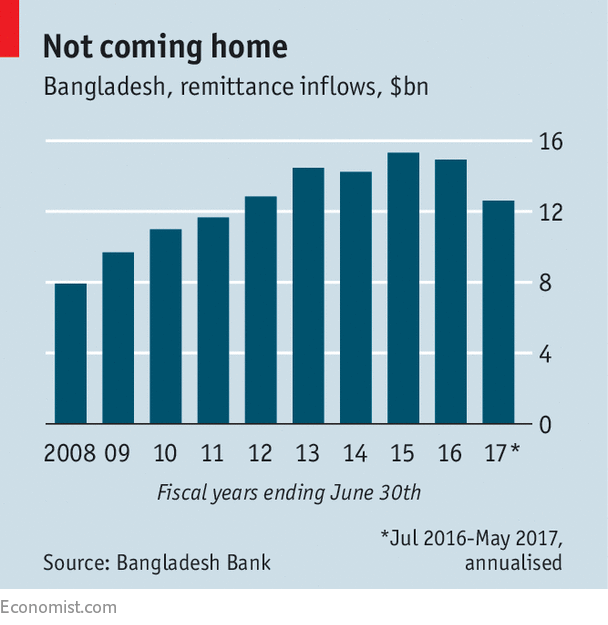

Bangladesh worries about falling remittances

Much of the blame lies with a dodge used by its importers

The abrupt cancellation last November by the Indian government of most banknotes by value was one factor: monthly inflows crashed, as the millions of Bangladeshis working in India were strapped for cash. In the Gulf, the source of 60% of Bangladesh’s remittances, the economy has been relatively sluggish.

But even without these shocks, remittances were falling—and fewer were being counted. Bangladesh is not unique in suffering such a downturn: for the first time in three decades, remittances to developing countries fell in both 2015 and 2016, according to the World Bank. But it has punched a hole in the balance of payments. The current account swung from a surplus of $3.7bn (1.7% of GDP) in the last fiscal year to a deficit of $1.8bn in the first ten months of this one. This does not pose an immediate threat, but alarms a government used to double-digit growth in remittances.

It is especially worried about mobile apps that facilitate transactions through hundi, an informal money-transfer system in which an expat transfers an amount of money to an agent wherever they are based, and an equivalent payment is made in taka back in Bangladesh. Hundi is cheaper, faster and thought to handle at least as much in remittances as banks, without foreign currency ever crossing the border.

The authorities have identified 15 illegal mobile apps. As hundi goes digital, more and more are using authorised mobile-money operators, such as bKash, which alone has 28m accounts and 170,000 agents. In February the central bank limited daily deposits of mobile money to 15,000 taka ($190) and withdrawals to 10,000 taka (down from 25,000 taka for both). In the budget, on June 1st, the finance minister promised to abolish banks’ fees on remittance transfers and to come up with other ways to keep cash flowing through official channels. The exchange rate, controlled by the government, makes remitting money through banks unattractive. The spread between banks’ and hundi rates is five taka (six cents) per dollar.

Ahsan Mansur of the Dhaka-based Policy Research Institute also links falling remittances to the rising demand among Bangladeshis to hold foreign currency abroad. Government cronies, businesses and the growing middle class are already nervous ahead of an election in late 2018 and want to keep money offshore.

Between 2005 and 2014, uncounted flows from Bangladesh amounted to $61.6bn, according to Global Financial Integrity, an American research and advocacy group. It blames an estimated 90% of these on trade misinvoicing. After an eightfold increase since 2002, about 40% of Bangladesh’s $40bn in annual imports come from China and Hong Kong, where underinvoicing is rife. Typically, a Chinese exporter invoices a Bangladeshi buyer for, say, $1, instead of $10, evading Chinese foreign-exchange controls on most of the income; the importer pays $1 through official channels, saving duties on $9, which is transferred via hundi.

So the hundi network has a demand for dollars to buy with taka. Expatriate savings are an obvious source, and are now, in effect, helping pay for Bangladesh’s imports from outside the country, shrinking official remittances. For all Bangladesh’s booming economy, growing at 7% a year, it is still a place where those with money are looking for clever ways dodge the rules.