Bad politics should no longer prevent Nepal and its neighbours making the most of some amazing geology

IT IS a thrill trekking beside the upper Marsyangdi river in northern Nepal. On view are spectacular waterfalls and cliffs, snowy Himalayan peaks, exotic birds and butterflies. But just where tourists and villagers delight in nature, hydropower engineers and economists have long been frustrated; in such torrents they see an opportunity that for too long has been allowed to drain away.

Himalayan rivers, fed by glacial meltwater and monsoon rain, offer an immense resource. They could spin turbines to light up swathes of energy-starved South Asia. Exports of electricity and power for Nepal’s own homes and factories could invigorate the dirt-poor economy. National income per person in Nepal was just $692 last year, below half the level for South Asia as a whole.

Walk uphill for a few hours with staff from GMR, an Indian firm that builds and runs hydropower stations, and the river’s potential becomes clear. An engineer points to grey gneiss and impossibly steep cliffs, describing plans for an 11.2km (7-mile) tunnel, 6 metres wide, to be blasted through the mountain. The river will flow through it, before tumbling 627 metres down a steel-lined pipe. The resulting jet—210 cubic metres of water each second—will run turbines that at their peak will generate 600MW of electricity.

The project would take five years and cost $1.2 billion. It could run for over a century—and produce nearly as much as all Nepal’s installed hydropower. Trek on and more hydro plants, micro to mighty, appear on the Marsyangdi. Downstream, China’s Sinohydro is building a 50MW plant; blasting its own 5km-long tunnel to channel water to drive it. Nearby is a new German-built one. Upstream, rival Indian firms plan more. They expect to share a transmission line to ill-lit cities in India.

GMR officials in Delhi are most excited by another river, the Upper Karnali in west Nepal, which is due to get a 900MW plant. In September the firm and Nepal’s government agreed to build it for $1.4 billion, the biggest private investment Nepal has seen.

Relations between India and Nepal are improving. Narendra Modi helped in August as the first Indian prime minister in 17 years to bother with a bilateral visit. Urged by him, the countries also agreed in September to regulate power-trade over the border, which is crucial if commercial and other lenders are to fund a hydropower boom. Mr Modi was back in Kathmandu for a summit of the South Asian Association for Regional Co-operation, on November 26th and 27th. Governments think the normally rudderless body could find a purpose in energy integration—though the talks were poisoned by poor relations between Pakistan and India. Another big Indian hydro firm agreed with Nepal’s government, on November 25th, to build a 900MW hydro scheme, in east Nepal, known as Arun 3. Research done for Britain’s Department for International Development suggests four big hydro projects could earn Nepal a total of $17 billion in the next 30 years—not bad considering its GDP last year was a mere $19 billion.

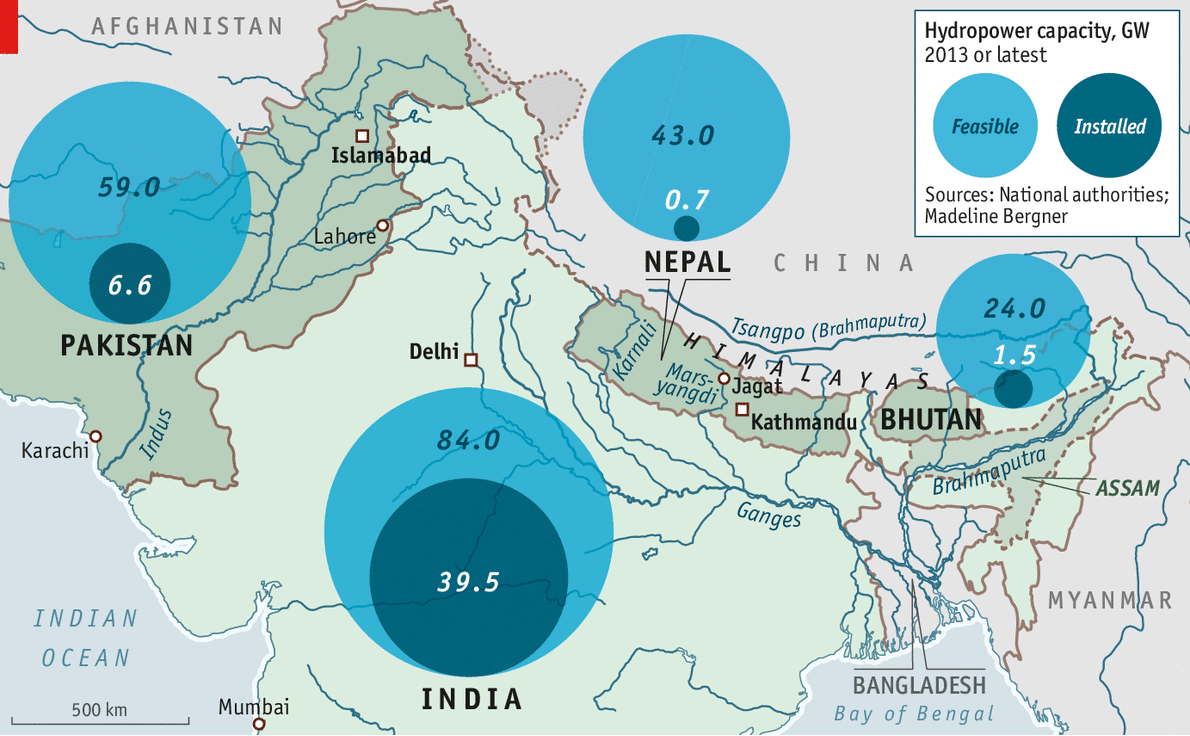

All Nepal’s rivers, if tapped, could feasibly produce about 40GW of clean energy—a sixth of India’s total installed capacity today. Add the rivers of Pakistan, Bhutan and north India (see map) and the total trebles. Bhutan has made progress: 3GW of hydro plants are to be built to produce electricity exports. The three already generating produce 1GW out of a total of 1.5GW from hydro. These rely on Indian loans, expertise and labour.

Why a Himalayan cross-border hydropower rush now? In Nepal projects were once scuppered by local politics, a ten-year civil war, suspicion of India and a lack of regulation that put off creditors. Slowly, such problems are being tackled. The war ended in 2006. It helps, too, that the terms of the projects look generous to the host. For Upper Karnali, GMR will set aside 12% of electricity production, free, for Nepali consumers. It will also give Nepal a 27% stake in the venture. After 25 years of operation the plant will be handed to Nepal.

A second reason, says Raghuveer Sharma of the International Finance Corporation (part of the World Bank), was radical change that opened India’s domestic power market a decade ago. Big private firms now generate and trade electricity there and look abroad for projects. India’s government also presses for energy connections over borders, partly for the sake of diplomacy. There has even been talk of exporting 1GW to Lahore, in Pakistan—but fraught relations between the two countries make that a distant dream.

An official in India’s power ministry says South Asia will have to triple its energy production over the next 20 years. Integrating power grids and letting firms trade electricity internationally would be a big help. It would expand market opportunities and allow more varied use of energy sources to help meet differing peak demand. Nepal could export to India in summer, for example, to run fans and air conditioners. India would export energy back uphill in winter when Nepali rivers dry and turbines stop spinning.

Governments that learn to handle energy investments by the billion might manage to attract other industries, too. Nepal’s abundant limestone, for example, would tempt cement producers once power supplies are sufficient. In the mountains, it is not only treks that are rewarding.

Source: Economist