experts came down heavily on the circular, saying it would cast a shadow over the whole banking sector. They said that offering such facilities would only increase the number of willful defaulters and discourage borrowers in good standing from repaying loans.

Manzill said the court found the circular protecting bad people and oppressing the good.

“They (defaulters) will get rid of the loan defaulters’ list by them paying just 2% and their names will not be in CIB (Credit Information Bureau). By doing that, they will be able to take thousands of crores of taka as new loans again, which will break the backbone of the banking sector,” he said.

The lawyer added that the court also observed that banks were desperately trying to work in favor of defaulters. “Thousands of crores of taka have been siphoned off from banks in loans, but no steps have been taken. If they get another chance again, they will do it again,” he said, quoting the court observation.

The court said Bangladesh Bank is discriminating against genuine businessmen by making them pay 14%-15% interest rates.

The court also highlighted the negligence of banks in executing Prime Minister Sheikh Hasina’s instructions to lower interest rates to single digits for bank loans.

Dhaka Tribune on Tuesday reached World Bank’s Lead Economist for their Dhaka office, Dr Zahid Hossain, and former caretaker government adviser, AB Mirza Azizul Islam, for comments, but they declined to comment on a sub judice matter.

The circular

Although almost all sectors were included in the latest loan rescheduling policy, the Bangladesh Bank circular specifically mentioned a number of privileged priority sectors such as wheat, food items, edible oil and refineries, and ship breaking.

Also Read – Bangladesh Bank offers huge waivers to loan defaulters

Defaulting loans at specialized banks sanctioned for purposes other than agriculture will also be entitled to the facility, it added.

According to the circular, defaulters will have to apply for the facility within 90 days of the circular’s issuance. Once approved, they will have to repay the rescheduled loans within the next 10 years, with a one year grace period.

The rescheduled loans would have to be repaid at a 9% interest rate only, it added.

Besides that, the circular said banks could waive all interest for defaulters, depending on the bank-client relationship.

It also said loan defaulters could enjoy a “One Time Exit” facility by paying only the bank’s cost of funds and the principal loan amount. To avail this facility, defaulters will have to pay the outstanding amount within a year.

Currently, a bank’s cost of funds is typically between 3% and 5%.

Loans in default before December 31, 2018, will be considered for the rescheduling policy and the “One Time Exit” facility, the circular added.

Where do we stand now?

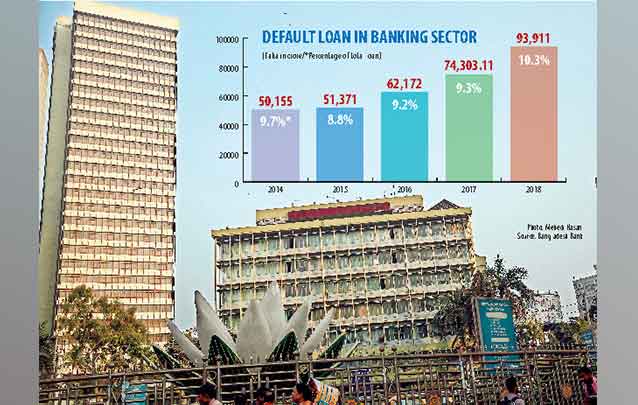

Although the government awarded similar incentives to loan defaulters several times in past years, the situation has deteriorated, instead of improving, with loans in default nearly hitting Tk100,000 crore for the first time in the country’s 48-year history.

As of December 2018, there were a total of 266,118 loan defaulters in the country and the monetary value ofthese bad loans was Tk93,911 crore — mainly due to poor governance that has plagued the financial sector in the absence of a strong and independent central bank, as well as lack of political will.

Defaulting loans stood at Tk50,155 crore in 2014, Tk51,371crore in 2015, Tk62,172crore in 2016, and Tk74,303 crore in 2017, according to central bank data.

On February 28 this year, Finance Minister AHM Mustafa Kamal also cited the top 20 defaulters in parliament by name.

HC wants list of loan defaulters

The High Court on May 16 also ordered Bangladesh Bank to submit by June 24, a list of borrowers with over Tk1 crore in loan defaults.

Earlier, on February 13, the court also asked the authorities concerned to submit a list of loan defaulters and money launderers over the the last 20 years.

It also issued a rule asking the authorities to explain why an order should not be given to form a powerful commission to identify past irregularities and corruption in the banking sector.

Source: Dhaka Tribune.