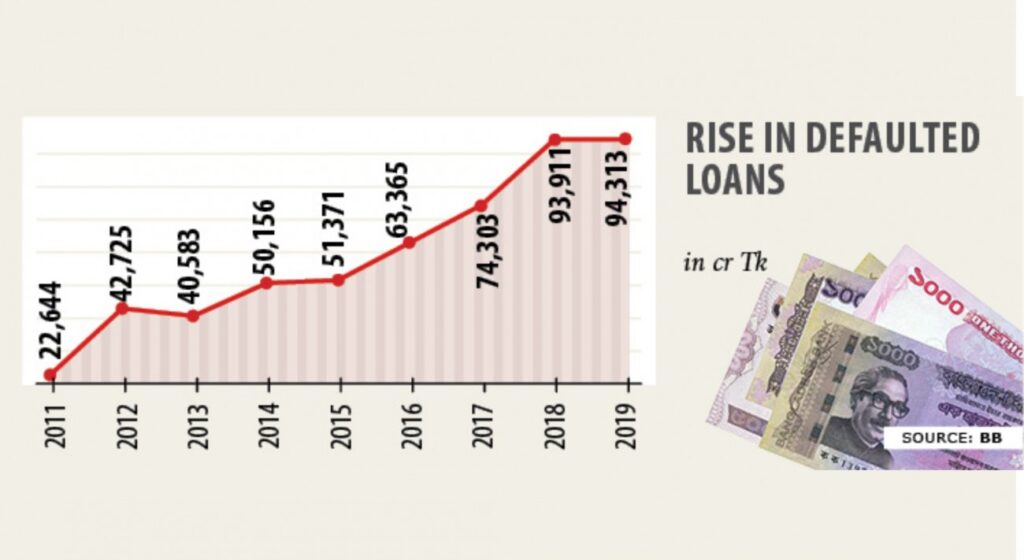

Defaulted loans still going up

Despite record rescheduling, non-performing loans rose to Tk 94,313cr in Dec 2019 from Tk 93,911cr a year ago

Defaulted loans crept up last year despite the government’s attempts to subdue them — by hook or by crook.

A record Tk 50,186 crore was rescheduled last year, often by breaching banking norms, and yet defaulted loans hit Tk 94,313 crore at the end of 2019, up 0.42 percent year-on-year, according to data from the Bangladesh Bank.

Defaulted loans, however, decreased last year in proportion to total outstanding loans: it stood at 9.32 percent, down from 10.30 percent at the close of 2018.

“This is a great success for the government as defaulted loans went down to single digit after a long time,” said Md Serajul Islam, spokesperson of the central bank

Serajul, also an executive director of the central bank, though admitted that the relaxed rescheduling facility had helped show a lower defaulted loan tally.

Of the sum regularised in 2019, Tk 18,584 crore was done under the central bank’s relaxed loan rescheduling policy that was announced on May 16 last year.

The policy allowed defaulters to reschedule their classified loans with a down payment of just 2 percent of the outstanding amount instead of the existing 10-50 percent.

The banks recovered only Tk 479 crore as down payment from the loans rescheduled under the relaxed policy.

“It is a temporary relief — the negative situation will come back in a very dreadful way,” said Ahsan H Mansur, executive director of the Policy Research Institute.

Loan rescheduling following a relaxed manner is not a lasting solution as defaulters earlier misused such facilities, he said.

Given the generous policy support afforded to delinquent borrowers historically, many good borrowers are tempted to default, said Khondkar Ibrahim Khaled, a former deputy governor of the central bank, while urging the BB to crack down on habitual defaulters with fervour.

“The soured loan situation would not have been this bad had a good amount of the rescheduled loans did not become defaults again,” said Fahmida Khatun, executive director of the Centre for Policy Dialogue.

In fact, Tk 13,284 crore of the bad loans regularised last year have defaulted, according to data from the BB.

This means, nearly one-fourth of the rescheduled loans has turned bad again.

“There is no scope to feel satisfaction given the feeble recovery track record,” Fahmida said.

Ahsan, also the chairman of Brac Bank, urged both the central bank and the government to ramp up their recovery drive.

The high volume of toxic assets means the banks will be unable to bring down the interest rate on lending to single digits, he said, while advising the BB to start calculating classified loans by including the rescheduled and written-off loans as well to take stock of the stressed asset scenario properly.

“The ongoing haphazard situation in the banking sector will get worse in the days ahead,” Fahmida added.

The upward trend of defaulted loans cannot be stopped if banks do not follow the rules and regulations when disbursing loans, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

Going forward, banks should sanction loans only to compliant borrowers, who repay on a regular basis, he added.

BB data showed more than 50 percent of the defaulted loans were with the eight state-run banks. As of December, the eight banks had Tk 48,057 crore of defaulted loans, down 10.14 percent year-on-year.

The 41 private banks together had defaulted loans amounting to Tk 44,174 crore, up 16 percent from a year earlier.

buy Buspar online

Buy Levitra plus online

Singulair no prescription

Buy Black Cialis