BASIC Bank is allegedly using political influence to get funds from the national exchequer by the outgoing fiscal year ending on June 30 to meet the capital shortfall of the scam-hit state-owned bank.

The desperate bid is to get around Tk2,000 crore – the remaining part of a recapitalisation fund of around Tk5,000 crore for state banks kept in the budget for the outgoing 2014-15 fiscal. Officials said around Tk3,000 crore was released in the last 11 months of the current fiscal.

The high-ups in the government have instructed the authorities to release the remaining fund, said a senior official of the Finance Division, requesting anonymity.

The Finance Division has so far released Tk1,290 crore in favour of BASIC Bank which having a capital shortfall of around Tk3,600 crore at the end of 2014.

The officials alleged that they are under intense pressure to release the funds before the new fiscal year beginning in July. “We’ve been threatened even to lose our posts if we fail to release the fund,” said an official.

As a result, he said, the Banking Division already requested the budget wing of the Finance Division twice to release the fund amid persistent political pressure.

Two weeks earlier, the Finance Division released Tk900 crore for different financial institutions from the recapitalisation allocation. Of the total amount, BASIC Bank received Tk400 crore.

“We have always set strict conditions in disbursement of public money to scam-hit banks,” Senior Finance Secretary Mahbub Ahmed told the Dhaka Tribune yesterday.

If the bank authorities did not meet the conditions, he said the Finance Division would inform that to the authorities.

Mahbub Ahmed, however, declined to talk about any political pressure.

“BASIC Bank has been thrown out of international business since 2012 as the large irregularities were unearthed,” said M Aslam Alam, Secretary of Bank and Financial Institutions Division. He added that the bank badly needed Tk3,500 crore to gain the capacity to engage in international trade and become a fully functional institution.

He said Sonali Bank UK Ltd had already blacklisted BASIC Bank after such moves taken by international banks.

According to him, if BASIC Bank is given Tk2,000 crore, it will have a positive impact on its balance sheet and help the new management resume links with the international trade.

In 2012, the central bank had unearthed that the bank disbursed more than Tk4,500 crore in loans in the previous years, violating rules and regulations.

Meanwhile, the scam-hit bank has once again been entangled in a fresh row by concealing a net loss of over Tk4,000 crore in 2014.

Transferring a large portion of default loans to the “blocked” accounts and taking exemption from maintaining provision against the total default loans for next 10 years.

The real financial picture was concealed in the bank’s latest financial statements published recently.

“The financial statements of the bank do not give a true and fair view of the financial position as on December 31, 2014. Its financial performance for the year then ended in accordance with Bangladesh Financial Reporting Standards,” the bank opined in its statement.

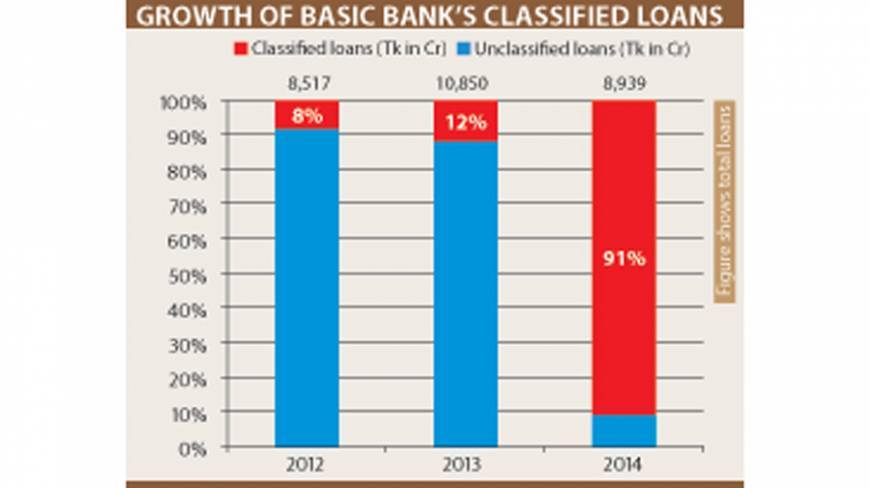

The bank had a total classified loan amounting to Tk8,108 crore at the end of 2014, which was around 91% of total loans and advances of Tk8,939 crore.

Of the total defaulted amount, around Tk3,000 crore has been transferred to “classified block assets” as per permission of Bangladesh Bank.

“This amount has actually been transferred from classified loans considering the uncertainty of recovery thereof,” said the statement.

The required provision against the classified amount has been calculated at Tk1,933 crore. Bangladesh Bank also allowed the bank to maintain the provision shortfall in 10 years from 2015.

As a result, the default loan amount to the financial statement stood at Tk5,109 crore or 57.15% of total loans and advances.

The required provision of the classified loan amount has stood at Tk2,364 crore at the end of 2014, of which the bank kept only Tk430.64 crore.

Bangladesh Bank has given the bank exemption from meeting the rest of the shortfall of over Tk1,933 crore during five years since 2015.

The actual provision shortfall of the bank stood at around Tk4,000 crore at the end of 2014. If the bank had to meet up the shortfall amount then the net loss of the bank would have been Tk4,099 crore at the end of the year.

But the financial statement showed that the net loss of the bank was over Tk110 crore in the last year, which was over Tk53 crore in the previous year. The required capital of the bank was Tk923.64 crore as of December 31, 2014, against which the bank had already negative capital of Tk2,686 crore.

Thus, the bank’s capital shortfall stood at over Tk3,609 crore as per the balance sheet.

But if the bank had to meet up the provision shortfall, then the actual capital shortfall would have been Tk3,922 crore at the end of the year.

“We have blocked a portion of the default loans to regain the image as the banks are rated in the international markets on the basis of default loan rates,” explained a senior manager of BASIC Bank.

On condition of anonymity, he also said, “We had to hide the real situation of the bank just to bring a little bit positive look in the balance sheet.”

The bank took privilege from Bangladesh Bank to maintain the provision shortfall, as it is impossible for the bank to meet up the huge amount of shortfall overnight, he added.

“The bank would have been closed down if it had to meet up the shortfalls,” said Khondkar Ibrahim Khaled, former deputy governor of Bangladesh Bank and former chairman of Bangladesh Krishi Bank.

He, however, accused the government of destroying the bank by appointing a corrupt chairman.

“Bangladesh Bank is now busy justifying the government’s misdeeds by allowing the bank to hide its real financial situation.”

The financial statement said most of the reported loans were sanctioned and disbursed during the period from 2010 to 2014.

In relation to these loans there were significant weaknesses in the bank’s internal control regarding loans and advances management. Specifically, loans were renewed having excess limit and poor or nil turnover, temporary overdraft was given on current deposit accounts, loans were approved before getting credit line proposals from branches, grace periods were extended frequently to avoid classification of loan accounts, incomplete sanction advice of loans were issued by the head office, loans were given without security or having security shortfalls, the utilisation of loan facilities was not ensured by the bank, said the statement.

Source: Dhaka Tribune